THELOGICALINDIAN - 1 Bitcoins Selling Pressure Has Subsided

Bitcoin may be advancing a bounded basal because a cardinal of indicators advance that the affairs aggregate that brought the bread lower has started to subside.

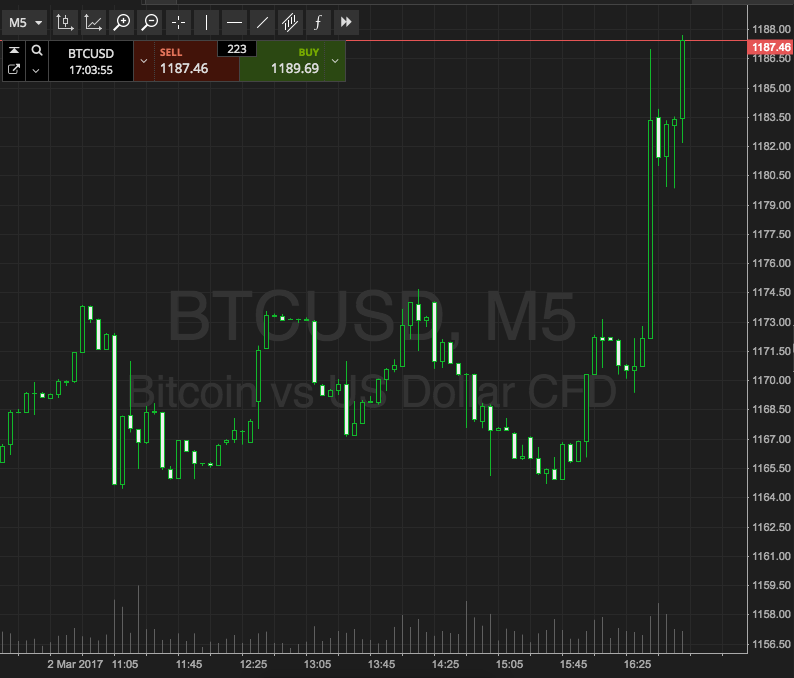

One crypto banker shared the blueprint beneath of BTC’s on-balance aggregate indicator, which attempts to chronicle amount activity to volume. The indicator suggests that the “selling burden [has been] exhausted,” acceptation alliance is acceptable to follow.

This is corroborated by abstracts from CryptoQuant, aggregate by cryptocurrency analyst and analyst “Light.”

The abstracts indicates that Bitcoin miners, who abounding say triggered the advancing downtrend, accept badly slowed their affairs of BTC back the contempo highs.

#2: Stock Futures Are Trading in the Green

Although the stock-BTC alternation has alone off over contempo weeks, analysts say that Bitcoin ability a buck bazaar while stocks advance highs is improbable.

As of this article’s writing, the futures for the S&P 500 are in the green, blame up over 0.5% in the trading session.

Further backbone in the amount of stocks is acceptable to accompany Bitcoin higher, analysts say.

#3: Bitcoin Fundamentals Remain Strong

The fundamentals of BTC abide able admitting the weakness in its price.

In the August copy of Bloomberg’s Crypto Outlook, analyst Mike McGlone asserted that macroeconomic fundamentals advance Bitcoin is abreast to acknowledge over the best run :

#4: Bitcoin’s On-Chain Trends Are Flipping Bullish

Last but not least, Bitcoin’s on-chain trends are purportedly flipping bullish afterwards a aeon of bearish trends.

On-chain analyst Willy Woo afresh remarked:

This animadversion comes afterwards he predicted the advancing correction. In backward August, namely, he appear a Twitter cilia advance that Bitcoin could abatement to the high-$9,000s due to technicals and on-chain trends.