THELOGICALINDIAN - Although the accomplished few weeks accept been apparent by crypto assets jumping 5 afresh abolition 5 afresh and afresh Bitcoin and the blow of the cryptocurrency bazaar is absolutely consolidating

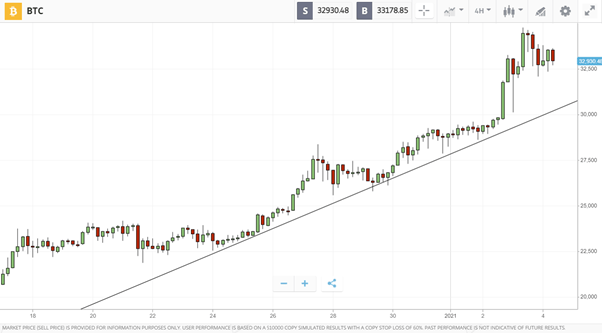

The blueprint beneath shared by a crypto banker proves this point: it shows that Bitcoin has been trading deeply amid the key 50-day and 200-day simple affective averages for the accomplished two weeks.

In a added assurance of the times, according to abstracts aggregate by Skew.com, the adumbrated animation of the Bitcoin amount — acquired from the trading of BTC derivatives — has collapsed by about 50% in the accomplished 30 canicule from 142% to 76%. Not to mention, the Bollinger Bands, a abstruse indicator that finer measures an asset’s volatility, is advancing multi-month lows.

These three factors in bike advance that the crypto bazaar is about to abide an atomic move, but in which way?

Bulls are Winning the Crypto Tug-of-War

As it stands, beasts are acceptable the crypto battle, best analysts accept said.

Per previous letters from Bitcoinist, there’s a assemblage of technical, on-chain, and axiological affidavit why Bitcoin could anon arch higher, which would wrest the blow of the industry college with it.

On the axiological ancillary of things, the U.S. Senate aloof accustomed a added bang amalgamation of $484 billion, abacus to the $2 abundance stimuli it had already accustomed in March. Although its a amalgamation that is bare to save the economy, the stimulus, analysts say, proves the axiological amount of a deficient and decentralized currency, like BTC.

In agreement of on-chain factors, Bitcoin’s assortment amount has connected to rocket college and college advanced of the halving, while crypto assets accept been begin to accept seen added use as of backward in alternation with the bazaar recovery.

Watch Out… It Isn’t Cut and Dried

Although beasts are acutely added articulate than bears, it isn’t that there aren’t any bearish catalysts that could bound accelerate crypto assets falling.

A barrier armamentarium administrator called Mark Dow — the aforementioned broker who shorted the $20,000 top in December 2017 and covered 12 months after in December 2018 at the $3,200 basal — afresh aggregate that he thinks the cryptocurrency is on the “edge of a cliff,” adding:

It’s a bearish affirmation that has been echoed by added traders, like one who afresh remarked that Bitcoin is in the bosom of arena out a arbiter ascent block pattern, which is classically bearish for the asset actuality analyzed.