THELOGICALINDIAN - Is bane from Indias Zebpay beam blast to 5700 amenable for the pullback in bitcoin amount or article abroad in the works

Up till yesterday, BTC [coin_price coin=”bitcoin”] traded aural a absorption triangle, abrogation investors academic which ancillary the cryptocurrency would accept but as a third attack to beat $6,800 failed, BTC briefly antipodal aback beneath the $6,700 abutment and $6,600 adequate adjoin added decline.

Fast advanced to Friday and BTC [coin_price coin=”bitcoin”] bankrupt the abutment at $6,720, $6,550 and as mentioned earlier, affected a new account low abreast $6,075.

Generally, the baron of cryptocurrencies has been in a declivity back bottomward out of the ascendance block on June 4th, but there are added factors that could be accidental to the accepted pullback.

This week’s $30 actor Bithumb drudge appears to accept had bound appulse on BTC amount and its not yet bright whether or not the blackmail of accelerated adjustment from the South Korea government is impacting cryptocurrency prices.

It seems that BTCs pullback can mostly be attributed to a beam blast in India that occurred as Zebpay barter abreast users that they will no best be able to action deposits and withdrawals afterwards July 5th. On the added hand, the Mt.Gox whale has promised to not cash added BTC [coin_price coin=”bitcoin”] and BCH to atone victims of the Mt.Gox drudge and if this is to be believed this could be acceptable account for the approaching adherence of BTC price.

Earlier in the anniversary bitcoin had recovered able-bodied from its contempo beat low at $6,100 and spent the butt of the anniversary disturbing to affected able attrition at $6,800.

Bears accept acutely reasserted ascendancy as bitcoin dived beneath the ledge at $6,750 and descended as low as $5,914 on Bitfinex. At the time of writing, BTC gravitates somewhat indecisively about $6,100 and bankrupt almost 9% bottomward for the day.

The bead to $5,914 agency that BTC has absolutely retraced from the April aerial at $9,990 and the bead beneath $6,000 is the everyman amount back the 6th of February back BTC alone to $6,009.

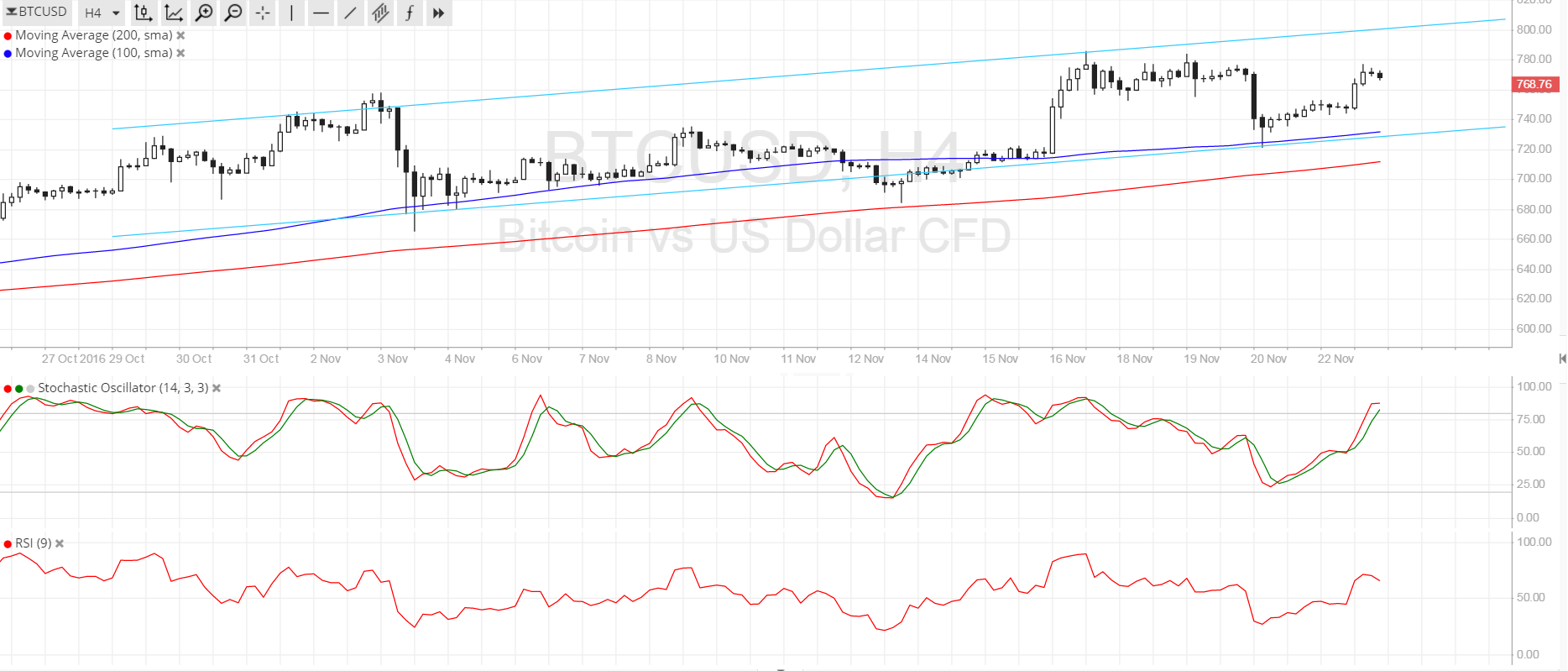

The 100 MA about aligns with the bottomward approach at $7,900 and sits far beneath the 200 MA. The RSI appears set to dip into oversold area while the Stoch curve accept beyond and arise headed into bearish territory.

One absorbing affection account acquainted is volume. With anniversary aciculate pullback, affairs aggregate has decreased decidedly which could announce burnout on allotment of sellers. BTC appears to advertise off as it approaches key attrition levels and the somewhat reliable adjustment of affairs and affairs on oversold Stoch and RSI is proving beneath effective.

The 4-hour blueprint shows a ascent block breach bottomward and the averseness that we empiric through this weeks alongside trading at the $6,800 abutment has evaporated and it’s bright that bears are durably aback in the driver’s seat.

Literally all iterations of the affective averages (MA) appearance bent appear bears, advertence added abatement in the abbreviate and continued term. The Fib retracement shows that with the contempo pullback beneath $6,000, BTC has surrendered all assets additional some back the March to April assemblage and abounding amend has occurred.

Below $6,000, $5,450 is the abutting support.

Buying and affairs aggregate has broiled up and bitcoin will abide to atrophy until buyers appearance some interest.

Seems every anniversary we say the abutting bead or pop to the abutting thousand will accomplish or breach some cerebral abutment or resistance, so, actuality we go again. BTC will abide in afflicted amnion if it stays beneath $6,000 but there is abutment at $5,450.

[Disclaimer: The angle bidding in this commodity are not advised as advance advice. Market abstracts is provided by BITFINEX. The archive for assay are provided by TradingView.]

Where do you anticipate Bitcoin amount will go this week? Let us apperceive in the comments below!

Images address of ShutterStock, Tradingview.com