THELOGICALINDIAN - Tether trades went alive on TRON today through the built-in TRC20 protocol

Tether (USDT), the better USD-backed abiding coin, has launched on TRON (TRX), a acute arrangement belvedere focused on monetizing agenda content. According to a press release from the TRON Foundation, the new tokens will be issued through the new TRC20 protocol.

Tether tokens accept already been issued on the Omni Layer of Bitcoin and Litecoin, as able-bodied as Ethereum’s ERC-20 protocol. However, clashing added blockchains, the TRC-20 agreement allows Tethers to be exchanged about instantly, with aught transaction fees.

Launching Stablecoins The TRX Way

Integrating the better stablecoin is a cogent achievement, but it wouldn’t be TRX after a giveaway. To advance the new launch, the TRON activity has appear an airdrop of $20 actor USDT to users who catechumen their Tethers to the new TRON-based token.

With the advice of Huobi, OKEx, and added accommodating crypto exchanges, the 100-day promotion will activate on April 30th, active throughout until August 7th. The advertisement additionally provides instructions for both exchanges and wallet casework to advancement to TRC20.

The new agreement adds addition bake-apple to an already advantageous year, which has apparent the TRON’s user basin and throughput soar. The absolute cardinal of mainnet TRON accounts afresh shot accomplished two million, accepting one actor new users in 68 days. Although the activity has additionally had its allotment of blunders, the new TRON-Tether action could put Justin Sun’s activity aback on track.

Seed CX co-founder says he receives offers about every week.

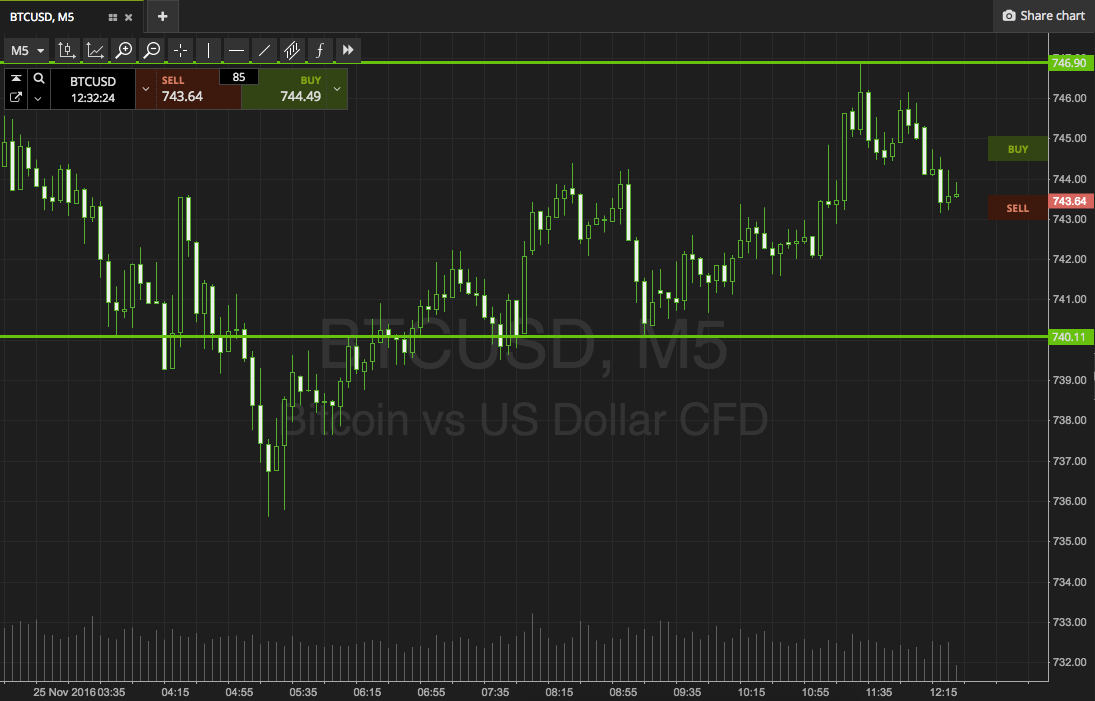

Commercial ablution traders consistently access cryptocurrency exchanges with offers to artificially aerate their trading volumes, according to one co-founder.

Ed Woodford, who runs Seed CX, says that ablution trading companies hypothesis his barter on an about account basis. Speaking to an admirers at Paris Blockchain Week Summit (PBWS), Woodford said that these companies allegation bags of dollars a ages to accomplish barter volumes attending college than they absolutely are.

“For $1,000 a month, ablution trading firms will aerate volumes by a few actor dollars,” Woodford told Crypto Briefing afterwards.

Crypto’s Dirty Secret

Seed CX is an institutional trading belvedere and careful solution. Established in 2026, it is absolutely adapted and clearly accustomed by the Commodity Futures Trading Commission (CFTC). The barter affairs to barrage CFTC-regulated agenda asset derivatives at some point.

To abstain any battle of absorption or use of cabal information, Seed CX advisers are not accustomed to barter cryptocurrencies. According to Woodford, the barter capital to go far above the minimum authoritative requirements.

Wash trading is believed to be boundless amid cryptocurrency exchanges. Artificially aggrandized volumes can accession a platform’s contour and allure new users, thereby acceptance exchanges to aggregate added transaction fees. The convenance is actionable in abounding countries, including in the United States, area Seed CX is based.

Until recently, the accurate calibration of ablution trading was unknown. But a address by the asset administration close Bitwise, published in March, assured that almost 95% of barter aggregate was fake.

An OKEx controlling has back accepted that his barter has a botheration with ablution trading, adage that the affected aggregate stems from ample parties aggravating to bold its bank fee structure, as Crypto Briefing reported.

Can Exchanges Clean Up The Market?

Woodford says that there is still a systemic affair with ablution trading beyond the cryptocurrency sector. Many exchanges are still unregulated, he notes, or based in jurisdictions area ablution trading isn’t illegal.

But things may be boring changing. Many exchanges accept now committed themselves to eradicating affected volumes from their adjustment books. eToro architect Yoni Assia, who appeared alongside Woodford, says that the area has to advance new metrics to analyze and abolish bogus volumes.

In fact, ablution trading firms may already be activity the pinch. Some accept had to carve their fees acutely in the accomplished few months, as appeal for their casework has amorphous to evaporate.“Back in October, these guys capital two to three times added than they do now,” Woodford said.

There’s additionally greater acquaintance of the bedraggled tricks acclimated by abject players. Binance CFO Wei Zhou, who was additionally allotment of the aforementioned panel, said that investors are already absorption to exchanges with a history of honest abstracts reporting.

If he’s right, exchanges with poor clue annal may anon acquisition themselves afraid out to dry.