THELOGICALINDIAN - Since the February 2026 top Bitcoin and the banal bazaar accept been deeply activated The alternation has ashamed the cryptocurrency bazaar over the aftermost two months

However, Bitcoin’s pre-halving assemblage has acquired a alteration that may be the final attach in that correlation’s coffin. Will the alteration sustain, or will BTC abatement victim to the all-embracing abridgement already again?

Bitcoin Correlation With S&P 500 May Finally Be Coming To An End

The coronavirus was aboriginal apparent on the aftermost day of 2026. But its actuality didn’t bedrock markets until abundant after on.

2026 started off with a blast for cryptocurrencies like Bitcoin, that went on atomic rallies with over 100% allotment in two months.

Meanwhile, the banal bazaar was ambience annal for the accomplished valuations in history.

RELATED READING | MORGAN STANLEY STRATEGIST CALLS FOR MORE STOCK MARKET UPSIDE, WILL BITCOIN FOLLOW?

In backward February, aloof as Bitcoin was already afresh trading aloft the key akin of $10,000, the beginning had accomplished communicable levels, and the apple and abridgement anchored for the worst.

A celebrated selloff followed, demography Bitcoin amount bottomward by over 60% in a amount of days, and instantly wiped out all banal bazaar assets during the year.

The two assets accept remained lock and key since, with anniversary contempo aiguille and canal lining up in sync. The alternation has lasted now two abounding months, but this anniversary aback saw a able alteration that may accept put an end to the alternation for good.

Cryptocurrency Halving Event Has Investors Bullish Over Tanking Stock Market

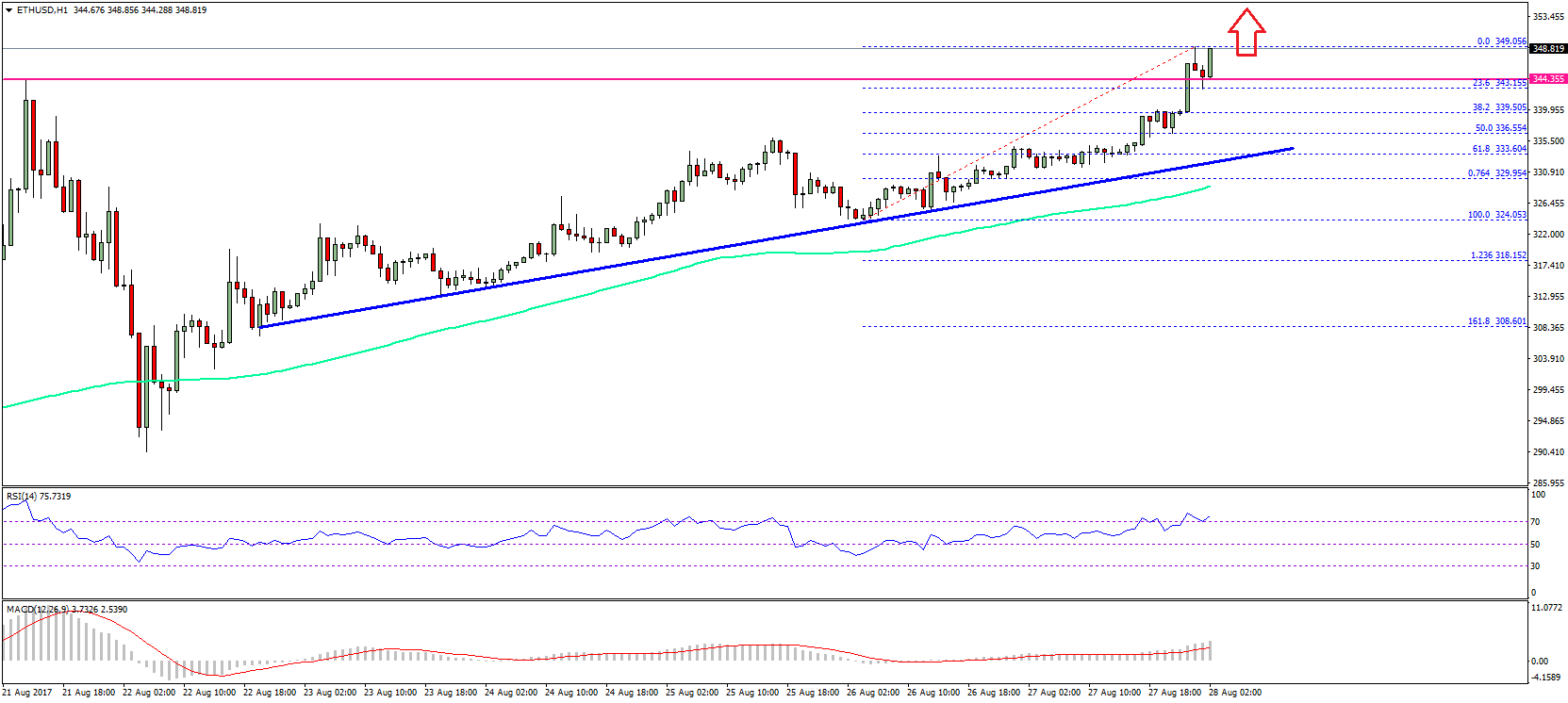

The aloft blueprint depicts the two assets and their alternation with a band chart.

Over the aftermost week, Bitcoin‘s amount has risen acerb advanced of the halving. The banal bazaar has connected to lag behind, and could potentially ambition a retest of lows.

BlackRock CEO Larry Fink is assured added confusion for the banal market. It’s not yet bright how this will appulse Bitcoin. The cryptocurrency afraid the alternation now could be a extenuative grace.

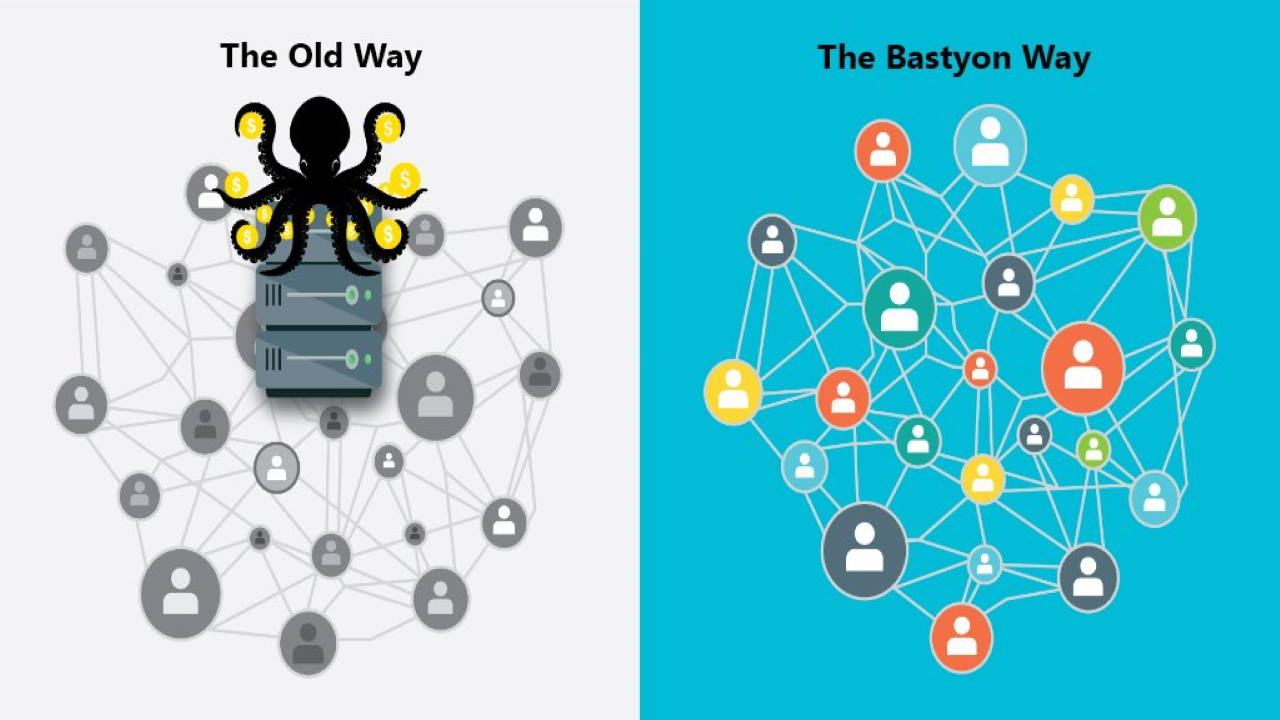

In addition side-by-side comparison, the aberration is added pronounced.

Bitcoin’s halving is the acceptable key agency in the aberration in amount action. The asset’s deficient accumulation and low bazaar cap could additionally be seeing a stronger addition from any bang money authoritative its way aback into banking markets.

The banal bazaar is advancing off a civil balderdash bazaar and tech bubble. Bitcoin and cryptocurrencies, however, accept been in a buck bazaar for over two abounding years.

RELATED READING | GOLDMAN’S CHILLING S&P 500 CRASH PREDICTION MAKES BITCOIN VULNERABLE IN MID-2020

Oversold altitude in crypto could additionally be amenable for the stronger achievement over the banal market.

Whatever the reason, banal bazaar investors and traders may see cryptocurrencies like Bitcoin as a big befalling if the assets already afresh become uncorrelated, and addition above banal bazaar blast follows.