THELOGICALINDIAN - USbased crypto barter Gemini wants to advice its users accede with the tax requirements in a acceptable address The aggregation assassin Sovos to improve its tax advice reporting

The Solution Will Automate Gemini’s Tax Filings

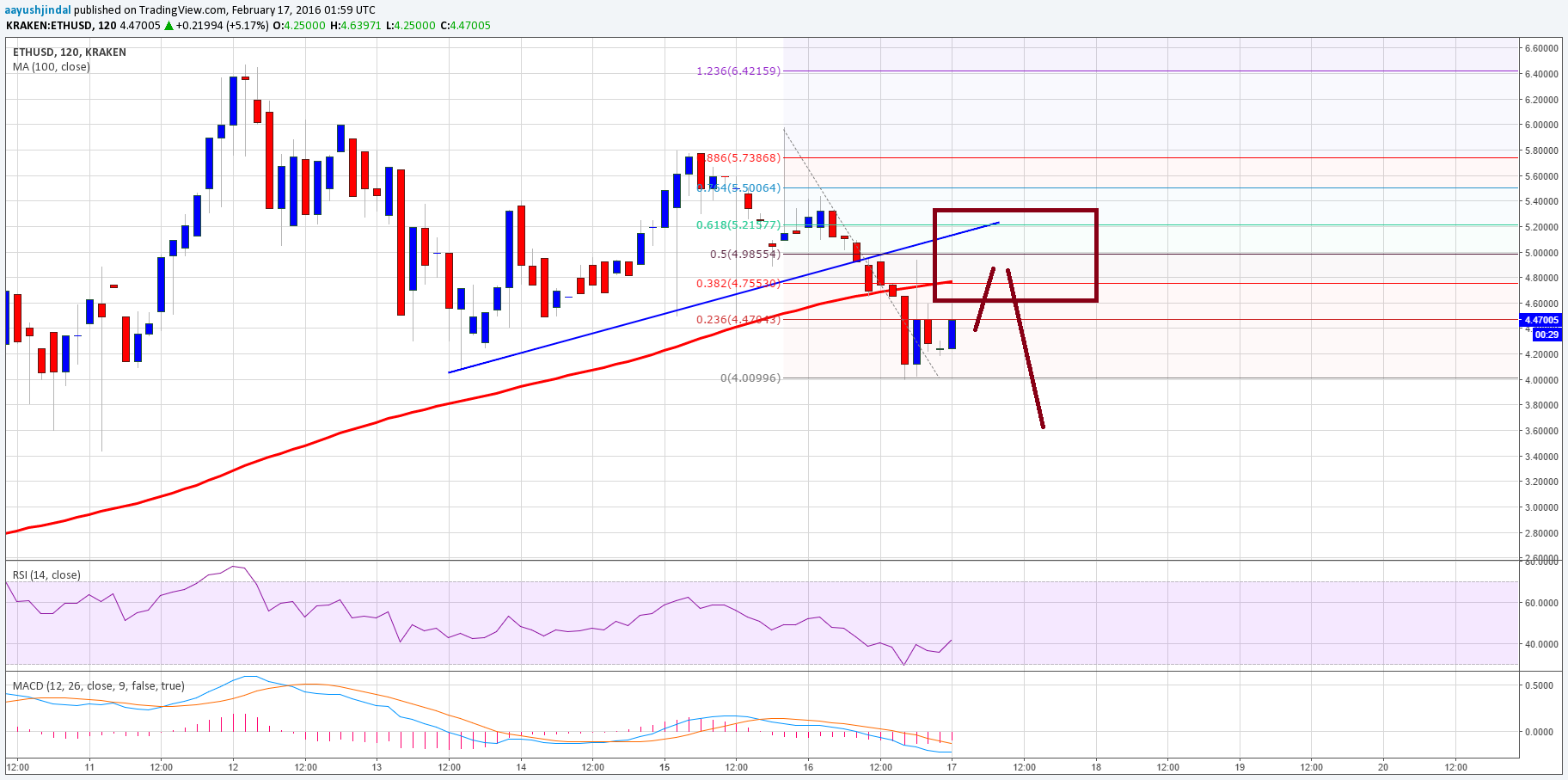

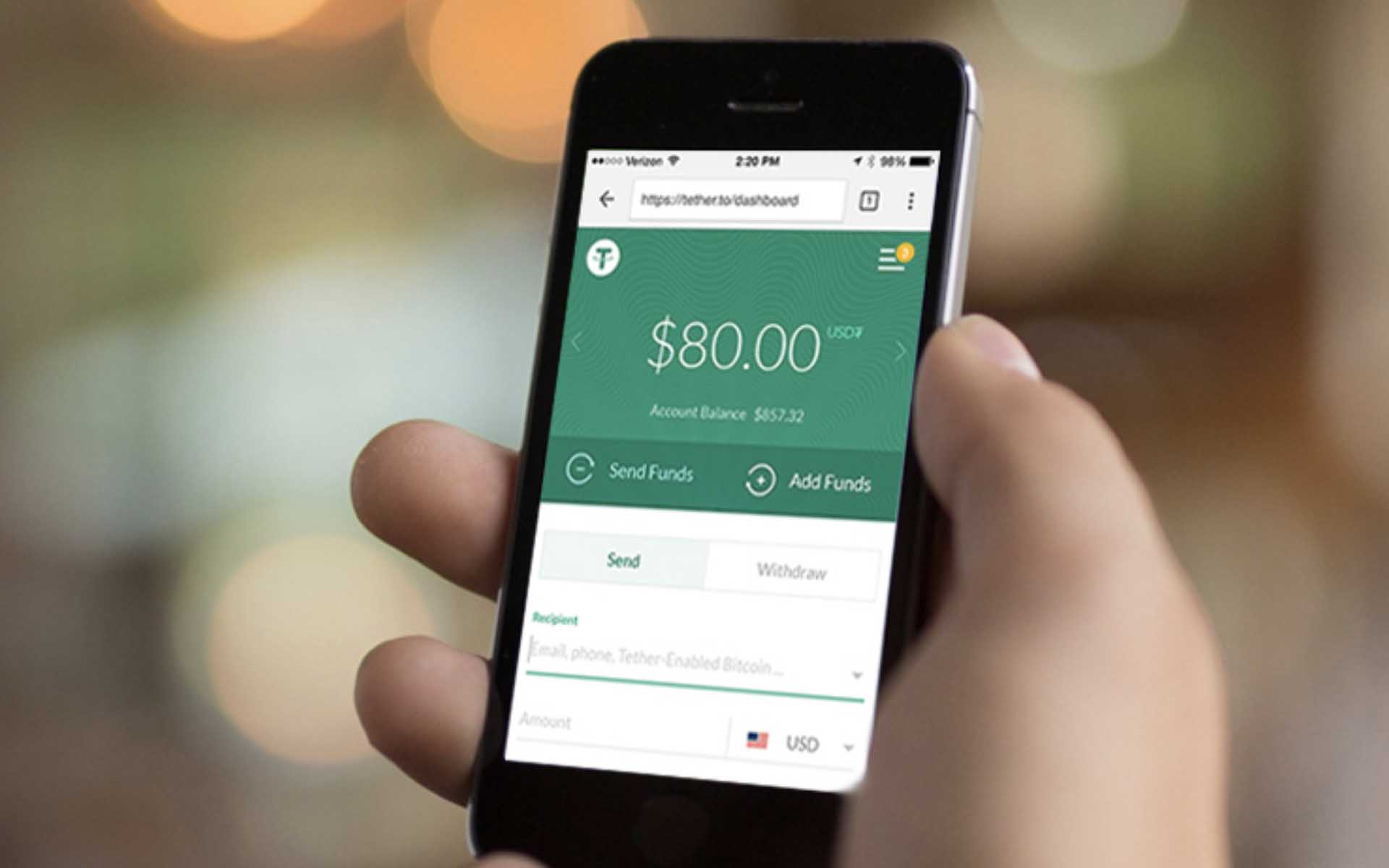

The barter belvedere managed by Taylor and Cameron Winklevoss will use Sovos’ technology to automate its 1099 forms and filings. The band-aid is accepted to abate abeyant animal errors and ensure automated authoritative updates. The closing is absolutely important in an industry that is still at its beginning stage.

Gemini best Sovos for its ability in tax reporting. The aggregation is currently the better clandestine filer to the Internal Revenue Service (IRS) of 10-series forms. Besides this, Sovos has acquaintance in administration tax affair in another bill markets.

Joshua Rawlins, managing administrator at Gemini’s banking operations, commented:

The controlling continued,

IRS Issues Updated Crypto Tax Guidance

The IRS is quite strict back it comes to taxes, and it couldn’t avoid the rapidly growing cryptocurrency market.

The IRS treats cryptocurrencies like Bitcoin and Ethereum as property. This suggests that the aforementioned tax rules activated to acreage affairs are accurate for the barter of cryptocurrencies. Thus, crypto affairs are accountable to basic assets tax and Gemini traders charge booty this into account.

Last month, the IRS issued two adapted pieces of advice for taxpayers who barter cryptocurrencies, which the tax bureau calls basic currencies. The new advice includes Revenue Ruling 2019-24 and FAQs.

IRS Commissioner Chuck Rettig explained:

Do you anticipate crypto traders who use Gemini, Coinbase, and added US platforms should be taxed? Share your thoughts in the comments section!

Image via Shutterstock