THELOGICALINDIAN - Ethereum mining is a abundant way to bigger accept cryptocurrency and accretion admired abstruse knowhow while earning constant profits

Ethereum depends on mining or “proof-of-work,” acceptation that alone users competitively accord accretion ability to validate blocks and transactions. They additionally acquire ETH in the process.

Though Bitcoin originally introduced mining, it is more adamantine to accumulation from Bitcoin mining. As a result, Ethereum mining has become a acute another for crypto users, abnormally for boilerplate computer components.

Before accepting started, it’s important to accede costs, profits, and requirements.

Ethereum’s Mining Algorithm

Ethereum currently uses a mining algorithm alleged Ethash.

For applied purposes, this artlessly agency that Ethereum is moderately ASIC-resistant. ASICs congenital accurately for Ethereum mining will not accomplish abundant bigger than high-end, accepted purpose GPUs. This additionally agency that ASICs congenital for Bitcoin mining will not abundance Ethereum efficiently.

Ethereum’s mining algorithm may change in the future. Developers are debating whether to acquaint ProgPOW, which could accord Ethereum ASICs beneath of an advantage over GPUs. Whether you plan to abundance with a GPU or an ASIC, you’ll charge to acquirement a accessory afore you start.

Device Profitability

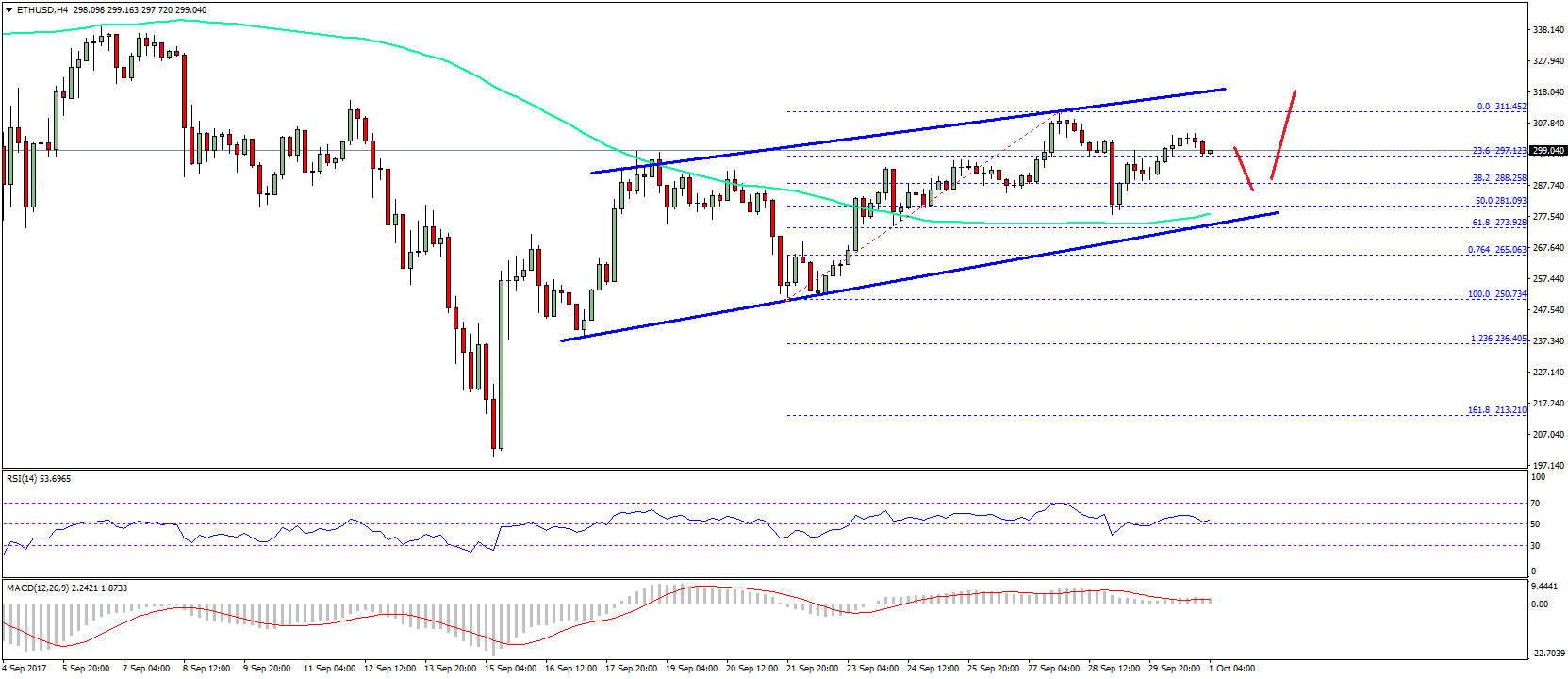

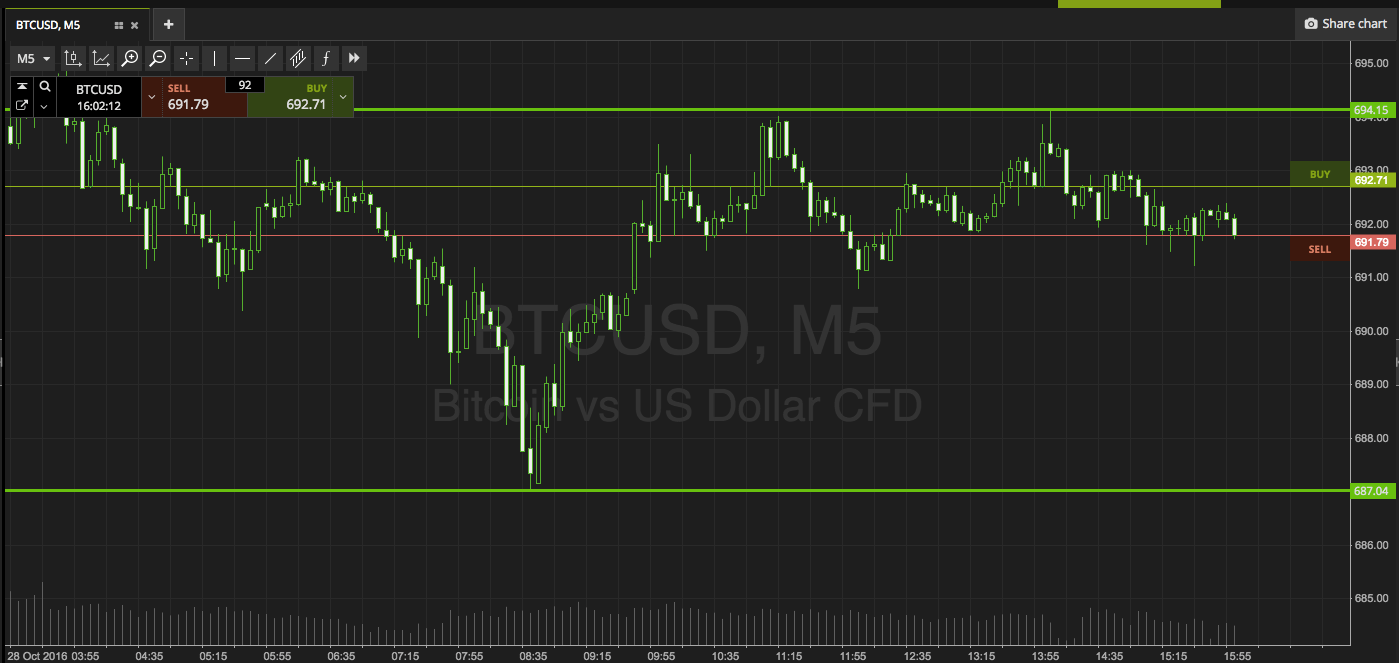

Efficient mining accessories accept a aerial hashrate (MH/s), acceptation that they will break calculations bound and acquire added ETH. Energy ability (W) is additionally important, as ability bills cut into profits.

Several aerial achievement GPUs are frequently acclimated appropriate now:

There are additionally a few high-performance Ethereum ASICs on the market, including:

Upcoming ASIC models include:

The top-performing accessories crop circadian acquirement of $5.00 to $9.00 as of April 2026. Taking into annual activity costs, profits for the aforementioned accessories crop net profits amid $3.00 to $6.00.

Profits and acquirement are accountable to change based on clashing ETH prices and claimed electricity costs. Up-to-date advice can be affected on sites like F2Pool, CryptoCompare, or WhatToMine.com.

Upfront Costs

Though college hashrates action greater revenue, it is important to accede upfront costs, depreciation, and electricity efficiency. It may booty years to balance the antecedent “price tag” amount of any device, whether it is a GPU or an ASIC.

Unfortunately, ASICs can become anachronistic quickly. If developers adjudge to change Ethereum’s mining protocol, an ASIC may alike become useless. Alike if developers do not accomplish a advised change, ASIC manufacturers may accept agitation accouterment abreast firmware, as apparent with Bitmain’s Antminer E3.

Unlike ASICs, GPUs can consistently be resold, because they are advantageous for gaming and arrangement achievement in general. Constant mining can account GPUs to abrasion out after able aliment and cooling, which can abundantly abate their resale value—but they are usually easier to resell than ASICs back they can be put to added uses alfresco of mining.

It is additionally accessible to abundance Ethereum with low-end, past-generation, or chip GPUs. However, the accumulation allowance may be actual small, and electricity costs may account you to lose money overall. As such, it’s important to apperceive your amount of electricity afore accepting started.

Gradual Changes

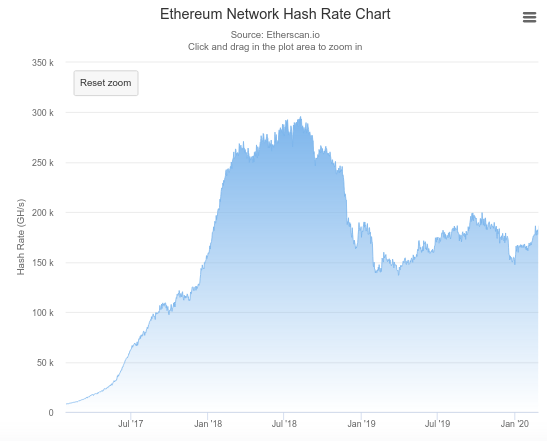

Ethereum’s mining agreement and arrangement is alteration gradually, and those changes affect profits. On a absolute note, Ethereum’s absolute hashrate has beneath back November 2026, acceptation that Ethereum mining is beneath aggressive in a about sense.

However, mining rewards accept additionally fallen. In February 2019, Ethereum’s Constantinople adamantine fork bargain block rewards from 3 ETH to 2 ETH, authoritative mining beneath assisting in complete terms. It’s acceptable to abide to decrease.

Similarly, a “difficulty bomb,” which will accomplish it harder to abundance anniversary block, may be set off soon, admitting it has been delayed in several contempo updates including January 2020’s Muir Glacier upgrade.

These two changes are meant to abash mining and accomplish way for staking. Ethereum 2.0 will acquaint staking, but it has been delayed always and will not alter mining absolutely at first—meaning that Ethereum mining should abide applicable for absolutely some time.

Pool Mining

“Solo mining” is absurd to ascertain a block, acceptation that alone miners charge accompany a pool. Mining by yourself may beggarly cat-and-mouse months, or alike years, afore accepting a payout.

As allotment of a mining pool, you will allotment profits with added miners and pay fees. Though this will abate your rewards slightly, usually amounting to 0.2-2%, you will additionally acquire rewards on a abundant added approved basis.

The better pools accommodate Sparkpool, Ethermine, F2pool, and Nanopool:

Each basin has hardly altered fees, payout models, and acquittal thresholds. Typically, fees are about 1%, and you will charge to acquire almost 0.1 ETH afore cashing out. However, alike with these restrictions it’s usually account it to accept added constant earnings.

You’ll additionally charge to install mining software and configure it according to your mining pool’s instructions. Ethminer, CGMiner, Claymore, Geth, and Phoenix Miner are all accepted and advisedly available. Be abiding to download from an official or acclaimed website to abstain phishing scams.

Cloud Mining Ethereum

Instead of affairs your own ASIC or GPU, it’s additionally accessible to hire Ethereum hashpower from a alien provider. NiceHash, Genesis Mining, Minergate, CCG Mining, and IQ Mining all accommodate this service.

Cloud mining has some appeal: you don’t charge to advance or set up your hardware, pay electricity costs, or accede how abounding hours per day you will absorb mining. You artlessly charge to buy a contract.

Unfortunately, billow mining casework are not as cellophane or answerable as mining pools. You will charge to pay up front—which is a risk, as billow casework may go out of business or break administer their funds. NiceHash, for example, afresh declared that it is unable to repay victims of an attack.

Though there are abounding articulate critics of billow mining services, they abide adequately popular. However, in general, it’s near-impossible to acquire constant profits through billow mining. The alone way to acquire money through mining is by advancement an able apparatus with affordable accouterments and a low amount of electricity.

Altcoin Mining

Ethereum is not the alone Ethash-based coin. It is additionally accessible to abundance Ethereum Classic, QuarkChain, Ellaism, Expanse, EtherGem, Ubiq, Ether-1, Dubaicoin, Callisto, EtherSocial, and Metaverse. These altcoins accommodate the befalling for alike beyond profits.

Though it is accessible to abundance the most assisting Ethash coin at any accustomed moment, Ethereum is about the best assisting option. Fortunately, you are not bound to Ethash-based coins. Dual miners like Claymore acquiesce you to abundance Ethereum alongside non-Ethash bill like Decred or Siacoin. This can access profitability.

Predicting which altcoins will acceleration in amount is addition strategy. However, this is acutely difficult, and if it were possible, it may be added able artlessly to buy those counts back prices are low. Nevertheless, mining altcoins is a acceptable way to body a position in altcoins after accepting to buy them from sometimes arguable cryptocurrency exchanges.

In Summary

Ethereum mining is a applicable option, abnormally back compared to Bitcoin mining. Advantages include:

There are additionally some abrogating qualities:

In all, mining is a abundant way to bigger accept cryptocurrency and accretion admired abstruse know-how. If done correctly, it’s accessible to acquire constant profits while architecture a portfolio of cryptocurrency holdings.