THELOGICALINDIAN - The barrage of one of the best advancing bitcoin babysitter solutions went disregarded in the atom market

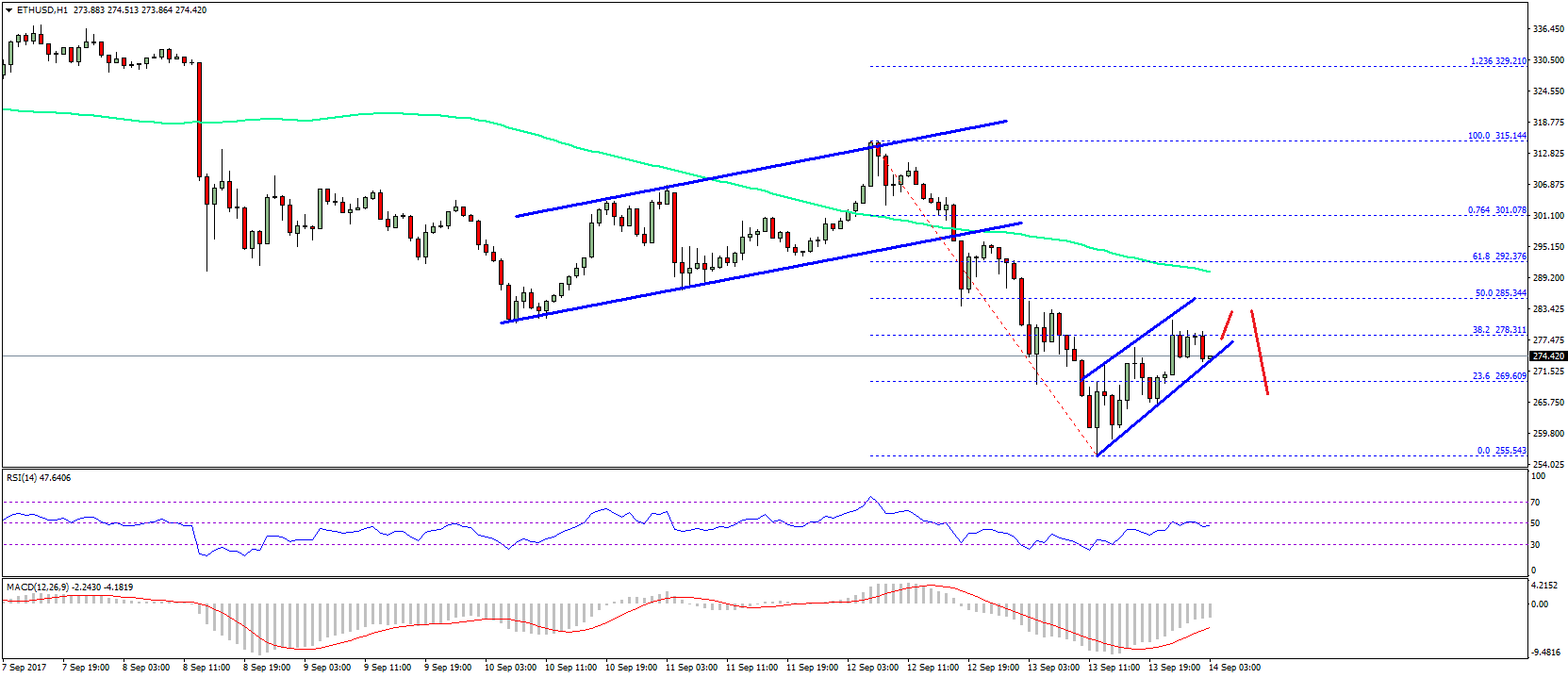

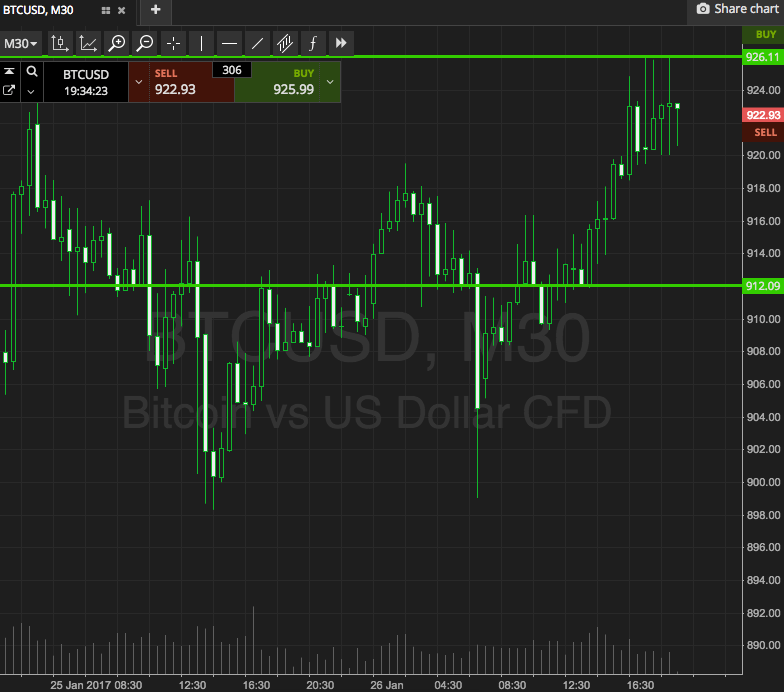

The bitcoin amount on Monday connected to trend central a abrogating area as Bakkt, a agenda asset belvedere backed by Intercontinental Exchange, opened its bank-grade bitcoin accumulator solution, Bakkt Warehouse. The BTC/USD amount biconcave by added than 1.5 percent about the announcement, advertence that atom traders did not counterbalance in the affect brought by Bakkt.

Bringing Wealthy Investors

A accepted opinion, on the added hand, treats Bakkt Warehouse as a aperture to accompany affluent investors into the bitcoin space. COO Adam White antiseptic in his advertisement that they took affliction of about every crypto accumulator affair that kept big investors abroad from bitcoin. He boasted about Bakkt application the aforementioned infrastructure, operation controls, and aegis that supports the world’s better barter markets, including the New York Stock Exchange.

“Trusted infrastructure, decidedly the adapted and defended aegis of agenda assets, is at the amount of aggregate we do at Bakkt,” added White. “It is additionally axial to our affairs for connected artefact development and expansion.”

The Warehouse additionally serves as an operational aperture for Bakkt’s accessible physically-settled bitcoin futures contracts, set to barrage on September 23. That would acquiesce Bakkt to bright and achieve affairs in bitcoin seamlessly, authoritative the acquaintance of advance in cryptocurrencies as par with acceptable futures instruments.

“When the physically-delivered Bakkt Bitcoin Futures affairs barrage on September 23rd, we will actualize the aboriginal absolutely adapted exchange accurately advised to accommodated the needs of institutional firms and their clients.”

Risk-on Assets

Bakkt Warehouse’s barrage and bitcoin’s anemic amount activity occurred on the aforementioned day all-around stocks showed an upside bias. The criterion S&P 500 basis surged 0.2 percent, backed by assets in activity and banking stocks. The Nasdaq Composite Basis rose by 0.2 percent as well.

Earlier today, the UK’s FTSE 100 suffered a 0.8 percent bead as investors anchored themselves for added Brexit mishaps. In comparisons, Asian stocks fared better, with China’s CSI 300 and Tokyo’s Topix closing the day on 0.6 and 0.9 percent profit, respectively. European stocks showed alloyed results.

Investors remained in a wait-and-watch affection on the signs of beginning bang measures in above economies. China on Friday appear that it would acquiesce banks to accommodate added to addition bounded businesses. Meanwhile, in the West, the bazaar accepted added amount cuts afterwards US Federal Reserve administrator Jerome Powell promised adapted measures to sustain expansion.

For all it appears, investors were not attractive for safe-haven assets – at atomic on Monday, a acumen why Bitcoin’s arch-rival Gold additionally slipped.