THELOGICALINDIAN - Bitcoin amount is at a cardinal moment potentially accessible for a blemish into a new balderdash trend The crypto bazaar has aloof been watching and cat-and-mouse for the appropriate spark

Crypto assets about pump back they’re listed on a new barter or platform. The atom the crypto apple may accept been cat-and-mouse for could be actuality with the allegorical advertisement of Bitcoin on every United States coffer in the world.

United States Banks Can Now Custody Crypto, OCC Clarifies

Yesterday, the crypto association erupted with acclaim over a description from The Office of the Comptroller of the Currency (OCC) that banks beyond the US could aegis cryptocurrencies for their customers.

Institutions alignment from civic banks accept continued stored cash, gold, and added claimed items of amount or accent for their customers. The OCC says it recognizes the “importance of agenda assets,” and accordingly capital to accomplish the description for banks to accommodate such services.

Related Reading | How Crypto Market Fear And Greed Be Used Profitably As A Trade Trigger

Services will accommodate “holding different cryptographic keys associated with cryptocurrency,” and “activities accompanying to aegis services.”

“Crypto aegis casework may extend above irenic captivation ‘keys,'” a acknowledgment from the OCC reads.

“From safe-deposit boxes to basic vaults, we charge ensure banks can accommodated the banking casework needs of their barter today,” explained Acting Comptroller of the Currency Brian P. Brooks.

The OCC additionally sees the charge for banks to body basement accessible for the approved aegis of agenda assets, acceptable due to the United States eventually advancing to agreement with a agenda dollar.

Will Bitcoin Pump On The Equivalent Of A US-Wide Bank Listing?

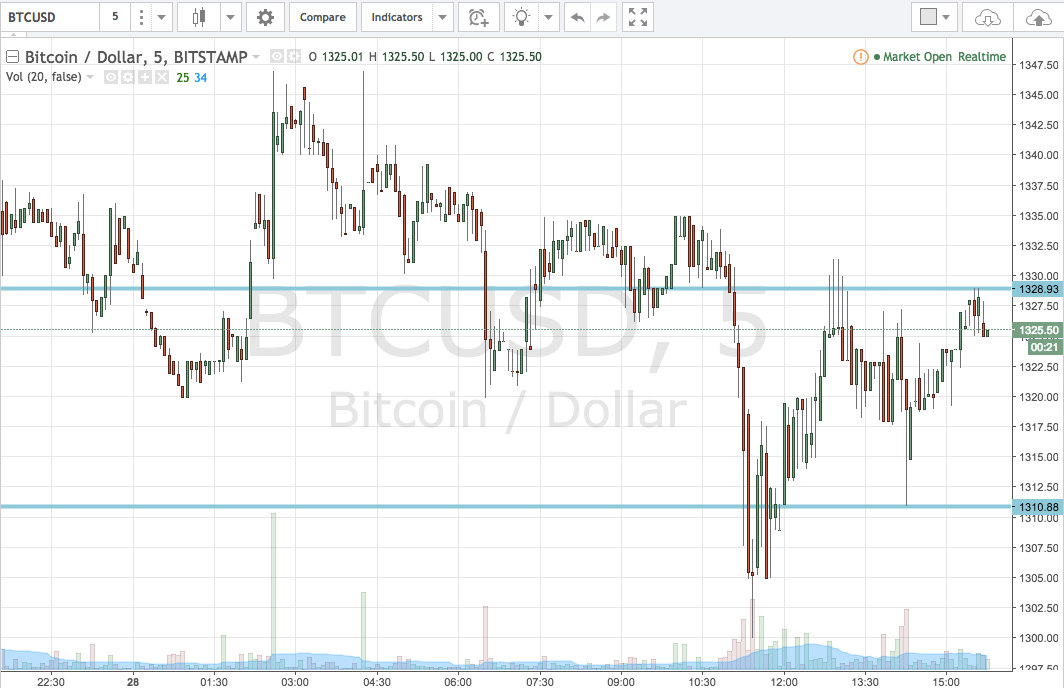

Bitcoin price is trading alongside afterwards several months. The asset’s halving is now in the past, and the asset’s concrete counterpart, gold, has been aerial for the aforementioned affidavit BTC is declared to.

Yet the cryptocurrency isn’t affective until addition strikes a bout and lights the fuse. An explosive move is expected, and it may assuredly be actuality afterward this groundbreaking news.

Related Reading | Here’s Why a Fund Manager Thinks Bitcoin Will “Punch” Past $10,500

When cryptocurrencies are listed on Coinbase or Binance, they generally pump sky aerial due to the nod of abutment and abrupt absorption from new customers. Could the aforementioned affair appear now to Bitcoin and crypto now that every coffer in the US has the blooming ablaze to accommodate crypto custody?

The barrier to crypto acceptance has continued been the amazing Bitcoin and blockchain interface. Front-end and second-layer technologies are bare for the boilerplate to booty notice. Proper and accustomed faces to abundance crypto with is addition important factor.

All of this is now advancing together, aloof as Bitcoin looks to be breaking out of its abiding amount pattern, and abide its long-term uptrend.