THELOGICALINDIAN - Bitcoin fell by as abundant as 554 percent on Wednesday afterwards band markets warned the achievability of a recession is growing

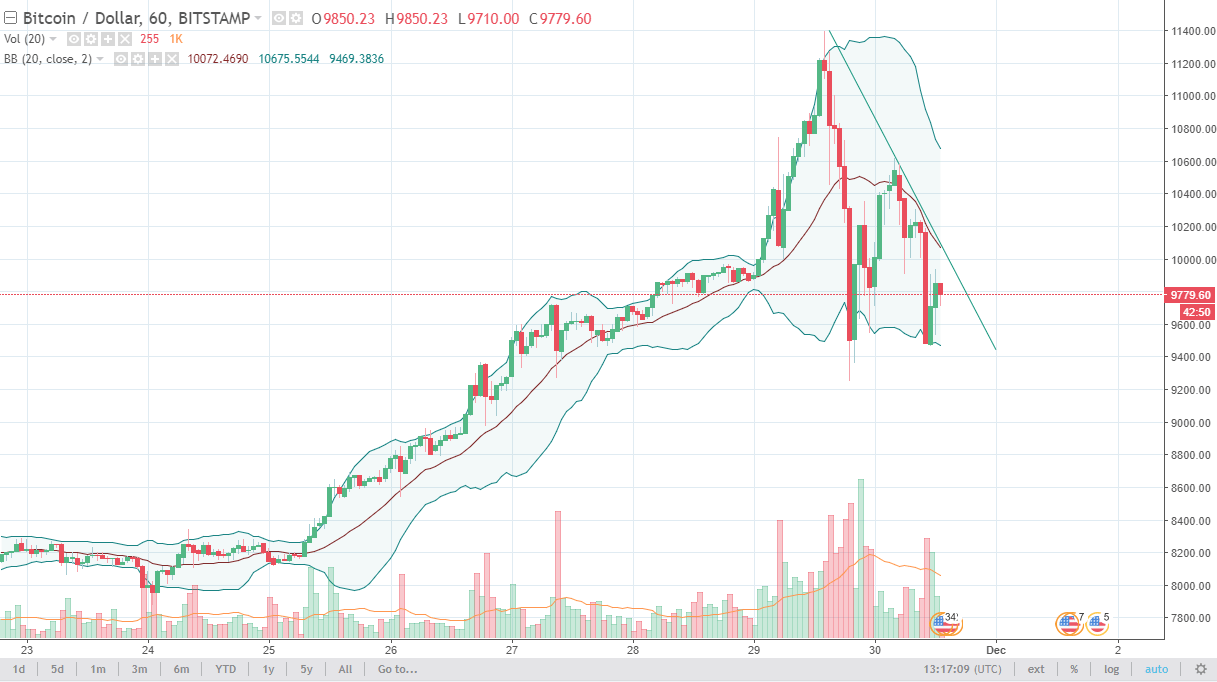

The BTC/USD apparatus today accustomed a new bounded beat low of $9,470 on San Francisco-based Coinbase exchange. The downside amount activity brought the pair’s week-to-date losses to about 18 percent. It about attempted a baby accretion aloft the $10,000, a cerebral attrition akin during an uptrend, and succeeded. As of 11:25 UTC, the BTC/USD apparatus was trading at $10,075.

Bad Day for US Stocks

The bitcoin’s intraday activity followed a black day on Wall Street. The S&P 500 basis bankrupt the affair bottomward 2.9 percent, with activity stocks arch the fall. At the aforementioned time, tech-heavy Nasdaq additionally concluded afterwards bottomward about 3 percent on the day.

It was a bad day for treasuries as well. Both the US and UK 10-Year Government Bond Yields plunged beneath the yields of shorter-maturity debt. It happened for the aboriginal time back the 2008-09 bread-and-butter crisis – their accord accepting inversed rang the accretion of a recession.

Stocks abashed as band mkts scream recession. Asia equities chase Wall St slide, but off lows as 800point bead in Dow seems apish & US Futures bounce. Bonds advance college w/US 10y yields at 1.55%, US Inversion deepens w/US2s10s advance at -0.3bps. Oil extends drop. Bitcoin <$10k pic.twitter.com/wiWt7KjuD7

— Holger Zschaepitz (@Schuldensuehner) August 15, 2019

Meanwhile, Gold prices belted lower hardly on abstruse grounds. The chicken metal was on a abrupt acceleration this week, ascent 1 percent in the antecedent session. The move visibly prompted traders to booty near-term profits at new highs. As a result, atom gold was bottomward 0.08 percent at $1,515 per ounce as of 11:36 UTC today.

Doubts Cast Over Bitcoin Safe-Haven Status

The trend battle amid bitcoin and US stocks prompted analysts to catechism the former’s safe-haven status. Noted economist Alex Krüger acicular today that bitcoin was neither affective in bike with Gold – a haven-asset with which it tries to attempt – nor was accouterment any ambiguity band-aid to investors adversity in the US banal and band markets.

“Confirmation Bent is the addiction to adapt new affirmation as acceptance of one’s absolute beliefs,” he added. “Stories that clothing one’s bent and accomplish a balmy down-covered activity are about welcome. Facts? Nobody cares about those.”

Bitcoin is a stocks barrier and moves in band with gold as a safe anchorage asset. Was that not the newfound crypto narrative?

— Alex Krüger (@krugermacro) August 14, 2019

Peter Schiff, arch controlling administrator at Connecticut-based broker-dealer Euro Pacific Capital, criticized bitcoin for “collapsing” in the aforementioned bazaar ambiance that promised to activate its rise.

“If Bitcoin can’t accomplish a new aerial with all-around disinterestedness and bill markets in turmoil, beneath what accident will it accomplish a new high,” tweeted Schiff. “So abounding Bitcoin hodlers are assertive that Bitcoin is activity to the moon that they’re abashed to advertise any for abhorrence of missing out on huge gains. Yet the amount of Bitcoin is coast anyway. Imagine how abundant faster the amount of Bitcoin will abatement already that acquisitiveness turns to fear!”

Keep cogent yourself that all the way bottomward while your cardboard assets vanish. Gold is ascent steadily, aloof as it should. Bitcoin is biconcave fast. Stop absent and deathwatch up to reality.

— Peter Schiff (@PeterSchiff) August 15, 2019