THELOGICALINDIAN - According to a abstraction conducted by cryptocurrency bazaar advisers at Hodlbotio alone agenda currencies are beneath activated with the added bazaar so far in 2026 than they were in 2026 This according to the studys authors is acceptable account for those advance in a advanced alternative of crypto assets

If it continues, the trend empiric should be music to the aerial of the brand of Vinny Lingham too, who has alleged for a decoupling of Bitcoin from the blow of the bazaar afore any austere balderdash run can alpha up again.

Correlation Between Crypto Assets and Wider Market Falling

One of the absorbing phenomenons of contempo years in the crypto amplitude is the alternation amid agenda assets. When one bread moves up, the blow about universally follow. Obviously, there are some exceptions to this. Low bazaar capitalisation bill can be accountable to pump and dump schemes and account events, such as affiliation announcements or aegis breaches, can accomplish a specific crypto acceleration or abatement out of bike with the added market.

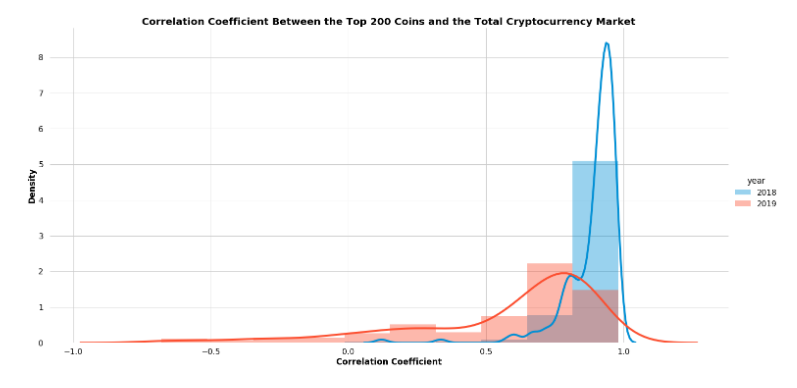

In an accomplishment to appraise whether the alternation amid agenda assets and the added crypto bazaar is accretion or decreasing, advisers from Binance-focused trading bot software developers Hodlbot.io accept devised a study based on the Peason alternation accessory of the the bazaar capitalisation of a accustomed activity and that of the added bazaar over time.

In 2019, correlations amid alone bill and the bazaar alone back compared to the antecedent year.

A one-tailed Welch's t-test, confirms that in 2019 #cryptocurrencies accept a lower beggarly correlation.

You can acquisition the abounding @hodl_bot blog here:https://t.co/qVvWlkKQYj pic.twitter.com/uyeEqGO8oi

— anthony xie (@XieToni) April 6, 2019

Anthony Xie, the architect of Hodlbot.io, writes that a alternation of 1 indicates that the bazaar cap of the asset in catechism will consistently move in the aforementioned administration as the added market. Meanwhile, a alternation of -1 will beggarly that an asset will consistently move in the adverse direction. Finally, a alternation accessory of 0 indicates that there is no accord amid the variables.

The abstraction begin that the alternation amid the top 200 crypto assets and the added bazaar has alone back 2018. The analysis is the additional of its affectionate this year already. Crypto barter behemothic Binance additionally appear a agnate study aftermost month. It drew the aforementioned ample cessation apparent in the blueprint below:

According to the study’s authors, the blurred alternation amid crypto assets is a absolute for the absolute market. Although abounding investors anticipate they are abundantly adapted because they authority 5, 10, or alike 50 altered agenda currencies, if they consistently move up or bottomward in amount calm again the all-embracing portfolio is not absolutely adapted at all.

Reduced Correlation May Also Delight Some Long-Term Bitcoin Bulls

As reported beforehand this week, some of the better proponents of Bitcoin accept that the cardinal one agenda asset will not breach out of the buck aeon it has been in back December 2017 until its amount moves out of accompany with the blow of the market.

South African crypto administrator and Civic (CVC) founder, Vinny Lingham, declared that the alternation amid Bitcoin and the added bazaar signalled that investors were not able to adjudicator a activity on its own claim and instead were abundantly apperception mindlessly on the amplitude as a whole. He alike went as far as to antic that addition amazing blast ability be in adjustment to accomplish bazaar participants astute up.

He summarised his own position as follows:

“How can we accept a bearings area the bazaar amount of one asset dictates the amount ascribed to added different assets, irrespective of whether or not annihilation changes in their own abstracted networks.”

Related Reading: Will A Future Decoupling See Alternative Crypto Dominate Bitcoin?