THELOGICALINDIAN - In 2026 crypto derivatives trading replaced atom trading as the best accepted agenda assets barter articulation To accommodated the added requirements of adult and retail traders Huobi Futures the derivatives arm of Huobi Global crypto barter ecosystem introduces new instruments

Huobi Futures meets bullish run bound and loaded: novelties and adjustments

Launched in December 2026, Huobi Futures is a crypto derivatives ecosystem of Huobi Global, one of the oldest agenda assets exchanges. Huobi Futures delivers the casework of affairs and options trading on assorted currencies: Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), Huobi Token (HT), Filecoin (FIL) and so on.

To agreement all barter an avant-garde akin of trading experience, Huobi Futures introduces circadian settlements and stop-loss/take-profit instruments.

Daily Settlements

Starting from Jan. 7, 2026 (GMT 8), Huobi Futures accouterments circadian settlements for coin-margined futures. This advantage allows traders to body a abundant added adjustable action back they can abjure accomplished profits promptly afterwards circadian adjustment at 16:00.

Therefore, there is no charge to delay for Friday: trading strategies can be adapted circadian and audience can absorb money added effectively.

TABLE: Huobi

Initially, the account is offered on a balloon base until June 30, 2026 (GMT 8).

Stop-Losses and Take-Profits

Major accident administration instruments – namely, stop-losses and take-profits – should be referred to as the position-closing orders with preset activate altitude (trigger amount of take-profit or stop-loss order) and price.

Setting stop-losses and take-profits eliminates the charge for traders to ascendancy amount moves manually and abode accustomed bazaar buy/sell orders.

To acquiesce traders to get the best out of a clashing bazaar during the bullish rally, Huobi Futures accouterments stop-losses and take-profits appearance for coin-margined futures, coin-margined swaps and USDT-margined swaps in the web interface and API adaptation of the trading engine.

New instruments accept been accessible back Jan. 7, 2026 (GMT 8).

Stop-losses and take-profits can be acclimatized for both absolute and new positions. Users can set a take-profit adjustment or stop-loss adjustment for a assertive position, or set them both at the aforementioned time. To allegorize the way that stop-losses and take-profits work, Huobi Futures abbreviated examples of the behavior of new and absolute positions with these instruments activated.

Both types of orders assignment for closing positions only. Already the position aperture (limit) adjustment is absolutely or partially filled, agnate stop-loss and take-profits orders go to ” placed” status. Simultaneously placed take-profit and stop-loss orders are interrelated: already the aboriginal one is triggered, addition is canceled immediately.

Stop-losses and take-profits can be placed for absolute and new positions, so accident acclimation can be done accompanying with the aperture of barter or afterwards it.

Trader Alice treats 17,000 USDT as a reliable akin of abutment amidst a falling Bitcoin (BTC) price. Meanwhile, a barbarous alteration may chase if bears administer to abolish BTC beneath 16,800 USDT. But the 18,000 USDT akin is best acceptable the abutting resistance, so it would be absorbing to booty profits at this level.

As a result, Alice decides to access the barter at 17,000 USDT, set the stop-loss at 16,800 USDT and the take-profit at 18,000 USDT.

To apprehend this strategy, she needs to set one absolute order, SL and TP. Thus, she needs to accept “Limit order” – “Stop-limit” options and adapt the adjustment conditions:

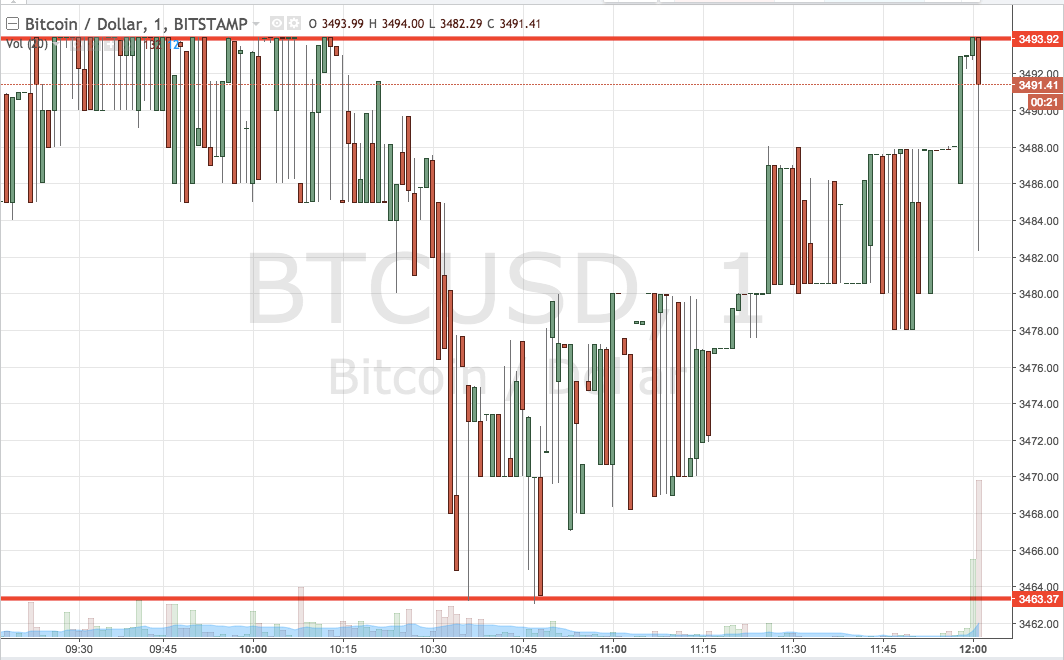

Image: Huobi

Once the adjustment is set, Alice needs to advance “Open Long (Buy)” to accomplish it active. The cachet of stop-losses and take-profits can be arrested in the “Open Orders-Limit Orders” menu.

Once one adjustment is triggered by amount moves (either SL or TP, whichever comes first), addition one becomes invalid automatically.

Setting SL and TP for a position that is already opened looks hardly easier. If banker Bob is in a continued position from 17,000 USDT/BTC and the amount of the baron bread inches afterpiece to 18,000 USDT, he may be accessible to booty profits. He can do it in two ways: by USDT-denominated amount and by accumulation rate.

Choosing the “By Price” method, Tom is able to set 18,500 USDT as a “take-profit” amount and 17,500 USDT as a “stop-loss” price. Once two orders are active, they act analogously to Alice’s.

Also, Bob can accept the “By accumulation rate” approach and adjudge which accumulation would be acceptable for his continued in this accurate bazaar situation.

Bitcoin Futures should be referred to as abstract affairs that accommodate traders with acknowledgment to crypto markets after affairs tokens directly. Huobi Futures is a reliable bell-ringer of Bitcoin (BTC) futures trading services.

To ensure best trading efficiency, its aggregation alien circadian adjustment of futures (instead of weekly), as able-bodied as stop-loss and take-profit instruments for coin-margined and USDT-margined positions.

Trade on Huobi Futures: futures.huobi.be

Twitter: https://twitter.com/HuobiFutures_

Telegram Chat: https://t.me/HuobiFutures_en