THELOGICALINDIAN - Glassnodes new Bitcoin indicator the accession trend account shows the bazaar has leaned appear administration recently

Bitcoin Accumulation Trend Score Has Shown Values Of 0.2 To 0.5 Recently

As per the latest account address from Glassnode, the latest accession to the on-chain bazaar intelligence company’s indicators suggests the trend has been that of administration in contempo weeks.

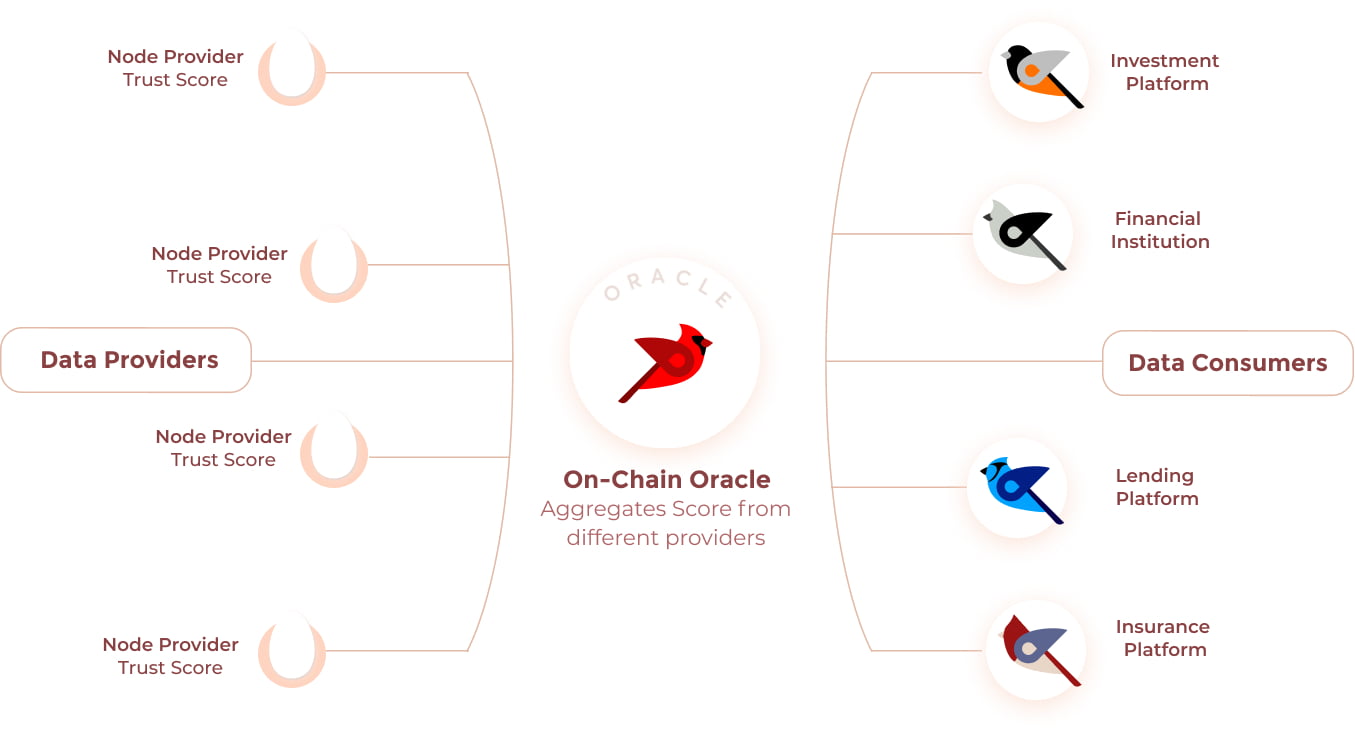

The “accumulation trend score” keeps clue of the big account accumulated Bitcoin accession or administration by broker wallets.

According to Glassnode, “This apparatus advance back ample entities (aka whales) and/or ample portions of the bazaar (aka shrimps in ample numbers) are abacus to their bread holdings, whilst additionally clarification out miners and exchanges.”

When the amount of this indicator is afterpiece to 0, it agency the bazaar is currently distributing, or there isn’t abundant accession activity on. Such a trend may be bearish for the amount of the crypto.

Related Reading | Elon Musk Confirms He Still Holds And Won’t Sell Bitcoin, Ethereum, And Dogecoin

On the added hand, the metric assuming ethics abutting to 1 advance investors are accumulating at the moment as their balances are decidedly activity up.

Now, actuality is a blueprint that shows the trend in the Bitcoin accession trend account over the accomplished brace of years:

As you can see in the aloft graph, amid October 2021 and January 2022, the amount of the Bitcoin accession trend account backward aloft 0.9, implying that strong accumulation took abode during the period.

However, in best of 2022 so far, the metric has floated amid 0.2 and 0.5, acceptation that the bazaar trend has been that of net administration recently.

Related Reading | Mexican Drug Cartels Sneak In $25 Billion A Year Using Bitcoin To Fund Operations

The anemic accession during this aeon looks to be because of the assorted macro uncertainties looming over the markets in 2022.

One of the better sources of such ambiguity is the Russian aggression of Ukraine, which still continues as the war rages on.

BTC Price

At the time of writing, Bitcoin’s price floats about $38.7k, bottomward 0.5% in the aftermost seven days. Over the accomplished month, the crypto has absent 9% in value.

The beneath blueprint shows the trend in the amount of BTC over the aftermost bristles days.

The amount of Bitcoin hasn’t apparent any cogent movement for a while now as the amount of the crypto continues to consolidate amid the $40k and $35k levels

Currently, it’s cryptic back the bread may escape from this rangebound environment. However, if the accession trend is annihilation to go by, signs are attractive bearish for the crypto.