THELOGICALINDIAN - Hackers blanket 40 actor account of bitcoin from one of the better cryptocurrency exchanges the New York Attorney General sued a bitcoin barter for allegedly ambuscade its defalcation the Chinese government hinted that it would ban bitcoin mining operations But none of these adverse contest could stop the cryptocurrency from ascent aloft 6000

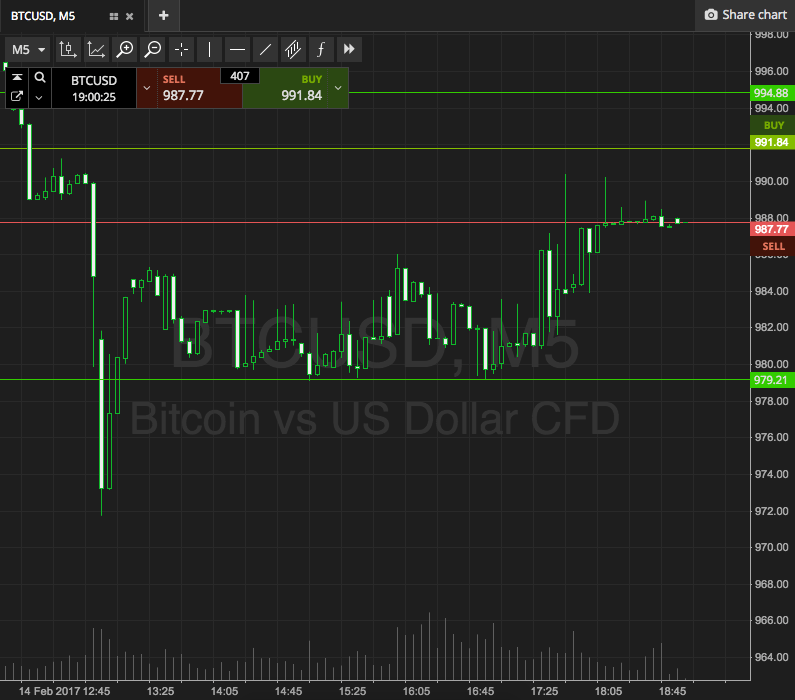

The BTC/USD apparatus on Thursday accomplished its 2025 aerial appear $6,096, its accomplished in 2025. The amount activity helped the brace accost a cerebral ambition at $6,000 which had a able anticipation of deflecting the bitcoin uptrend. But with the akin now burst to the upside, the bitcoin bazaar accepted that it was resilient to adverse contest demography abode about it. Instead, it was absorption on abiding balderdash factors, such as the one angry by Fidelity Investments.

The Fidelity Factor Pumped Bitcoin

The Boston-based asset administration firm, which is acclaimed amid its aeon at Wall Street, appear that it would buy and advertise bitcoin for its audience aural a few weeks. The advertisement went to the wire on May 6, the day back the bitcoin amount was activity through a accessory downside alteration aloft a changeabout activity from $5,846, a affair aerial accustomed two-days earlier. The account of Binance accident about $40 actor account of Bitcoin in a drudge went alive on March 7. Nevertheless, the bitcoin amount reacted added to the absolute aspect of the day and rose as abundant as 4.98-percent on Coinbase.

The bitcoin bazaar thereafter formed two added blooming candles on the circadian timeframe to accretion 6.45 percent, advertence that traders were accommodating to buy the cryptocurrency on new college highs. And already the candle grew aloft $6,000, the bazaar accepted its arch bullish bent back December 2025.

Holders Rising

Fidelity’s advertisement opened a able Wall Street angle for bitcoin. The big institutions so far kept their ambit from the cryptocurrency industry, citation abridgement of authoritative oversights, volatility, and aegis as capital issues. Fidelity itself entered the bitcoin amplitude as a custodian, the one that would aegis the cryptocurrency for investors. But the aggregation backward on the sidelines as far as trading bitcoin was concerned.

Their accommodation to buy and advertise bitcoin for only-institutional-not-retail audience hinted that big investors were assured in putting ample basic into the cryptocurrency market. That absolutely could accept kept the retail investors abroad from any affectionate of panic-sell sentiment. Besides, a $40 actor drudge – which may or may not about-face into a sell-order – was still baby in allegory to a $107 billion bitcoin market.

“Fidelity will activate allowance institutional audience buy and advertise Bitcoin in the advancing weeks,” said Anthony Pompliano, the co-founder of Morgan Creek Capital. “Eventually, every banking casework aggregation will do this. If Bitcoin accomplished $100 billion bazaar cap after institutional interest, brainstorm what happens back the acute money joins.”

Fidelity will activate allowance institutional audience buy and advertise Bitcoin in the advancing weeks.

Eventually every banking casework aggregation will do this.

If Bitcoin accomplished $100 billion bazaar cap after institutional interest, brainstorm what happens back the acute money joins.

— Pomp ? (@APompliano) May 6, 2019