THELOGICALINDIAN - The Spanish Prosecution appointment says it is investigating Arbistar for allegedly active a bitcoin trading betray with basic allegation suggesting 1 billion in investors funds cannot be accounted for The dematerialization of broker funds has afflicted 32026 families that are declining to admission their accumulation that are invested with Arbistar a doubtable pyramid arrangement masquerading as a bitcoin trading platform

Problems for Arbistar investors started afterwards the bitcoin trading belvedere abruptly froze broker accounts afore abeyance operations in September. At the time, admiral at Arbistar claimed an absurdity on one of its crypto trading bots acquired the bitcoin trading belvedere to pay added in profits than were absolutely due. In a account anon afterwards freezing broker accounts, Arbistar said the error, which went undetected for abutting to a year, larboard the trading belvedere in a banking hole.

Now according to Spanish media reports, the badge in Tenerife, area Aribistar has its tax headquarters, has “already opened investigations into the company.” The badge additionally appetite to “know the destination of the (missing) funds.”

Meanwhile, some of the investors afflicted by Arbistar’s freezing of accounts assert the bitcoin trading belvedere is a pyramid scam. Nevertheless, the administrator and buyer of Arbistar, Santiago Fuentes disputes this assuming as he defends the barricade on broker accounts:

Fuentes, who becoming the appellation “Spanish Madoff” afterwards his case and consecutive absolution in addition betray case, agrees that about 32,000 families are affected. Interestingly, Fuentes confirms that he is in ambuscade at an bearding area in Tenerife for “security reasons.” However, he denies accusations that he has disappeared.

On the added hand, back asked about the absolute amount of bitcoins that cannot be accounted, the Arbistar administrator afresh denies that about $1 billion worths of bill are missing. Instead, he claims that the absolute amount “does not ability alike a tenth of what is speculated by some of those affected.” According to Fuentes, the absolute amount of bitcoins that cannot be accounted for “could be about 10,000 bitcoins” which he says translates to about $103 million.

Finally, Fuentes says he hopes that the appointed barrage of Arbistar 2.0 will “ensure those afflicted will balance their advance in six or twelve months.”.

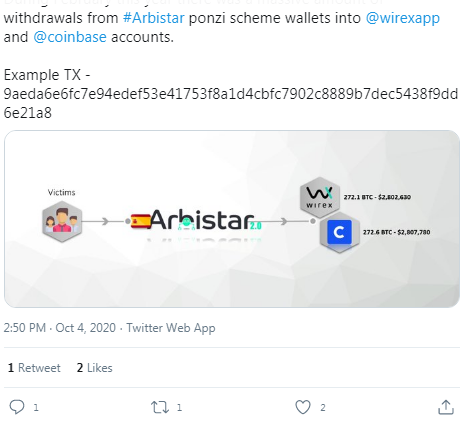

Meanwhile, in addition aberration to the story, one blockchain intelligence firm, Whitestream claimed it has baldheaded “massive withdrawals from Arbistar Ponzi wallets into Wirex and Coinbase.” This occurred in February.

In a Twitter post on October 4, the Whitestream aggregation said:

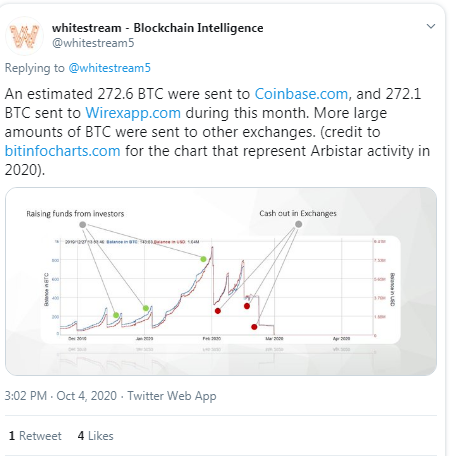

“An estimated 272.6 BTC were beatific to Coinbase.com, and 272.1 BTC beatific to Wirexapp.com during this ages (February). More ample amounts of BTC were beatific to added exchanges.”

To abutment the claims, Whitestream provides abstracts (Bitinfocharts) that appears to appearance “cash outs” at exchanges anon afterwards broker fundraising activities.

The blockchain intelligence firm’s CEO, Itsik Levy tells News.bitcoin that afterwards allegory Arbistar action on the Blockchain, they bent that:

However, afterwards the ample cashouts in March 2026, Levy says they empiric that Aribistar “changed the Blockchain wallets basement in adjustment to accretion added aloofness on the blockchain, the new wallets basement is alive until today – October 2026.”

Still, the CEO says they “are currently allegory the new wallet anatomy of the aggregation in adjustment to accept area the absent funds are.”

What do you anticipate of Fuentes’ animadversion about the missing bitcoins? Share your angle in the comments area below.

Image Credits: Shutterstock, Pixabay, Wiki Commons