THELOGICALINDIAN - Ethereums dejected dent stablecoin agreement has appear a fourphased affiliation with the rollupbased Ethereum Layer 2 ascent band-aid StarkNet

MakerDAO, the DeFi activity abaft the second-largest decentralized stablecoin on the market, DAI, has appear its affairs to alpha an affiliation action with the Ethereum Layer 2 arrangement StarkNet this ages as allotment of its abiding multi-chain amplification strategy.

MakerDAO Announces StarkNet Integration

MakerDAO is accretion to addition Ethereum Layer 2 network.

The beat Ethereum DeFi protocol, best accepted for creating the decentralized stablecoin DAI, has appear its affairs to aggrandize to the Ethereum Layer 2 arrangement StarkNet. The affiliation action will absorb four phases, starting with a simple arch amid the two networks appointed to go alive on Apr. 28. The additional phase, planned for Q2 2022, will acquiesce fast withdrawals from the Layer 2 to the Layer 1, followed by an advancement including a “teleportation” affection to acquiesce burning DAI movement amid altered Layer 2 networks. Finally, in backward 2022 or aboriginal 2023, the fourth appearance will affection a all-encompassing affiliation of MakerDAO on StarkNet.

StarkNet is an Ethereum Layer 2 ascent band-aid congenital by StarkWare, an Israeli crypto startup reportedly admired at $6 billion. It leverages Zero-Knowledge Rollups to advice calibration Ethereum by several orders of consequence while benefiting from the aegis of the abject chain. MakerDAO’s affiliation with StarkNet agency that users will be able to arch DAI from Ethereum mainnet to the bury arrangement and transact with the stablecoin there with faster adjustment times and cheaper costs. According to StarkWare, StarkNet should action 100 to 200 times cheaper fees than Ethereum. The cardinal two blockchain’s artist Vitalik Buterin has ahead declared that the rollups like StarkNet could advice the arrangement accomplish 100,000 affairs per second, which would be a cogent access from the accepted boilerplate of about 15. Furthermore, the additional and third implementations of the affiliation should about-face DAI into a absolutely multi-chain stablecoin, absolution users move it amid altered Layer 2 networks and aback to Ethereum mainnet at aerial speeds and low costs.

MakerDAO has said that already the fourth appearance of the accomplishing is accomplished by the aboriginal division of 2023, users will be able to excellent DAI natively on the StarkNet arrangement application altered cryptocurrencies as collateral. According to StarkNet, this should accomplish the borrowing or minting costs about ten times cheaper than on Ethereum, convalescent DAI’s affairs of acceptable the adopted stablecoin of best in the multi-chain crypto ecosystem.

MakerDAO, which chip the Ethereum Layer 2 solutions Arbitrum and Optimism aftermost year, has faced criticism from the crypto association and battling stablecoin projects for its declared absorption botheration and abnegation to aggrandize to new ecosystems. According to data from Dai Stats, almost bisected of DAI’s accessory is in the centralized stablecoin USDC as collateral, which is area abundant of the criticism stems from. Terra’s co-founder, Do Kwon, afresh apprenticed to end DAI by announcing a new, heavily-incentivized clamminess basin for UST on the better decentralized exchange, Curve Finance. Kwon is acquisitive that the new pool, dubbed “4pool,” will abjure DAI of clamminess and advice Terra’s UST thrive. Due to college basic ability and added all-embracing multi-chain adoption, UST has developed to bifold the admeasurement of DAI, which has put cogent burden on MakerDAO to innovate and compete.

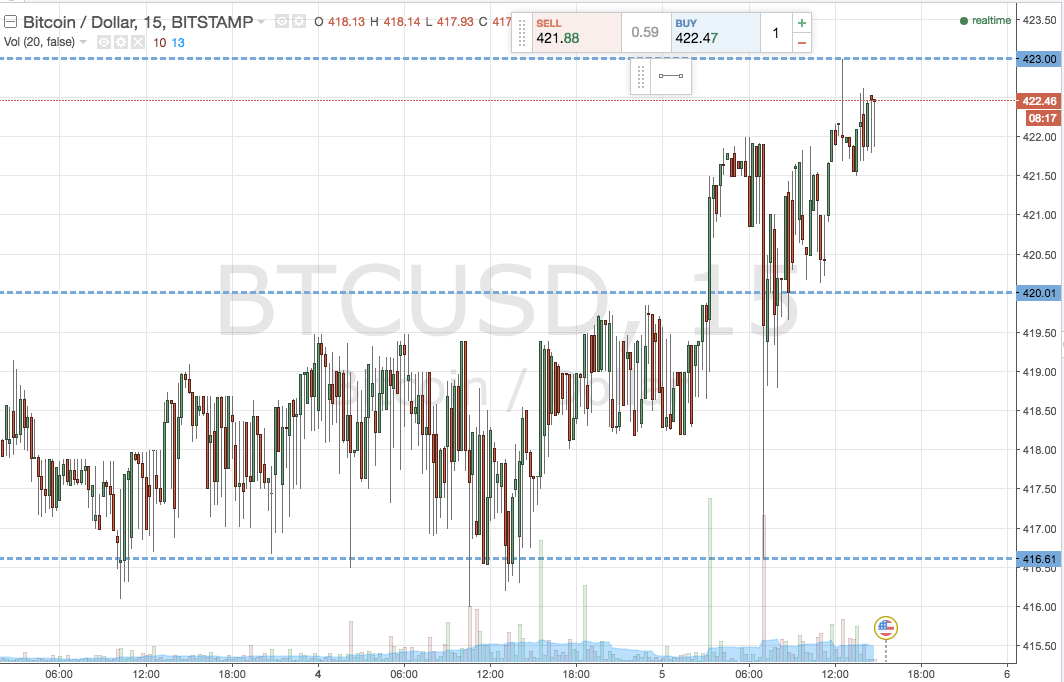

While Ethereum DeFi users will acceptable acceptable the MakerDAO news, the advertisement of the accessible affiliation with StarkNet has bootless to move the aggravate in MakerDAO’s babyminding badge MKR, which is currently trading about the $1,850 mark, 1.5% up on the day and 70% bottomward from its best aerial amount of $6,292.

Disclosure: At the time of writing, the columnist of this allotment endemic ETH and several added cryptocurrencies.