THELOGICALINDIAN - One of the better mysteries in the Bitcoin apple abreast from the absolute character of Satoshi Nakamoto is how abundant of it is actuality bought and awash on exchanges anniversary day As acicular out in a cheep from Messari architect Ryan Selkis the acknowledgment actual abundant depends on who you ask

Bitcoin Volumes – Compare And Contrast

To highlight the point, Selkis compared the appear 24-hour aggregate for accepted exchange, OKEx, on a accurate day, with assorted abstracts providers. The after-effects ranged from $67 actor to $2.5 billion, which seems like a ample abundant advance that the accurate acknowledgment should be independent about within.

But seriously, the allowance of absurdity there is so abundant that we cannot accretion any allusive advice from it. So why is there such a alterity in reporting?

The botheration has stemmed from the actual attributes of the beast. Volume on exchanges happens off-chain, so we charge await on the exchanges themselves to address circadian volumes.

One of the longest continuing bitcoin and cryptocurrency abstracts providers, CoinMarketCap (CMC) again agilely compiles these self-reported abstracts into a top-100 chart. Because so abounding bodies use CMC for information, actualization college in the blueprint tends to allure added cartage to your exchange, and allows exchanges to allegation college advertisement fees. So it was benign to beating the numbers slightly… or indeed, a lot.

Incidentally, for the 24-hours in question, the appear aggregate for OKEx on CMC was a whopping $523 million.

Cutting Through To The Heart Of The Wash

The affair was first raised by the Blockchain Transparency Institute, who developed techniques to band abroad affected aggregate and ablution trading by exchanges, to broadcast an ‘actual’ top-ten. OKEx was one of the exchanges who fared abominably in the BTI study, with an declared 90% of aggregate arresting fake. For our 24-hour sample volume, BTI gave the everyman $67 actor figure.

Amusingly, OKEx CEO, Jay Hao, again challenged BTI, betting 100 BTC that he could prove that added than 10% of OKEx aggregate was real. It ability conceivably accept been added absorbing if he had been able to prove that beneath than 10% of aggregate was fake, but that is apocalyptic of aloof how big the botheration was. Hao advised that affidavit of beneath than 90% of aggregate actuality ablution traded was a win.

Bitwise again took up the mantle, appliance its analysis to abutment its Bitcoin ETF appliance with the SEC. ‘Only ten exchanges accept any absolute aggregate at all’, it proclaimed, ‘but these ten are actual able-bodied ordered and regulated’. The tactic didn’t assignment too able-bodied for Bitwise as the SEC alone its Bitcoin ETF appliance after in October.

However, it did activation CMC to acquire that concerns over its advertisement of affected volumes were valid, and it alien an ‘adjusted 24-hour volume’ metric. For the 24-hours in question, the CMC adapted aggregate for OKEx was absolutely the aforementioned as the appear volume, so the ability of this is absolutely questionable.

So What’s The Truth?

Around the aforementioned time, Messari alien a ‘real-10’ metric, which aloof advised those ten barter which Bitwise had declared genuine. But surely, not all of the aggregate alfresco of this is wash-traded?

FTX advised the BTI/Bitwise claims, and whilst acceptance that abundant appear aggregate is fake, believed that these letters went too far in the added administration and bare out too abundant 18-carat volume. The FTX Global aggregate adviser is the antecedent of the $2.5 billion amount for our 24-hour period, so somehow they accept managed to address volumes college than OKEx itself provided.

Gabor Gurbacs, of adolescent Bitcoin ETF hopefuls, VanEck, replied to Selkis’s aboriginal cheep adage that CryptoCompare tends to be best authentic ($328 million). Although absolutely how he justifies that is unclear.

The sad accuracy is that we absolutely don’t know. The alone aggregate abstracts we can accurately accompaniment are those on-chain. Even account advertence that all-around barter volumes are up, are alone based on the abstracts sources we have.

And, if a bourgeois appraisal of about 85% is ablution traded, again a new barter aggravating to get to the top of the archive can disproportionately access these figures.

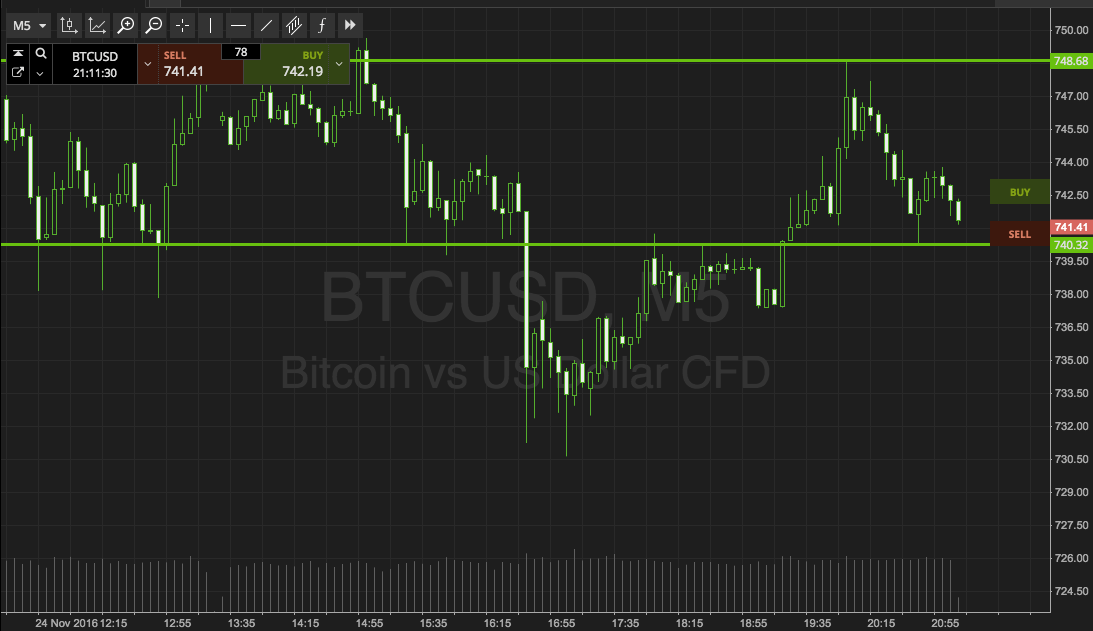

Better to aloof analysis abstracts from one or added barter that you trust. All of the 18-carat exchanges see agnate patterns of peaks and troughs in volume, so although a absolute amount is absurd to calculate, we can still see back aggregate goes up and down.

Do you anticipate we’ll anytime apperceive Bitcoin’s accurate volume? Add your thoughts below!

Images via Shutterstock