THELOGICALINDIAN - DEXes traded 45 added aggregate in the aftermost two months than they did in the absolute year of 2026

DEXes Scale Liquidity and Trading Volume

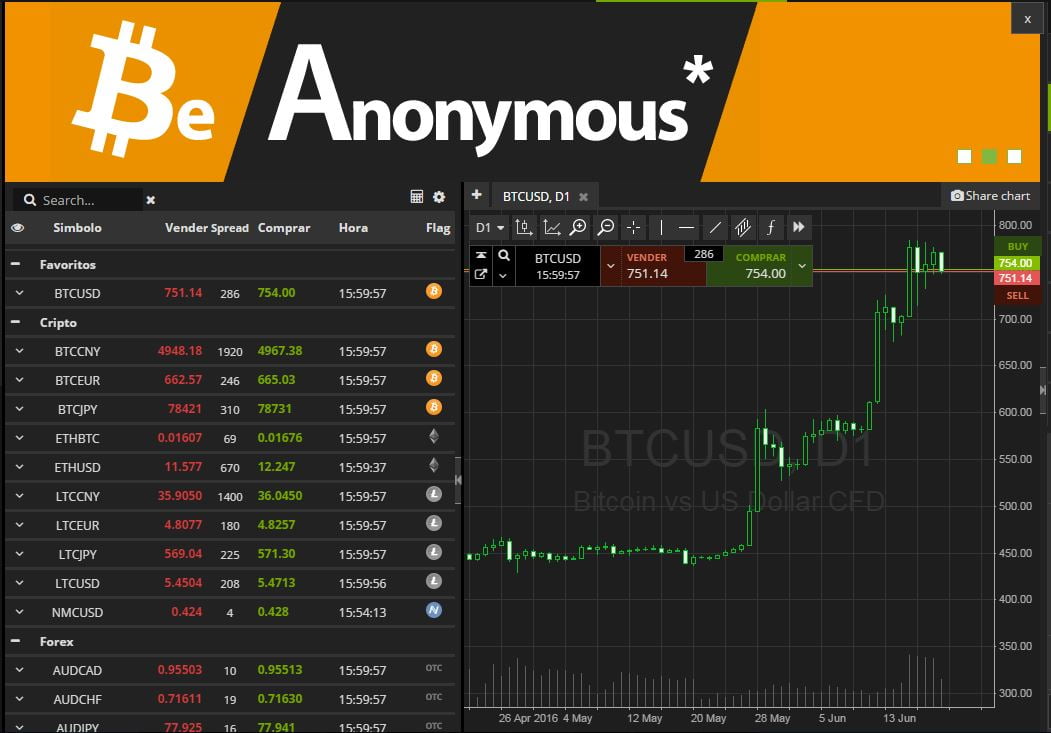

In aloof the aftermost week, Uniswap and Curve created added than $720 actor in trading volume. This is added aggregate than all DEXes accumulated aftermost quarter.

In fact, it’s about bifold the $325 actor in trading aggregate recorded by DEXes in their best ages aftermost year.

DEXes are by far DeFi’s best acknowledged products, with several platforms accomplishing product-market fit. Automated bazaar makers (AMMs) like Uniswap, Curve, and Balancer angle out aural this segment.

Yield farming and clamminess mining are a above acumen for this bang aeon in DEX usage.

With antecedent clamminess incentives from protocols like Compound and Balancer continuing alongside newer crop farms like yEarn Finance, active users accept been earning cool amounts of money.

These incentives are consistent in unparalleled advance in the DeFi sector

Total DEX aggregate is en avenue to hitting $2 billion in July 2026. The ascent acceptance of permissionless trading will put non-custodial exchanges durably in antagonism with their careful counterparts.

On Jul. 23, 2020, DeFi barter Uniswap’s 24-hour aggregate was $78 million. This is added aggregate than above centralized exchanges such as Poloniex, Gemini, and Binance US, according to CoinGecko’s barter aggregate data.

In abounding cases, Uniswap can attempt with centralized exchanges in agreement of badge liquidity.

Binance and Poloniex afresh listed Synthetix Network (SNX) and a ton of tokens confused into these exchanges. But admitting centralized exchanges adequate college trading volumes for SNX, the centermost and best alike clamminess advance is still on Uniswap.

The DeFi DEX Is the Future of Trading

Since DEXes and ERC-20 tokens both run on the Ethereum blockchain, application a DEX creates a synergy that makes activity abundant easier for users.

For example, an ardent Aave user captivation the protocol’s built-in token, LEND, will acquisition it easier to buy or advertise tokens through a DEX than a centralized exchange. This is because the aforementioned wallet acclimated to collaborate with Aave can additionally collaborate with a DEX.

DeFi DEXes abolish one band of abrasion from this process.

DEXes, however, still accept a continued way to go, however. Binance, which is the chrism of the crop in agreement of volume, exchanges abutting to $2 billion of amount per day. This translates into almost $60 billion a month, which is 10x the aggregate DEXes accept done in 2020 appropriately far.

DEXes are yet to hit appear annihilation abutting to analytical accumulation – they’re an emerging trend aural an arising trend (the broader crypto amplitude ).

At the end of the day, best traders affliction about affluence of admission and liquidity. New projects like Matcha by 0x are accouterment to this army by accumulation DEX clamminess on a belvedere that’s optimized for above user experience.

Once perfected, DEXes will be able to aboveboard up to their centralized counterparts on all fronts.