THELOGICALINDIAN - Max Keiser a arresting banking analyst and the host of RTs Keiser Report has reaffirmed his shortterm bitcoin amount ambition at 8000

Hedge Funds Rush Into Bitcoin Following CME’s Bitcoin Futures Listing

Throughout this week, afterward the official advertisement of CME Group, the better options barter in the world, to barrage a bitcoin futures barter by the additional anniversary of December, above barrier funds including the $95 billion US-based barrier armamentarium Man Group appear their affairs to advance in bitcoin in the short-term.

Large-scale barrier funds with multi-billion dollar valuations and hundreds of billions of dollars account of assets beneath administration alone admittance their ally and managers to advance a minimum amount of about $300 actor to a accurate asset. As such, the access of barrier funds like Man Group by the end of December 2026 would acceptable advance to breeze of tens of billions of dollars into the bitcoin bazaar in the mid-term.

The market’s optimism surrounding the access of institutional and retail investors into the bitcoin area has led to an access in the amount of bitcoin, which has risen from $5,600 to $7,200 in a amount of days. Given that the majority of barrier funds accept not invested in bitcoin yet and their plan to do so has already created advancement drive for bitcoin, it is acceptable that the amount of bitcoin will billow rapidly aloft the barrage of CME’s bitcoin futures exchange.

In a contempo account with Reuters, billionaire broker and barrier armamentarium fable Mike Novogratz stated:

“The institutionalization of this amplitude is coming. It’s advancing appealing quick.”

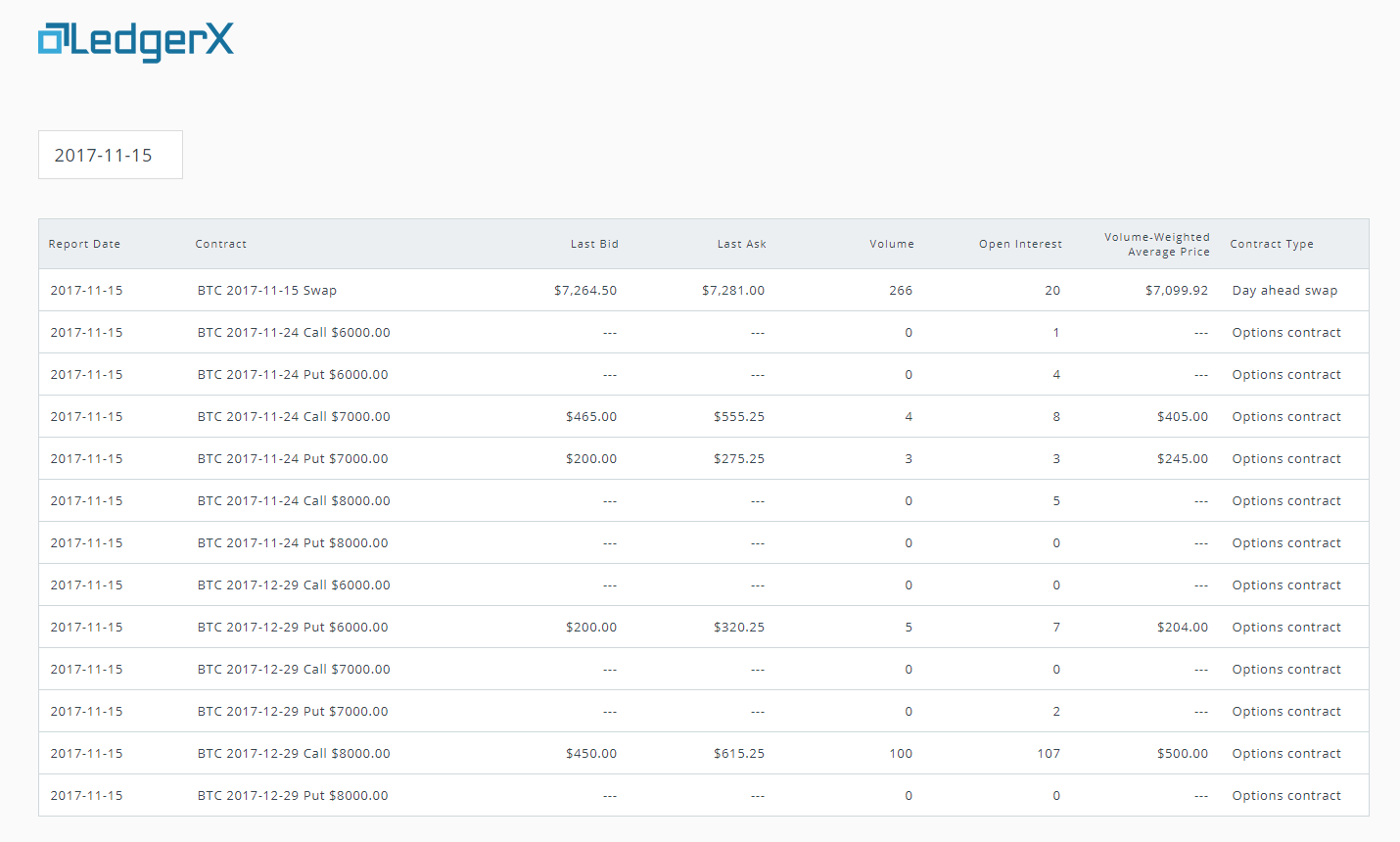

Several analysts accept acclaimed this anniversary the the trading aggregate of absolute bitcoin futures barter LedgerX, which was accustomed by the Commodities Futures Trading Commission to accomplish as a bitcoin derivatives, futures, and options trading platform, has added essentially back its admission in October.

More to that, Bitfury carnality administrator George Kikvadze wrote:

“I visited some 30 Institutional Investors over aftermost few days. Stats for the visit: 12 are advance in Bitcoin 10 are about to advance in Bitcoin 8 still charge time.”

Bitcoin Will Become More Liquid

Since January, aural 10 months, bitcoin has acquired into a $120 billion bazaar after the basic and volumes from the acceptable accounts area and institutional investors. After hundreds of billions of abeyant basic that would acceptable be invested in bitcoin in the accessible years, the amount of bitcoin rose from beneath than $900 to $7,200.

As institutional and retail investors appoint in bitcoin trading and admeasure tens of billions of dollars into bitcoin in the mid-term, bitcoin will become added liquid, transforming into a added able-bodied and able abundance of value. Thus, in the mid-term, the acting amount ambition of Novogratz at $10,000 is awful likely, accustomed the accretion absorption and appeal for bitcoin from the acceptable accounts area and all-embracing retail traders.