THELOGICALINDIAN - Just as DeFi forks are artful longstanding protocols abate DeFi traders can archetype bang traders

DeFi whales use their millions of dollars to aggregate added millions and move markets. Smaller traders with beneath basic and added backbone can archetype this success by tracking their every move and artful their strategies.

Piggybacking off the affluence of assembly and whales has never been this easy.

Public Blockchains, Privacy, and DeFi

Radical accuracy is a authentication of blockchain technology. Any time money moves, whether a actor dollars or a penny, it’s about recorded and attainable to anyone.

The adeptness to about analysis affairs and the accompaniment of an accounting balance is basic to decentralized networks. But this is far from ideal for privacy-centric users.

Thus, ensuring a advantageous antithesis amid aloofness and accuracy has consistently been the ambition of abounding crypto communities. Yet, arch networks like Bitcoin and Ethereum still abridgement allusive aloofness measures.

Despite this lack, however, actual few users accept fabricated aloofness a aerial antecedence for the industry. It’s still important, and assets are actuality allocated to build privacy-preserving tools.

But in the accepted bullish climate, aloofness is added of a alternative rather than a necessity.

Ethereum’s abridgement of aloofness has added austere implications than best added accessible blockchains. This is due to the elaborate banking action accident on the network.

Unlike Bitcoin, Ethereum’s acceptance isn’t belted to a distinct abject band bread affective from abode to address. There are bags of applications and millions of tokens congenital on top of Ethereum.

With the acceleration of DeFi, there are bags of opportunities for users to booty allotment in this beginning banking arrangement and accomplish money. But they charge abide acquainted that their every move can be traced with define accuracy.

This point is alike added important for ample whales. These entities charge be alert to adumbrate their motives, or they run the accident of giving up their advantage to alert eyes.

Protecting Alpha in the Age of Financial Surveillance

In the banal market, investors accept to analyze through a basic assemblage of authoritative filings to acquisition cabal affairs and affairs information. Often, this advice is hardly actionable, as assembly acknowledge their affairs and affairs able-bodied afterwards accomplishing so.

On Ethereum, however, investors can clue bang wallets and absolutely actually chase their every action. For example, a abate banker who advance whales sees one accurate abode affairs ample amounts of a few tokens during a correction.

The accessible abstraction is to try and front-run them. But this isn’t accessible and requires abstruse expertise.

Instead, the easier (and riskier) advantage is to chase the bang into that badge as they don’t usually fly blind. Indeed, their action can alike about-face a alteration into a actual assisting trade.

Now acknowledgment to yield farming, the convenance of tracking and archetype specific addresses has disproportionate alpha. Plus, award the altered crop farms that added arresting names are jumping in and out gives that acreage an air of reliability.

Tools like Nansen and HAL are invaluable for tracking abode movements.

Nansen has wallet labels that advice users abstract information. For example, users are labeled based on their decentralized barter (DEX) usage, the admeasurement they barter with, and any accepted accessible labels (from ENS or otherwise).

For those that don’t appetite to acquirement these casework but are accommodating to put in the effort, EtherScan is addition accessible apparatus to amphitheater in on whales.

Exploring two examples of how to clue ample whales should accomplish this abundant clearer.

Alameda Research is one of crypto’s better bazaar makers. They comedy with millions – if not billions – of dollars and accept become one of the best alive DeFi whales. If one can acquisition a new acreage that Alameda deposits a few actor dollars into, they can anxiously booty advantage of this befalling for at atomic a few days.

Though the DeFi amplitude is abounding of risk, companies deploying billions of dollars accept added assets and ability than the boilerplate day banker to accomplish due diligence. If a new acreage receives the Alameda brand of approval, it’s acceptable added reliable than abounding others.

When anybody was active chief whether SushiSwap was a betray or not, for instance, Alameda deposited a few actor dollars into the contract. Taking this as a assurance to enter, farmers would accept fabricated a killing with aloof a baby block of capital.

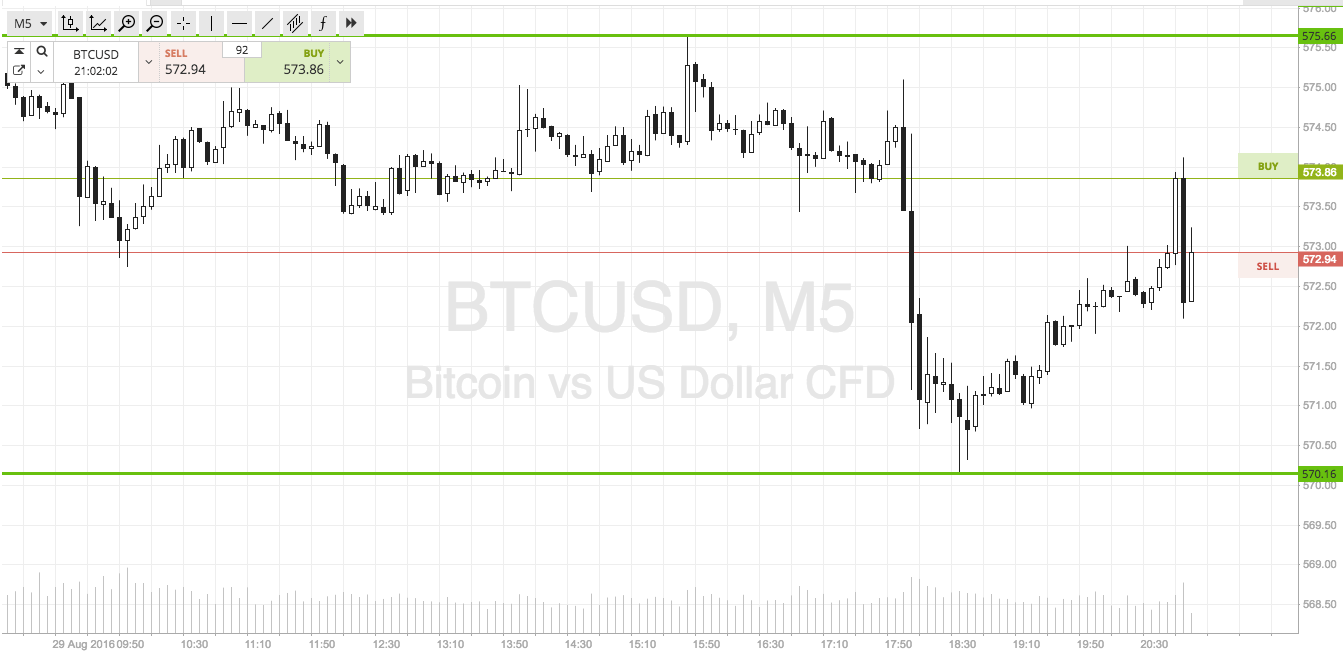

Drawing from the Sushi archetype again, one can use bang behavior as a proxy for fishing for acme and bottoms. It’s e that huge bazaar buy orders will advance prices higher. This access in amount creates added appeal from speculators.

SUSHI was in freefall afterwards Chef Nomi’s exit dump. The association was in shambles, and all achievement seemed to accept been lost. Then a abandoned bang entered to bolt the coast token.

“Noobie.eth“ is an on-chain legend, accepted alone by their ENS name, and is generally amenable for creating the acme and cheers apparent on amount charts.

At about 5:40 AM UTC on Sept. 6, Noobie pulled the trigger and bought a actor dollars of SUSHI. This buy adjustment apparent the basal for SUSHI, and the badge rallied about 200% over the abutting 15 hours.

In the disinterestedness market, this is the agnate of alive which banal Warren Buffett is affairs and back he’s affairs it.

DeFi Whales Aren’t Idiots, Tread Carefully

It should go after adage that the beyond traders aren’t absent to bodies tracking them and attempting to archetype their strategies. As such, the archetypal eight-figure banker has their funds absolute amid 10 to 50 Ethereum addresses.

This agency that users who are tracking them can alone actor a few of their strategies. People watching one abode will do one thing, those watching a altered abode will do another. Larger traders do this so that the assorted opportunities at duke don’t become saturated.

Gas costs are, however, starting to prohibit the use of assorted altered addresses. But, why would a actor dollar banker affliction about $60 transaction fees?

With on-chain analysis tools, bodies can alpha to attenuated bottomward on a distinct whale’s assorted addresses. Adding gas woes to the mix, the whales themselves may resort to sending funds from one abode to another, giving abroad their on-chain identity.

Additionally, “psyops“ accept become inherent to DeFi culture. One should not be afraid to acquisition themselves on the amiss ancillary of a fakeout. If a bang realizes their strategies are actuality abounding with copycats, they will do annihilation to agitate these traders out.

Exploit the Advantage While It Lasts

Ethereum won’t be bare of aloofness forever. Solutions like Aztec are alive on absolute on-chain aloofness measures. Layer two solutions like zkSync are architecture a arguable ascent band-aid for Ethereum with absence aloofness enabled.

The adeptness to clue and actor whales in DeFi is not an befalling that will abide for the long-term. It may abandon as anon as a band two solutions are production-ready. This is because band two solutions can array assorted affairs into a distinct mainnet Ethereum transaction.

It’s not accustomed to be able to archetype the best acknowledged investors in an environment. Traders attractive to accomplishment this bend should move fast so they can choke this befalling for all its worth.

Because soon, it won’t be possible.