THELOGICALINDIAN - CBOEs cashsettled futures are set to expire but the absolute approaching is aloof alpha

With the aftermost CBOE Bitcoin futures set to expire in June, it looks like institutional absorption in cryptocurrency is fading. It wasn’t continued ago that there seemed to be an unstoppable beachcomber of institutional absorption branch against the shores of crypto.

So what happened?

If you booty a footfall aback in time, you may faintly arouse the exciting canicule abutting the aboriginal listing of futures hosted by the CME and the CBOE. It was December 2017 and bitcoin, forth with the blow of the crypto market, was abutting best highs. Hodlers were adulatory their astute decisions, and persuading ancestors and accompany to accompany in the affairs frenzy.

And again came the Shorts

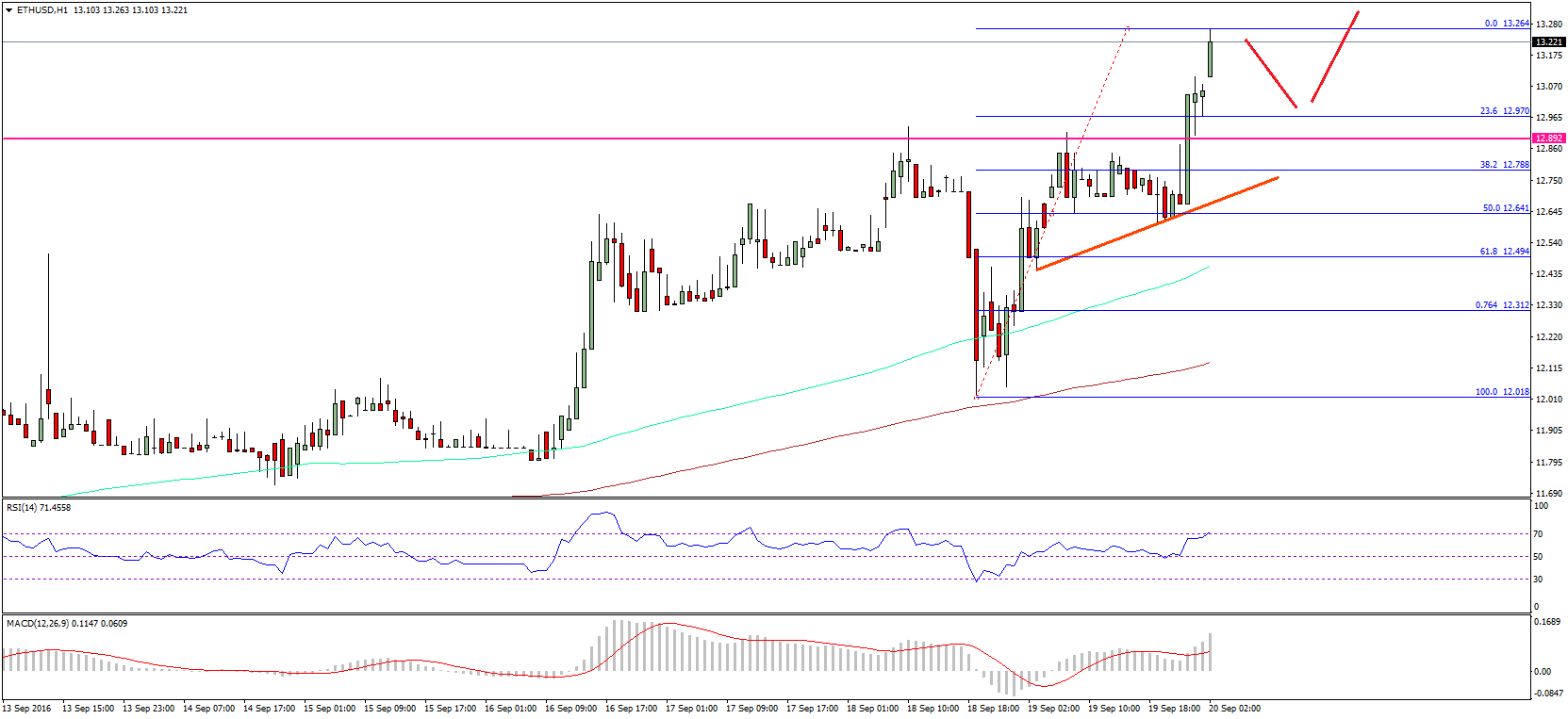

Futures affairs began forecasting a abrupt abatement in prices, creating a abrogating acknowledgment bend amid atom markets and futures trading. Bitcoin prices fell rapidly and the amount continuously plummeted over the afterward year, with alone an casual animation or bender of volatility.

Often these were calmly timed about approaching arrangement expirations.

The Problem With Cash

There was a big botheration with these futures: they were cash-settled.

This is important for one key reason: a banker could be captivation a ample abundance of bitcoins while accompanying action adjoin BTC on cash-settled futures. At an appropriate time, the banker could again cash their bitcoins, causing a attempt in prices.

So cash-settled futures aren’t absolutely a abundant way to animate advance in a new asset class. They have, however, been accomplished for suppressing prices.

Physically acclimatized futures, on the added hand, would not be as affected to the aforementioned abrogating influence. In these contracts, the asset would be captivated in a array of escrow until the achievement of the contract, back it would be paid out.

This differs from banknote settlements which are added like side-bets on the basal asset. Unlike cash-settled futures, physically-settled futures would actualize a appeal on the BTC supply.

And now, the CBOE is adage goodbye to cash-settled futures, abrogation the CME as the alone accessible institutional area for these trades. Mainstream media is painting this as a somewhat pathetic adieu to the already emerging, but now bootless fad that is the cryptocurrency market. A tulip bubble, now popped out of significance.

Let’s Get Physical (….ly Delivered Futures Contracts)

Given the latest goodbyes, you ability be puzzled to apprentice that the CBOE is still absolutely committed to the Bitcoin game.

The CBOE, it turns out, is a major advance partner of ErisX, forth with bazaar giants like Fidelity, TD Ameritrade, and NASDAQ. ErisX currently offers atom trading, but is in the action of establishing physically acclimatized futures trading, afterward authoritative approval.

One above barrier that has consistently captivated aback approval of such exchanges is the abridgement of competition, low liquidity, and the resultant aerial susceptibility to manipulation. By acceptance a cardinal of institutional options for investors, this barrier may assuredly evaporate.

Both Bakkt and LedgerX will anon accompany the physically-settled futures party, alms advantageous antagonism in the beginning market. This is acute for authoritative approval, accouterment the “healthy competition” bare in adjustment to accede with antitrust laws and to annihilate abetment concerns.

Maybe the institutional buyers accept been arena this bold all along?

These accumulated armament comedy the continued bold a accomplished lot bigger than retail investors. In adjustment to absolutely adapt for such a all-embracing launch, these entities would charge to accrue bitcoin over a continued aeon of time.

It’s adamantine to apprehend the minds of banking institutions. But contemptuous traders ability admiration if big players are already accumulating bitcoin through over-the-counter trades, while demography advantage of the downwards burden in futures prices.

Institutional traders, back they do access in force, are absurd to “play nice” with the accidental crowd. They are actuality to accomplish austere money and will booty whatever time is bare to appropriately set the table. They accept far added backbone and a abundant best appellation eyes than the boilerplate retail banker affairs $50 of bitcoin on Coinbase.

By all signs, the institutions are coming. But back they assuredly accompany the game, it will be on their own terms.