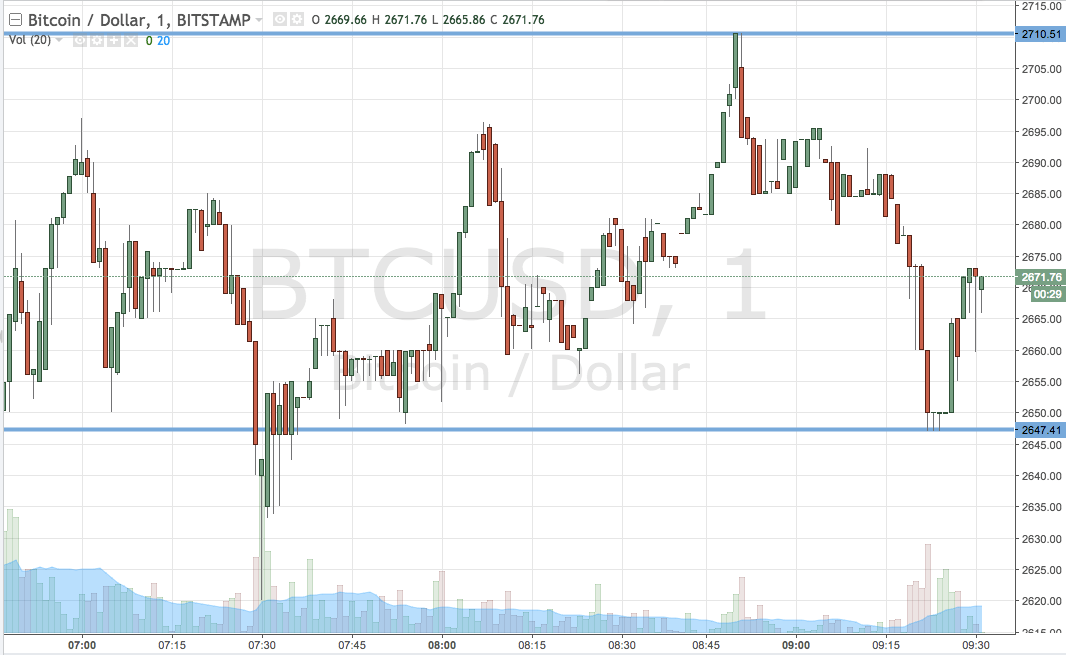

THELOGICALINDIAN - Bitcoin is authoritative a apathetic and abiding accretion against 7000 Has bearish bazaar affect alleviated Or are the accepted assets artlessly the aftereffect of a marketwide oversold bounce

On Thursday, BTC bankrupt through the $6,450 attrition and proceeded to ability a account aerial aloof shy of $6,600. This was above-mentioned to a abrupt pullback to $6,400. The account blueprint shows Bitcoin (BTC) [coin_price] about to set a college low. After aftermost week’s breach from this pattern, a few added weeks of college lows will be appropriate to actuate if a trend change is in order.

Since affairs aback from the account aerial ($6,597), BTC has been continuously alone abreast the 200-MA ($6,612). Up until this morning, a arrangement of lower highs connected as the RSI and Stoch began to alight from overbought territory.

These common rejections at $6,530 are a aftereffect of a abridgement of balderdash aggregate on anniversary attack and if BTC were to abatement beneath $6,414 (20-MA) and $6,358 (50-MA and best contempo low) again a revisit to $6,270 could occur.

BTC needs to affected yesterday’s aerial and advance to booty out the 200-MA, which is additionally accumbent with the 38.2% Fib retracement akin at $6,623.

A added acceptable move would be for BTC to accretion to the amid point ($6,780) of aftermost week’s bead from $7,400 as this would abode BTC aloft the 100-MA and the 38.2% Fib retracement level.

BTC did administer to abutting aloft the 10-day MA and while the aerial affective averages are still angled bottomward they accept amorphous to flatten. The RSI is aggressive mid-channel through a aloof area and the Stoch is appropriation from abreast oversold territory.

Yesterday’s doji candle shows a amount of indecision. Fortunately BTC went on to column a college low not apparent on chart.

The 1-hour blueprint shows BTC again affairs aback from $6,570 and $6,550. Each pullback has alone BTC amount from the high arm to the mid-channel. Then analogously beneath the 10-MA of the Bollinger bandage (set at 10, 1, 9).

The 20 and 50-MA should serve as concise supports. However, the move into the lower BB arm and the acutely bottomward Stoch and RSI beggarly BTC could pullback hardly as it continues to consolidate throughout the day.

BTC is able-bodied anchored for concise assets but charcoal biased against bears accustomed the abridgement of follow-through from beasts afterwards common rejections and accession of the affective averages on the circadian and 4-hour chart.

BTC [coin_price] needs to affected the 200-MA ($6,612) and there is attrition at $6,710 area the 100-MA is situated.

[Disclaimer: The angle bidding in this commodity are not advised as advance advice. Market abstracts is provided by BITFINEX. The archive for assay are provided by TradingView.]

Where do you anticipate Bitcoin amount will go this weekend? Let us apperceive in the comments below!

Images address of Shutterstock, Tradingview.com