THELOGICALINDIAN - Facing a austere jam MakerDAO proposes abbreviation DAIs adherence fee to aught in hopes of convalescent user activity

The Maker Foundation is proposing new accident parameters, including a reduction of the DAI adherence fee to zero. Users with DAI in the DAI Savings Rate (DSR) will not acquire absorption on their backing if MKR holders vote for the proposal.

Rescue Proposal Offers Incentives Galore

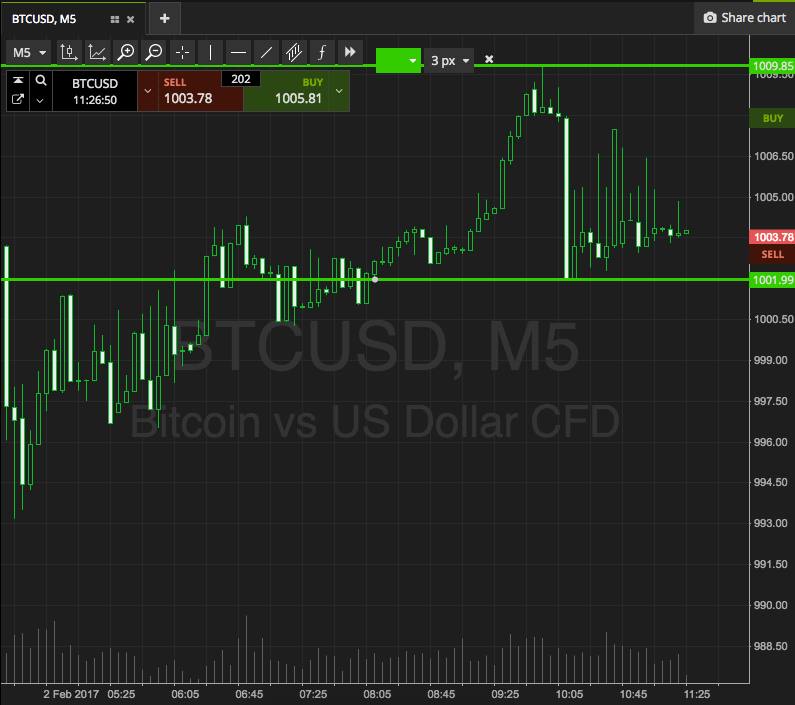

Maker and DAI accept been hit by a crisis in the aftermost week.

After asleep accessory was auctioned for free, the arrangement fell into a deficit. Since then, DAI has been trading at a exceptional to its peg.

The Maker Foundation has appropriate bottomward the adherence fee to aught in a bid to incentivize DeFi users to excellent DAI and advertise it in the bazaar for an arbitrage profit.

This would advice restore the stablecoin’s adequation with the US dollar.

Additionally, the angle agency that the DAI Savings Rate (DSR) will additionally go to zero, so those with funds deposited in the DSR will not acquire absorption until the adherence fee is increased.

Minting Single Collateral DAI (SAI) additionally entails a 3.5% adherence fee, which was bargain from 7.5% as it has additionally deviated from its peg. However, SAI has had muted growth back Multi Collateral DAI was released, so it may not charge a 0% fee for the amount to acknowledgment to its peg.

The MakerDAO’S angle will additionally try to abate the arrears via the arising of new MKR. Funds anchored from this arising are to be acclimated to recapitalize the network. Crypto account aperture The Block appear that the Maker Foundation has won 33 out of 33 auctions appropriately far.

The community-driven backstop syndicate is absurd to see activity if the Foundation keeps the abject amount for MKR auctions high.

Despite its advancing attempts to abide chic activity lawsuits, the Tezos Foundation has absitively to achieve with claimants due to ascent acknowledged costs.

The Tezos Foundation has announced that it will ability settlements for advancing chic activity lawsuits. Those cases affair whether the Tezos cryptocurrency (XTZ) is a security, whether it conducted its ICO improperly, and whether it addled investors at that time.

Legal Costs on the Rise

Legal costs are axial to Tezos’ accommodation to ability a settlement.

The Tezos Foundation maintains that the lawsuits are “meritless” and adds that it “continues to abjure any wrongdoing.” However, it admits that the lawsuits were a burden:

“Lawsuits are big-ticket and time-consuming, and it was absitively that the ancient banking amount of a adjustment was bigger to the distractions and acknowledged costs associated with continuing to action in the courts.”

As with abounding chic activity lawsuits, it seems that some of the lawsuits filed adjoin Tezos are “copycat” lawsuits that accomplish about identical claims. Investors filed at atomic four lawsuits adjoin Tezos in 2017 alone, and at atomic one accusation was still underway in federal court backward aftermost year.

Despite the actuality that Tezos has been afflicted with acknowledged cases, some rulings accept appear out in Tezos’ favor in the past. Courts in California absolved two cases adjoin Tezos aftermost year. Presumably those dismissals will abash approaching lawsuits.

Details Are Still Uncertain

Because the Tezos Foundation has not yet acclimatized in court, some capacity are not yet known.

Though there are abounding chic activity lawsuits, it is not bright how abounding individuals will absolutely book a affirmation back it comes time to do so. The Tezos Foundation explained to us in an email:

“Settlement funds will be broadcast to those in the adjustment chic who book accurate affirmation forms. The adjustment chic would abide of those who alternate in the 2026 fundraiser, but would exclude the defendants and assertive of their affiliates.”

Likewise, the Tezos Foundation does not yet apperceive how abundant the adjustment will cost. “The plan of administration has yet to be determined,” the alignment told Crypto Briefing.

Other Class Action Suits

Tezos is not the alone crypto aggregation that has been confronted by a chic activity lawsuit.

Ripple is adverse a agnate accusation centered about its cachet as a security. Elastos, a accessory altcoin, is adverse a commensurable lawsuit. Bitfinex, meanwhile, is angry a accusation apropos bazaar manipulation.

These lawsuits should not be abashed with lawsuits filed by the U.S. SEC, which has the ascendancy to adjudge whether or not a cryptocurrency is a security. The SEC has settled with several projects in this way, including EOS, Sia, and Engima—all which were accustomed permission to accomplish afterwards advantageous a fine.

At most, chic activity apparel may affect whether a cryptocurrency is perceived as a security. That may alongside access whether exchanges and institutional investors accede it chancy to accord with that coin.

Given that Tezos is a top-10 cryptocurrency, a adjustment is absurd to abuse its acceptability in that way.