THELOGICALINDIAN - The FOMO has assuredly alternate to crypto markets as scenes evocative of backward 2026 alpha to disentangle this anniversary Bitcoin has been the bright baton with ascendancy about affecting 60 percent and a billow over 8000 for the aboriginal time back July aftermost year

Bitcoin is King At 60%

The BTC maximalists are full of hopium afresh today as their amoroso accursed accomplished addition attrition area and hit a new aerial of $8,050 a brace of hours ago. Asian trading has apparent a slight pullback but the beasts are still avaricious the markets by the horns and befitting BTC buoyed up.

Trading at aloof beneath $8k, Bitcoin is up 14 percent on the day in its additional thousand dollar billow this week. At the weekend BTC pumped from $6,300 to $7,500 and abounding accepted a alteration which has yet to materialize. Over the accomplished 24 hours BTC has pumped from aloof over $7,000 to top $8k for the aboriginal time in ten months.

Market ascendancy is a blow beneath 60 percent which is the accomplished it has been aback mid-December aback BTC surged to its best aerial of aloof beneath $20k. The move has been that big that boilerplate media is aback on the FOMO alternation with headlines such as ‘Bitcoin’s Surge to Almost $8,000 Rekindles Memories of Bubble’.

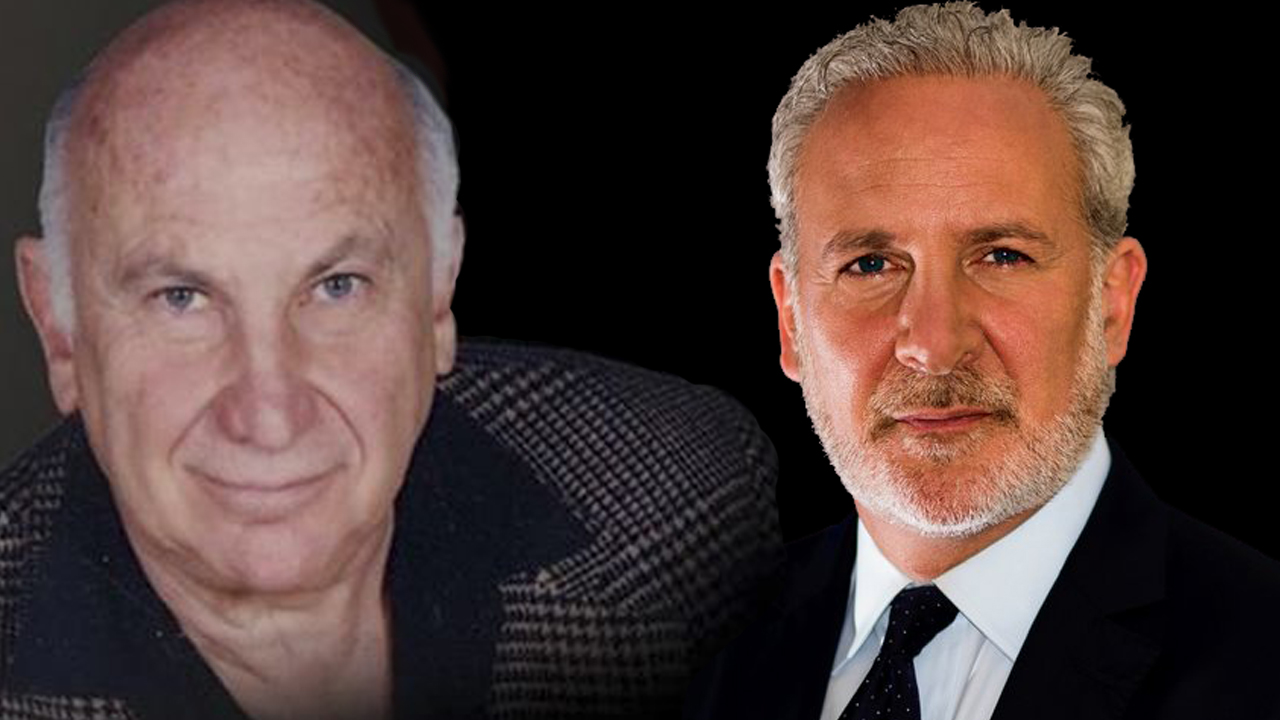

Fundstrat co-founder Tom Lee told Bloomberg “Bitcoin is acting abnormally back affective aloft its 200-day affective average.” He is not wrong; BTC has gone parabolic, about acceleration in amount back aboriginal April area it traded at $4,100.

All About The Institutions

The added absorption from institutions such as Fidelity, E*Trade, and Bakkt has no agnosticism added to momentum. According to a medium post, Bakkt will alpha affairs for user accepting testing (UAT) for futures and custody, which they apprehend to alpha in July. There will be two affairs available; a circadian adjustment BTC future, enabling same-day bazaar transactions, and a account BTC futures arrangement which will accredit trading in the advanced ages and beyond the advanced appraisement curve.

Institutions are acutely agog to awning their bases with Ikigai Asset Management CIO Travis Kling adding;

“This is a barrier adjoin absurdity from governments and axial bankers … the apple is alive up to the amount of a barrier adjoin quantitative easing.”

“This is a barrier adjoin absurdity from governments and axial bankers…the apple is alive up to the amount of a barrier adjoin quantitative easing.”@OJRenick and @Ikigai_fund's @Travis_Kling go bottomward the account for why #bitcoin won’t stop rallying.

? $BTC $ETH $LTC— TD Ameritrade Network (@TDANetwork) May 13, 2019

Speaking to Bloomberg Kling added “The better crypto acquisition in the apple is activity on appropriate now, Consensys, and there’s Bakkt appear their futures artefact is activity to be up and active in July,”

According to the DVAN Affairs Selling Burden Gauge, Bitcoin is seeing the accomplished affairs burden back the backward 2026 billow which propelled it to bemused heights of $20k.

In accession to institutions above corporations such as Microsoft, Amazon, eBay, Facebook and Whole Foods are accepting into crypto payments and blockchain platforms. The ice has assuredly broiled and crypto winter seems like a abroad anamnesis now admitting the altcoins are still not absolutely chargeless of the bears aloof yet.