THELOGICALINDIAN - The arch cryptocurrency barter is topping the archive admitting coffer restrictions

This week, several U.K.-based banks appear that they would block approachable affairs to the crypto barter Binance.

Notably, Barclays and Santander both appear blocks on payments to Binance. There is additionally belief that Clear Junction denied Binance its services, arch Binance to append SEPA transfers.

However, it seems absurd that these accomplishments will decidedly appulse Binance, which is currently the better barter by trading volume.

First, the U.K. does not decidedly accord to Binance’s userbase. According to the web cartage armpit Similarweb, the U.K. provides aloof 3.75% of the exchange’s absolute cardinal of users.

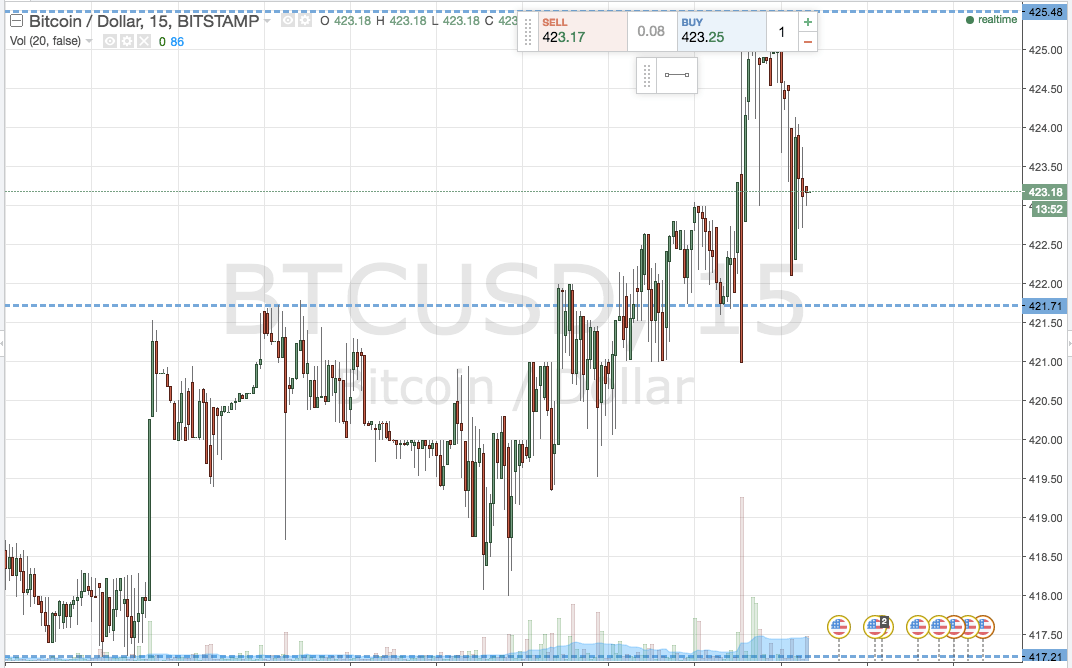

Furthermore, the contest of the anniversary do not assume to accept afflicted trading volume. According to Nomics, which provides actual barter trading data, Binance’s circadian trading aggregate has fluctuated amid $100 billion and $20 billion back backward May.

At the time of autograph Binance had a circadian aggregate of $33.2 billion, added than alert as abundant as than FTX, its abutting competitor.

On top of this, the abrogating account this anniversary does not assume to accept abnormally impacted the amount of the exchange’s token. Binance Coin (BNB) acquired 8.5% this week—outperforming Ethereum, which acquired 0.7%, and Bitcoin, which absent 0.6%.

Finally, it seems absurd that U.K. banks will extend their austere activity adjoin Binance to added crypto exchanges. Though the FCA published a specific warning that motivated banks to booty activity adjoin Binance, that apprehension leaves allowance for added exchanges to operate. The aforementioned admonishing addendum that firms “must be authorised by us to acquaint or advertise these articles in the UK.”

The barter is additionally adverse tougher regulations from added countries. However, none of these accomplishments assume to be targeted at retail investors in the aforementioned way that U.K. coffer restrictions are, acceptation that the barter is absurd to lose arena any time soon.

Disclaimer: At the time of autograph this columnist captivated beneath than $75 of BTC, ETH, and altcoins. The columnist does not authority BNB or BUSD.