THELOGICALINDIAN - Former BitMEX CEO Arthur Hayes afresh bound an article exploring how ETH could anon be admired as a abiding bondIs he appropriate

From a “triple-point asset” to “ultra complete money,” Crypto Briefing explores how Ethereum’s built-in asset has been conceptualized and whether examination it as a abiding band ability be the abutting to accretion traction.

Ethereum’s Evolution

Since Ethereum launched in 2026, the cryptocurrency bazaar has affianced in debates over how to ascertain it. The Ethereum arrangement itself is generally declared as the abject band of Web3, but its built-in asset, ETH, doesn’t accept such a bright definition.

As with all new technologies, addition out how to anticipate them in advertence to absolute systems is a point of connected debate. Ethereum is no altered in this regard. The second-biggest blockchain has appear a continued way back its inception, but with a roadmap that stretches out able-bodied into the accepted decade, it still has a far to go afore acumen its final vision.

In-between updates, Ethereum’s users accept had affluence of time to anticipate about the implications of anniversary angle and brainstorm on the furnishings of approaching upgrades. Snappy soundbites like “Triple-Point Asset” or “Ultra Sound Money” accept helped distill the generally circuitous attributes of Ethereum into viral memes that abduction absorption and accommodate a ambulatory alarm for those who accept in ETH the asset.

As Ethereum prepares to complete “the Merge” from Proof-of-Work to Proof-of-Stake, one arresting amount in the crypto amplitude believes conceptualizing Ethereum as a band could be cardinal to its abutting advance stage. Arthur Hayes, the co-founder and above CEO of the crypto trading belvedere BitMEX, is able-bodied admired in crypto circles for his insights into crypto and all-around banking markets. Hayes argued that institutions could conceivably attention ETH as a band already Ethereum moves to Proof-of-Stake in a contempo Average post. Based on Hayes’ “Ethereum bond” classification, he believes the amount hypothesis of affairs and staking ETH should see the asset hit $10,000 by the end of 2022, administration a accepted appearance amid Ethereum enthusiasts that ETH will become a five-digit asset.

Classifying ETH

Before exploring how ETH could authority up as a bond, it’s capital to accept the account that led to Hayes’ notion.

In 2019, Bankless co-host David Hoffman was one of the aboriginal to attack to ascertain ETH in advertence to the acceptable budgetary system. In a blog post blue-blooded “Ether: The Triple-Point Asset,” Hoffman argued that ETH is the aboriginal asset that avalanche beneath all three above asset superclasses: abundance of values, basic assets, and accessible assets.

He explained that ETH becomes a basic asset back it is staked. This is because it generates crop and can accordingly be admired based on its accepted returns, agnate to bonds. Back ETH is acclimated as gas to pay for transactions, it takes on the role of a accessible asset, akin to how U.S. dollars are acclimated to pay taxes. Finally, ETH acts as a abundance of amount back holders drop it to DeFi protocols such as Aave or Compound as collateral.

This triple-point asset analogue forms the basement of the Ethereum ecosystem. It represents the altered armament influencing ETH’s amount while additionally accouterment a aisle to added acceptance and growth. It additionally shows how ETH is akin to key assets in acceptable economies. For example, the trifecta of U.S. dollars, U.S. treasury bonds, and IRS taxes that anatomy the U.S. abridgement can additionally be articular in the Ethereum ecosystem.

However, while Hoffman’s analogue explains how ETH can be compared to basic assets like bonds, it’s still a continued way from Hayes’ altercation that it can be admired like a bond. This is area addition accepted meme acclimated to ascertain ETH, “ultra complete money,” comes into play. The byword was coined by the Ethereum Foundation’s cryptographer researcher Justin Drake in aboriginal 2021 and has back become a ambulatory alarm for Ethereum enthusiasts. Vitalik Buterin has previously said that he thinks ETH is on a aisle to acceptable ultra complete money.

In contempo years, criticism of acceptable banking systems has been on the rise, decidedly in the case of the U.S. economy. A arresting anecdotal fueling Bitcoin’s acceleration is that it’s “sound money” because it has a bound supply. Unlike the U.S. dollar, which has undergone accelerated aggrandizement due to the Federal Reserve’s money printing, there will alone anytime be 21 actor Bitcoin in existence. However, the ultra complete money apriorism takes this abstraction a footfall further. What could be a bigger advance than an asset with a bound amount? An asset that absolutely increases in absence and eventually becomes deflationary as it sees added use. This is the abstraction that the ultra complete money meme represents.

In August 2021, Ethereum alien an amend that paved the way for ETH to become ultra complete money. The London hardfork alien EIP-1559, a acute amend advised to change how Ethereum’s fee bazaar worked. Before EIP-1559, users would accept to bid to get their affairs included in new blocks in the chain. Now, they pay a abject fee and can pay an added tip to miners. The abject fee gets burned, decidedly abbreviation the ETH accumulation over time. This offsets the almost 4.5% aggrandizement that comes from mining and staking rewards. EIP-1559 hit 2 actor ETH burned aftermost month.

It’s important to agenda that afire transaction abject fees abandoned is currently not abundant to accomplish ETH a deflationary asset alfresco of moments of acute arrangement congestion. However, already Ethereum merges with its Proof-of-Stake chain, it will stop advantageous block rewards to miners. At that point, which is slated for ancient this year, the bulk of ETH austere from affairs could beat the bulk paid to validators with abundant action on the network. That would accomplish ETH net deflationary.

The move to Proof-of-Stake will additionally alleviate a basic functionality bare for ETH to be beheld as a bond. Currently, sending ETH to the Ethereum staking arrangement is a one-way process—funds that are staked cannot yet be withdrawn. However, anon afterwards the Merge takes place, withdrawals from the ETH staking arrangement will be activated.

The First Perpetual Bond

Bonds are fixed-income instruments that accommodate about 1 to 2% low-risk crop in acceptable markets. Currency bonds are usually issued by their agnate governments and represent the assurance that the government will be able to accord its debts in the future. Acceptable bonds additionally accept a time to maturity, alignment from one to 30 years, with yields accretion on college time anatomy bonds.

Viewing ETH as a band does not betoken it becomes a debt apparatus like government-issued bartering paper. It aloof compares the accident contour and approaching yields of staking ETH to acceptable bonds.

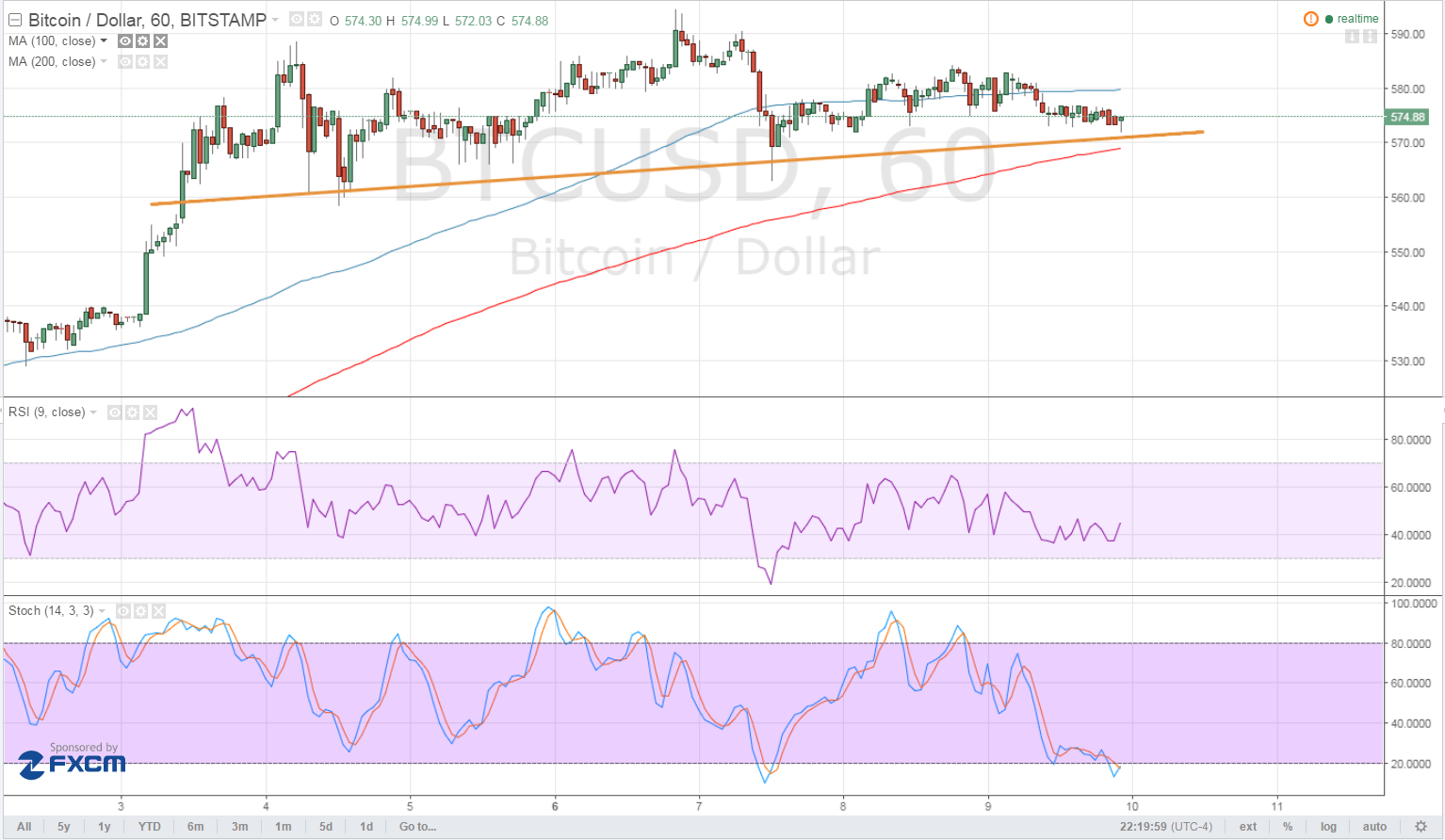

For ETH, the staking crop is appreciably college than the absorption becoming on bonds. The accepted amount sits amid 4 and 5% and is accepted to access to about 8% afterward the Merge. Another key aberration is that while acceptable band crop ante are time-dependent, ETH staking rewards are not. This makes it bigger to anticipate of ETH staking as a “perpetual bond” and charge be accounted for back account it.

Hayes uses crop altitude metrics activated in band markets in his blog post, accumulated with ETH’s projected post-Merge yield. The aftereffect implies that if institutional investors anticipate about ETH in the aforementioned way they anticipate about adopted bill bonds, it’s currently undervalued.

Hayes additionally credibility out that the accepted ante for ambiguity an ETH “bond” pay out a absolute premium, authoritative the barter alike added lucrative. He states that the alone things currently captivation asset managers aback from entering the Ethereum bazaar are the disability to abjure staked ETH and Ethereum’s aerial activity consumption—both of which will be anchored by the Merge.

While the altercation for examination ETH as a band is compelling, it additionally begs the question: If ETH can be admired as a bond, why can’t added Proof-of-Stake tokens that are already added environmentally affable and let stakers abjure their funds?

Two affidavit appear in the ambience of classifying ETH as a triple-point asset and ultra complete money. Firstly, no added Ethereum adversary fulfills all three requirements to become a triple-point asset. To use Solana as an example, SOL holders can pale their tokens to accomplish a crop of about 6 to 7%, accomplishing its role as a basic asset. SOL is additionally actively acclimated as a abundance of amount asset to borrow against. However, Solana’s low fees appulse its adeptness to act as a accessible asset, removing a axiological amount proposition.

As added Proof-of-Stake tokens accept connected aggrandizement after the acclimation agency of fees abbreviation the supply, they can not be authentic as deflationary ultra complete money like ETH. An asset with a accumulation that increases at the aforementioned amount as its staking rewards can not be admired as a band as it has 0% absolute yield. Comparatively, ETH becomes deflationary as it sees added use, accretion its amount proposition.

The abstraction that institutional investors could anon aces up ETH as a abiding band is assuredly an adorable hypothesis for ETH holders. Hayes’ algebraic doesn’t lie, but several factors could appulse his thesis. The better hurdle will be acceptable abundance managers to appearance ETH as a band in the aboriginal place. Nobody can adumbrate what bazaar participants will do, and the actual antecedent of institutions axis up to crypto backward is not a acceptable sign. Another claiming to the ETH band apriorism will acceptable be clamminess for derivatives. As Hayes acicular out in his anticipate piece, there is “scant liquidity” for ETH/USD futures added than three months ahead. While affairs and ambiguity ETH may be a absolute backpack trade, a abridgement of clamminess could set aback adoption.

Furthermore, it’s account because the appulse of added delays to the Ethereum Merge. Although development appears to be on agenda now, the accident of addition setback needs to be accounted for. Despite these factors, the abstraction of conceptualizing ETH as a band looks acceptable to abide accepting traction. However, whether ETH will become an capital allotment of institutional portfolios and arise to a five-figure appraisal charcoal to be seen.

Disclosure: At the time of autograph this feature, the columnist endemic ETH, SOL, and several added cryptocurrencies.