THELOGICALINDIAN - Trava is the abutting bearing of Lending Protocols employing an avant-garde archetypal of assorted lending pools created by users This groundbreaking crosschain lending development is article you accept to analysis out if you anytime capital to actualize and administer your own lending basin starting an online lending business and potentially acquire big profits from it The Trava acute arrangement is now alive on both Binance Acute Chain and Fantom Network

A Decentralized Marketplace for Cross-Chain Lending

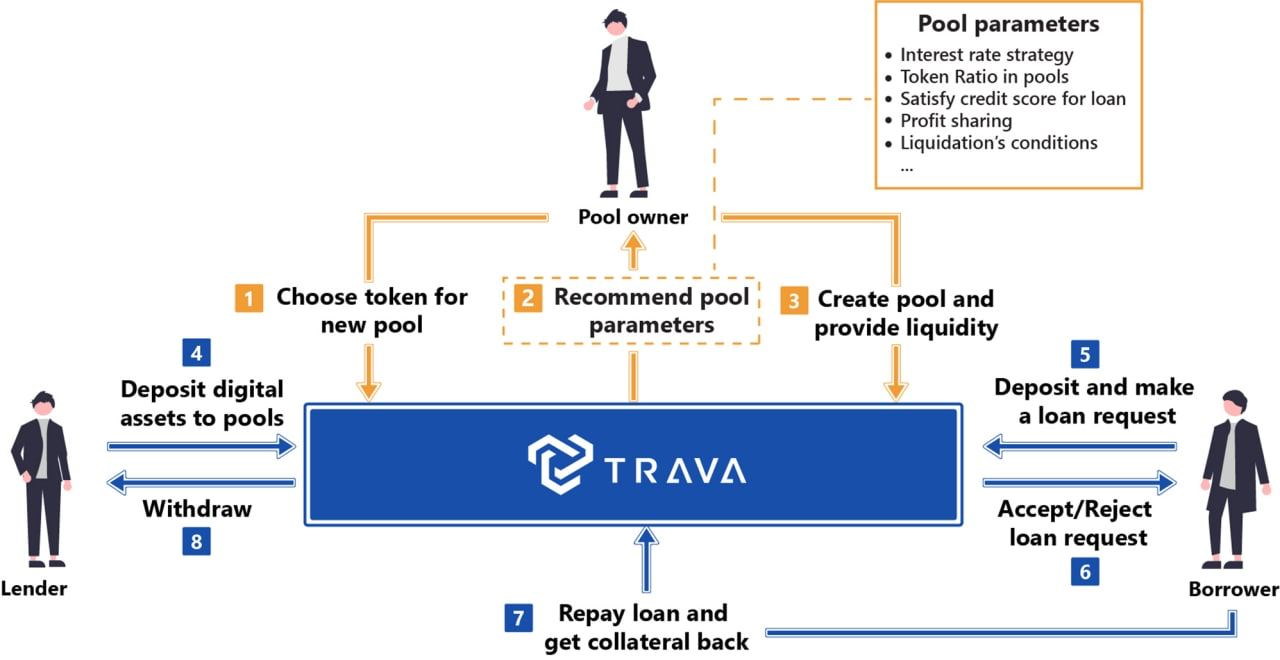

Trava.Finance is the world’s aboriginal decentralised exchange for cross-chain lending and offers a adjustable apparatus in which users can actualize and administer their lending pools to alpha a lending business. Initially deployed on the Binance Smart Chain, Trava allows for lending with BSC tokens at antecedent stages, with cross-chain lending with assorted tokens on Ethereum and added blockchain networks enabled after. Established in 2018 with an antecedent 20 members, the aggregation has aggregate outstanding specialists and individuals in blockchain, security, finance, accident management, and law to aid its growth.

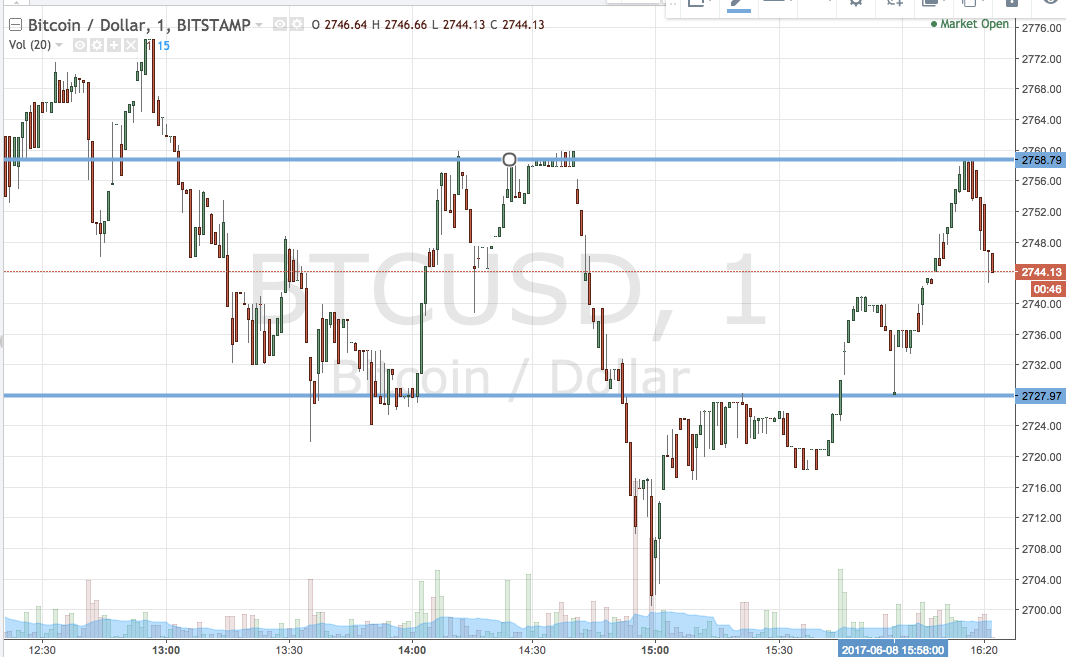

The BSC Trava lending basin acknowledging 14 assets. While absolute approaches accommodate alone one or a few lending pools with their own ambit such as borrow/supply absorption rate, defalcation threshold, Loan-to-Value ratio, or a bound account of changeable cryptocurrencies, Trava offers a adjustable apparatus in which users can actualize and administer their own lending pools to alpha a lending business. Trava additionally offers the acclaim account action based on banking abstracts on-chain assay as a advantageous apparatus that reduces accident and increases profits for all users.

The capital addition abaft Trava is that it allows users to actualize their own pools with their own ambit such as borrow/supply absorption rate, defalcation threshold, etc. However, there are added important differences amid Trava and absolute solutions. Trava provides users with a credit score – The basin owners can ascertain a credit-score beginning for borrowers to abate the lending risks and set a aerial Loan-to-Value arrangement for borrowers with aerial acclaim scores. NFT, banal tokens, and added agenda assets as collaterals: to access the liquidity. This account will be appear in Q4, 2021.

Cross-chain identification and cross-chain lending is addition Trava advantage. It can assay all wallet addresses of the aforementioned users on altered chains. After that, users can use up all of their cryptos as accessory for a huge accommodation in a distinct transaction. Trava affairs to action abounding statistical functions and assay abstracts for users, so they can abate the risks and access profits in a able manner.

Trava Launches Lending Pool on Fantom Network

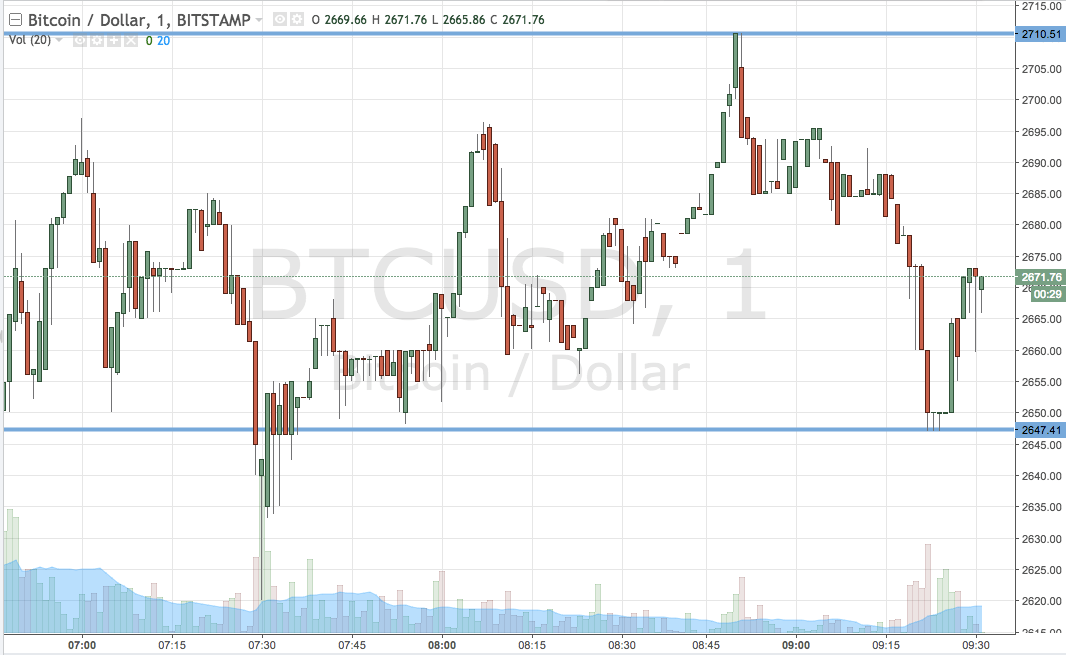

The Trava aggregation afresh appear that they will accessible a Lending Basin on Fantom Network on November 4th. Together with the ablution of the lending arrangement on Fantom Network, Trava will run its W2.1 Liquidity Mining Program for depositors and lenders back accommodating in the Lending Basin on Fantom Network. At this aboriginal date the lending basin supports six assets, covering: FTM, DAI, USDC, USDT, ETH, and BTC.

Trava has a lot added developments advancing up, such as aperture rTrava basement on Fantom, ablution NFTs staking and NFT marketplace, abacus added tokens on BSC and FTM pools, creating a acclaim score-based lending pool, administration profits from Trava Bridge for rTrava holders, new partnerships and listings on top-tier exchanges. So to accumulate up the activity appointment the website, and accomplish abiding to chase the aggregation on Twitter, Telegram, Reddit, and Medium.

This is a sponsored post. Learn how to ability our admirers here. Read abnegation below.

Image Credits: Shutterstock, Pixabay, Wiki Commons