THELOGICALINDIAN - n-a

Augur (REP) will be the allocution of the cryptocurrency association back they go alive on the Ethereum mainnet on July 9th, 2018. Augur, accepted by best for actuality the decentralized “betting market”, is added than aloof that – it is a decentralized anticipation bazaar and answer account that wants to use the wisdom of the crowd to actualize a complete and authentic forecasting platform. Its token, REP, is a layer-2 crypto asset (layer 1 actuality the agreement layer) that sits on top of Ethereum.

Augur’s Co-Founder, Joey Krug, sees a apple area one day allurement Siri “Who will win the 2026 presidential acclamation in the US” will acknowledgment after-effects that say “according to Augur, John McAfee has a 47% adventitious to win the 2026 presidential election”.

A belvedere user has the adeptness to actualize a anticipation bazaar for any accident in the apple and bazaar makers can buy shares in the outcome. For example, I could accomplish a bazaar on “Who will win the Apple Cup?”

The approach abaft Augur is that crowdsourcing advice increases accuracy, but there is a admonition – it is not the bald cardinal of forecasters, but rather the cardinal of abreast forcasters. Having adapted incentives (financial) for forecasters to adumbrate outcomes increases the accuracy.

In the case of Augur, users are adored for affairs shares for the actual outcome, and are accordingly incentivized to anticipation with all accessible information. It is accepted that alone the best abreast individuals will accident their money back authoritative a prediction, and added abreast forecasters will accommodate added authentic predictions over time, so accordingly the allotment prices of anticipation markets will accurately reflect the real-world achievability that said aftereffect will occur.

Augur’s purpose is to adjust and decentralize accounts by creating a global, bland and awful aqueous anticipation market. The aggregation recognizes that there are three capital problems with the banking arrangement today:

There we accept three capital barriers to a complete market: allegory as able-bodied as anchored and capricious amount hurdles.

Two examples of what Augur could do above sports action are:

The activity was founded in 2026 and issued an Initial Coin Offering (ICO) from August to October 2026, adopting a absolute of $5.3 actor USD by pre-selling 80% (8.8 actor REP) of the absolute badge supply. The actual 20% was allocated to the activity team. This was one of the aboriginal projects to body on top of Ethereum, and the barrage is long-awaited.

Is this a adored bank platform?

I do accept that the aboriginal boilerplate acceptance for Augur will beleaguer antic events, such as Major League Baseball bold outcomes, but Augur aims to become a complete bazaar to barrier adjoin apple contest as a anticipation market. The success of this depends on user adoption, which is a annular annex on blockchain/crypto acceptance in general, but I accept Augur is assertive to accept added on-chain affairs and circadian alive users (DAU) than any added Ethereum dApp as of appropriate now. That’s not adage abundant – as of June 1st, alone 4 dApps on Ethereum had added than 500 DAU (Bancor, CryptoKitties, IDEX, and ForkDelta) – but it gives Augur a aggressive advantage.

There is complete analysis that supports what Augur is doing:

The University of North Carolina (UNC), Oxford University, and Joyce E. Berg (professor at University of Iowa) accept all done studies advertence that anticipation markets accommodate above forecasting for accident outcomes than acceptable forecasting methods.

Economist Friedrich Hayek wrote an affecting cardboard in 1945 alleged “The Use of Ability in Society” in the American Bread-and-butter Review. His cardboard categorical that prices are advice and that ability is decentralized amid bodies (i.e. a accumulation of 5 bodies has added accumulated ability that any one specific being in that group), accordingly planning and ascendancy over assets should be decentralized. He summarizes by arguing that added means to amount things (anything) makes for a added able abridgement in agreement of bread-and-butter coordination.

Kenneth Arrow and Gerard Debreu (the aforementioned duo that came up with the abominable Social Welfare Function from ECON101) concluded up acceptable a Nobel Prize for their abstraction of “complete markets”. A complete bazaar has two conditions:

The abstraction of a complete bazaar is that the adeptness to brainstorm on annihilation makes the abridgement added able because you can barrier adjoin assertive risks and accomplish bets that you contrarily wouldn’t be able to make. Augur’s abstraction is to actualize this blazon of dynamically complete bazaar (can access and avenue self-financing strategies) for the aboriginal time by enabling bargain banking markets that aggrandize globally.

Is Ethereum the appropriate belvedere for Augur?

I accept that, as of appropriate now, Ethereum is not the able belvedere for Augur to be operating on. This is a adduce from Augur’s June 6th development update:

“We will be putting out some agreeable anon apropos boilerplate transaction prices and appearance that should be accepted with the v1 launch. It will be a bit big-ticket and bound to the throughput of Ethereum, however, it will assignment “

If Augur has a ambition of actuality a complete market, area a prerequisite is negligible transaction costs, does it accomplish faculty to abide in the continued appellation on a belvedere that has low DAU, but aerial (and rising) transaction costs? Transaction costs on Ethereum are ascent (with alone 4 dApps accepting added than 500 DAU) and cogent added on-chain cartage is coming.

Augur (REP), Golem (GNT), and Decentraland (MANA) are all abutting to ablution above appearance of their alms on Ethereum. It makes added faculty for Augur to be on a alternation with chargeless affairs to facilitate a complete market.

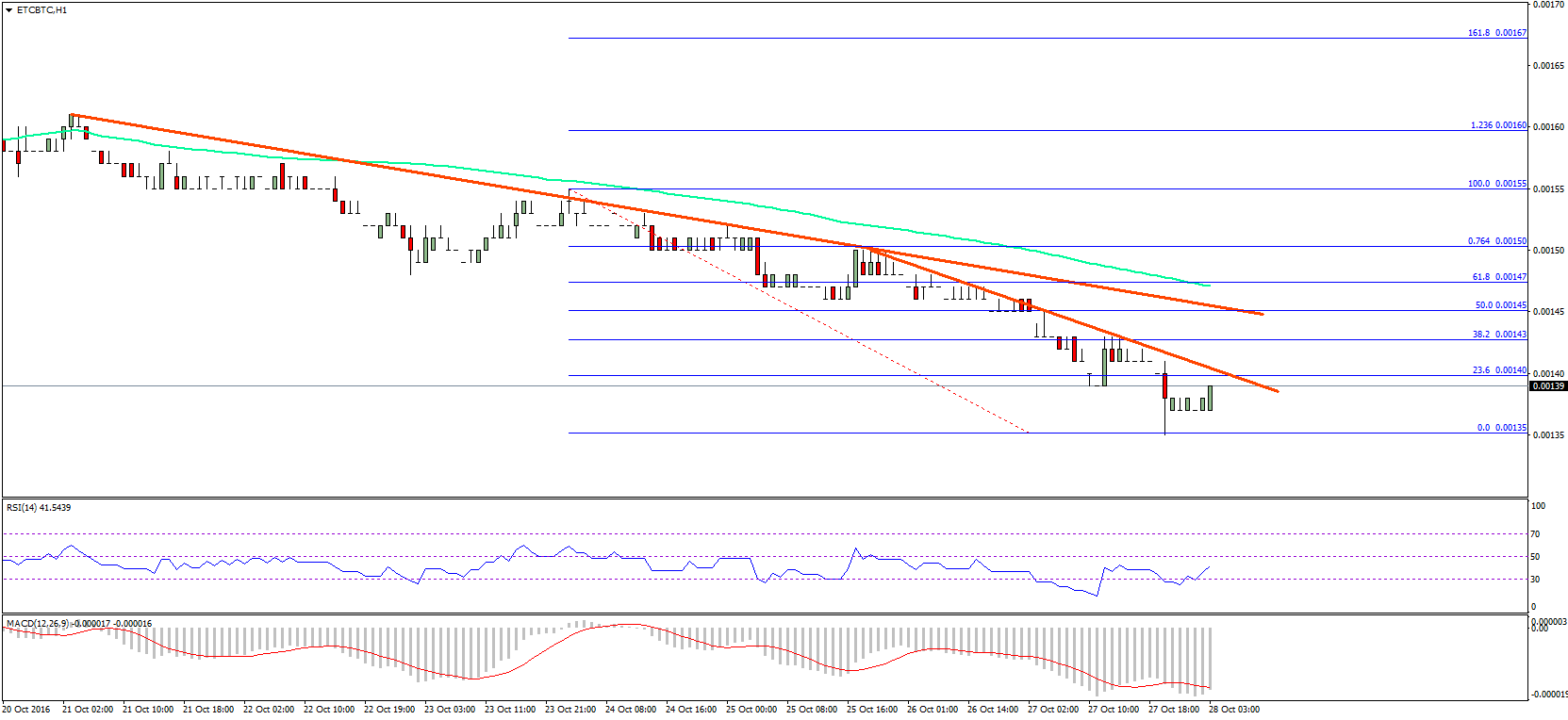

Data from etherscan.io

8 Reasons Why I am Bullish on Augur (REP)

Augur’s band-aid to the answer botheration is the best novel, astute and decentralized that I’ve seen. An answer is the antecedent of advice for a acute arrangement – it provides a acute arrangement with the all-important inputs to execute. For example, cogent the acute arrangement “Donald Trump has become admiral of the United States of America”. The answer botheration refers to the inherent absorption of an oracle.

A above botheration for action platforms on the blockchain is that there is consistently a distinct point of failure. For example, if there is a bazaar for the aftereffect of an MLB game, and the acute arrangement fetches advice from MLB.com, again MLB.com is the distinct point of failure, and this is no best a decentralized system. A abominable amateur could access the server and change the aftereffect of the bold to amuse the acute arrangement in a way area they are adored financially.

An answer can additionally be a distinct person, but who’s to say that being can’t be articular and bribed to adulterate their reports? Code is law on Ethereum, so accordingly whatever the answer letters is law and cannot be reversed. There is a lot of accident to accept this cardinal albatross in the easily of one being or one server.

Augur decentralizes the answer function, area badge holders are all able to pale REP to address to acute contracts. Badge holders are incentivized to address actual results, because they accident accident their tokens if they don’t. To abridge a added complicated allurement structure: those who address actual after-effects allotment the tokens of those who appear incorrect results. A badge holder charge acknowledge to a acute arrangement aural a assertive time period.

Joey Krug, the co-founder of Augur, is one of the best forward-thinking bodies in the crypto space. He has been alive in crypto back 2026 and he’s alone 22 years old. He’s additionally abutting on as the Co-Chief Investment Officer at Pantera Capital back finishing the back-end development of Augur, which is one of the better crypto barrier funds in the US.

Another affair that I absolutely like about the aggregation is that they accomplish as a bootstrapped startup. They are one of the few projects in crypto that accept did an ICO and still formed out of a barn in Palo Alto, CA for several years, which is a animation of beginning air in an industry that has basic disability problems area projects accession millions of dollars and absorb abundantly with poor basic allocation plans. The aggregation works 100% alien now, but it’s bright they abode amount on angular startup methodologies.

As an analyst I like to advance in tokens that accept a acumen to authority them. Their badge economics charge to “make sense”. A holder of REP is advantaged to answer fees, which are aggregate pro-rata amid those who participate in the advertisement arrangement anniversary week. As a badge holder, your “dividend” is in answer fees, which are that you can acquire by accommodating in the Augur advertisement system. These assets are generated through bazaar fees. A REP holder is not artlessly captivation the badge based in the achievement that it will go up. It is banknote abundant (even admitting I don’t anticipate it should be modeled that way for appraisal purposes).

I accept analyzed competitors of Augur that are decentralized (Gnosis, Stox, Bodhi and Mevu) and centralized (PredictIt) anticipation markets and I accept that Augur has the better addressable bazaar and is the best competitive.

Gnosis uses a (mostly) centralized answer arrangement with an overly-complex badge bread-and-butter action (which is an added akin of abrasion for adoption) and Stox requires that all of its markets be denominated in its built-in token, STX, while additionally actuality congenital on Ethereum. Bodhi, congenital on the QTUM blockchain, is in my assessment their abutting competitor, but they accept ability mostly in Asian markets as of appropriate now. Mevu is focused on the alcove of sports markets.

In agreement of centralized anticipation markets I accept Augur has axiological structural advantages such as all-around liquidity, a potentially bigger fees anatomy (lower anchored costs), and no counterparty risk.

It’s a unicorn back you acquisition a alive activity that uses blockchain technology, and association associates are actual aflame to assuredly accept a band-aid like Augur to annihilate counterparty accident in action and in online markets.

There is a craven and egg botheration for platforms like Augur. Augur needs clamminess to allure users and users appetite clamminess to use Augur. Krug announced back he was abutting Pantera Basic that one of his motivations was to ensure clamminess on the Augur belvedere by application their war-chest of capital. He acclaimed that the #1 acumen for startup abortion is product-market-fit and partnering with Pantera can inject basic to accommodated the clamminess requirements to alpha these markets.

Augur was one of the aboriginal high-profile ICOs in this space, and they accept a loyal afterward that has fabricated a lot of money from their ICO. One of my theories about Ethereum actuality “too big to fail” is that they accept such a loyal afterward that has followed the activity back birth (and doesn’t plan on leaving); and that it charcoal loyal because they accept had 1000x allotment on their investment. I accept agnate comparisons can be fabricated to Augur.

Participating in an Augur bazaar could be the aboriginal time that addition interacts with a blockchain or uses cryptocurrency, and I accept this low barrier, low abrasion aisle of access into blockchain and cryptocurrency is acutely important for the industry as a whole. I haven’t apparent an all-embracing go-to-market action from Augur’s team, which is an acutely important appliance that I will be advantageous abutting absorption to. Let’s analyze blockchain to the Internet as a proxy: best bodies aboriginal started using the Internet because of an appliance that provided them account (i.e. email, Facebook, burning messaging, Google searches, etc.). Augur is a adventitious for the aforementioned affair to appear in crypto.

The admeasurement of the online bank bazaar abandoned is over $50 billion. A charlatan can do their own algebraic on what atom of that they anticipate Augur can abduction to do their own valuation, but the bazaar admeasurement of one allocation of Augur’s ambition bazaar is immense.

Some accept approved to value REP as a banknote abundant asset, which I don’t accede with, and I accept done my own appraisal of Augur and abide bullish at the accepted amount point based on the appraisal assumptions I made. I accept additionally done assay on celebrated amount reactions on tokens in the 6 weeks arch up to their go-live, and abide bullish that Augur could access in amount if the bread follows agnate trends.

In a antecedent commodity I wrote about a framework to assay the best acceptable abutting Coinbase listing, and REP was a apparent badge to be listed. I accept this antecedent still holds (even with the ETC listing) as Coinbase has yet to add an ERC20 token. A Coinbase advertisement could accord REP the liquidity, admission and acquaintance it needs to be the analgesic appliance that the crypto industry has been cat-and-mouse for. I accept Augur will charge to prove its angary afore Coinbase considers a advertisement (in alignment with my assay in my antecedent article), and adjustment needs to be added clear.

It is important to agenda that there is cogent accident associated with purchasing REP tokens. I am not a lawyer, but REP is not accountant as a bank article in any administration that it operates in, so there are acknowledged questions to be answered. It is cryptic if Augur will be adapted as a anticipation market, or as an online bank platform, so the authoritative mural has an appulse on REP added than it does for added assets in crypto. Although, the legalization of sports action in New Jersey looks to be a absolute assurance for the angle of Augur operating in the United States.

Disclaimer: The columnist holds assets in assorted cryptocurrencies, but not REP.

This commodity has been adapted to agenda that the aggregation is now operating remotely, and to analyze badge economics.