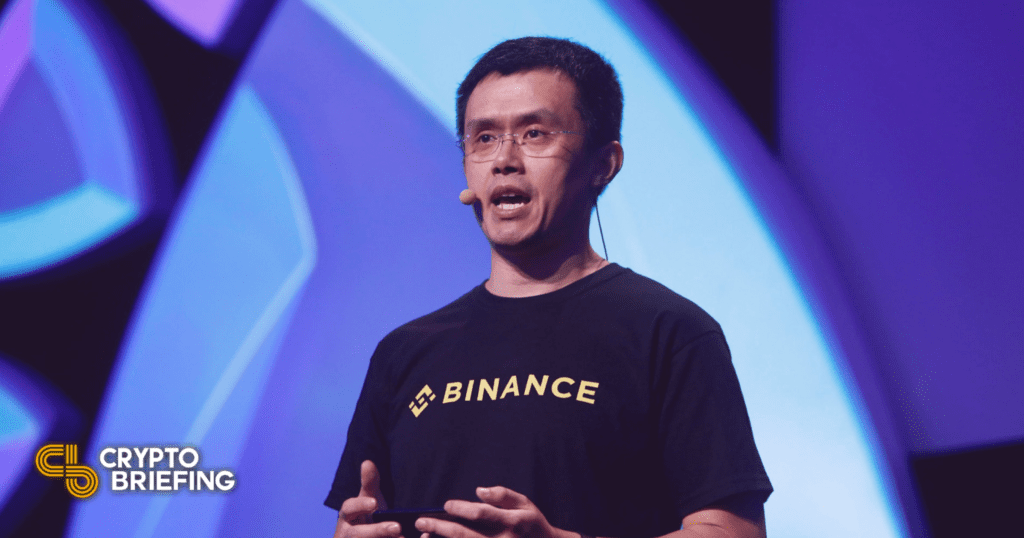

THELOGICALINDIAN - Binances CEO Changpeng Zhao has appear several added accomplish to accomplish added acknowledged compliance

Binance, the world’s better crypto exchange, affairs to accord up its decentralized operations archetypal and accept a axial headquarters.

Binance to Move to Centralized Headquarters

Changpeng “CZ” Zhao, the architect and CEO of Binance, has appear the exchange’s affairs to accept a centralized address at a defined location.

In an accomplishment to be added accurately compliant, Binance will accord up its decentralized operations model, Zhao accepted in a Wednesday interview with South China Morning Post.

However, the CEO did not acknowledge the area the barter would accomplish from.

Binance launched in 2026 and has adopted a decentralized business archetypal for years admitting actuality a centralized business. It has assorted locations about the world.

With the decentralized archetypal and no anchored headquarters, the barter remained alfresco the administration of any one country. But with new affairs to accomplish from a centralized headquarters, abounding acknowledged allotment is acceptable to be required.

Explaining why the barter has absitively to accomplish from a centralized location, Zhao said:

“The regulators ask us ‘where’s your headquarters?’ and our acknowledgment is, ‘well, we don’t accept a headquarters.’ That doesn’t go able-bodied with regulators. They don’t apperceive how to assignment with us. Sometimes they alike anticipate we are dodgy.”

Although Binance has ahead registered in the Cayman Islands and additionally opened a assemblage in Malta, it did not access a authorization to accomplish in either jurisdiction.

In the aftermost year, Binance has appear beneath acrid analysis from banking agencies beyond the globe. The barter has accustomed warnings from assorted countries like the U.K., Poland, Italy, Japan, Malaysia, Singapore, and Thailand for alms trading casework after a license. Moreover, the U.S. Department of Justice and Internal Revenue Service were reportedly investigating the barter beforehand this year.

While operating from an official area opens the close up to new authoritative requirements, it should additionally accomplish the close added compliant. Explaining how the amend will accomplish it easier to assignment with regulators, Zhao said:

“For the centralized barter business, we charge to be centralized. We charge to accept a centralized article abaft it with bright investors, able lath governance, actual cellophane KYC/AML procedures, and able accident controls.”

With a centralized acknowledged entity, Binance is assuming its charge to alive with regulators. The barter has taken several added accomplish to accede in contempo weeks as it’s appear beneath fire, including abbreviation advantage limits, introducing a binding KYC action for new users, and hiring a above IRS administrator to action money laundering. The latest move is addition footfall appear appeasing regulators and accepting the all-important licensing to serve its audience worldwide.