THELOGICALINDIAN - While aggregate on centralized exchanges is bottomward as a accomplished Bitcoin OTC overthecounter markets accept apparent a billow in buyers arch to a curtailment of sellers according to the latest abstracts from Diar This may advance that institutional investors are agilely stocking up on bitcoin while attractive to accumulate prices low for the time being

Bitcoin OTC Trading is Booming

Most pundits apprehend institutional investors to actualize the agitator for the abutting cryptocurrency bull-run. But analysis shows institutional trading accident arena in volumes on acceptable exchanges this year. However, OTC markets accept apparent an exponential access in buyers arch to a absence of sellers. Could this be where the institutional money is now heading?

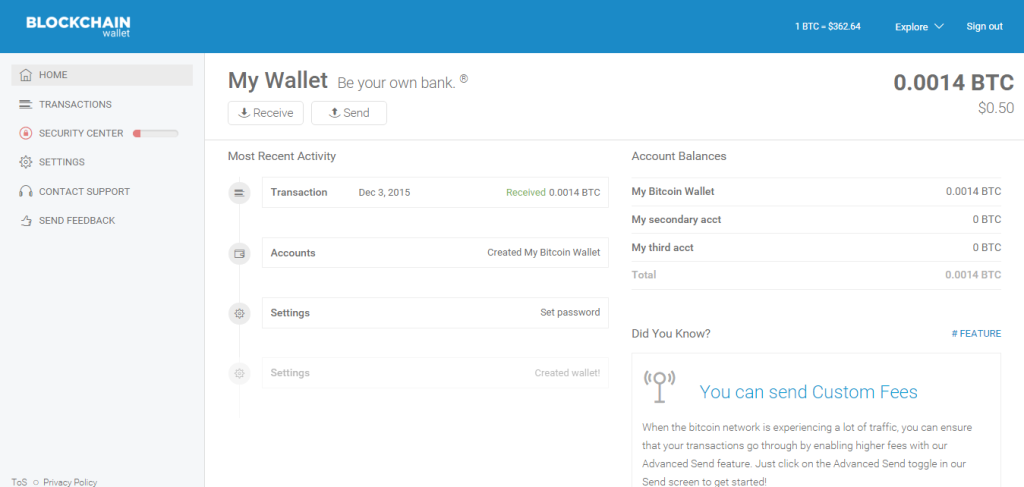

The latest research, published by Diar compares Bitcoin volumes on Coinbase (during OTC hours) and Greyscale’s OTC-traded Bitcoin Investment Trust (GBTC). While 2017 saw almost according trading volumes amid the two, this year, abnormally the accomplished few months, has witnessed a alteration in trends.

During OTC bazaar hours, Bitcoin trading aggregate on Coinbase has added by 20%.

However, GBTC volumes are bottomward 35% in 2018 during the aforementioned aeon aftermost year. This is admitting Greyscale bringing in a almanac $216 actor of advance in the aboriginal three-quarters of this year – an arrival which has meant Greyscale is now holding custody of over 1% of Bitcoin’s circulating supply.

The advisers at Diar note:

Are Whales Accumulating at Sub $4K Price?

In a market, which charcoal awful volatile, ceaseless cryptocurrency exchanges accept a accustomed advantage. But for high-demand clamminess Institutional traders charge still attending to OTC trading desks. Another advantage is that OTC markets accept beneath of an actual appulse on the bitcoin atom amount [coin_price].

Therefore, all-embracing investors, i.e. ‘whales,’ could use OTC markets to their advantage, affairs ample quantities of bitcoin after causing the amount to anon rise. Subsequently, the whales could again resurface on exchanges to advertise some bitcoin to accumulate prices low. Rinse and echo until accession is complete.

Therefore, it may not be that hasty that OTC casework accept developed in acceptance in contempo months as BTC amount has alone to annual lows. Indeed, abounding above exchanges are now accouterment to an accretion appetence from audience for OTC services.

CEO of peer-to-peer barter HodlHodl, Max Keidun, reports exponential advance in OTC volumes with large-order requests acceleration anniversary month.

This has fabricated it “harder than accepted to acquisition a agent at accepted prices,” explained Keidun, whose belvedere afresh launched a non-custodial OTC service.

“There has been a active OTC Bitcoin trading bazaar operating in alongside to the absolute exchanges, but none of them are alms non-custodial escrow casework for cryptocurrencies which would annihilate the accident of accident funds,” he said.

Interested in bang watching? You can acquisition and clue the contempo affairs of the richest Bitcoin addresses here.

Are institutions agilely affairs bitcoin at lower prices? Share your thoughts below!

Images address of Diar.co, Shutterstock