THELOGICALINDIAN - n-a

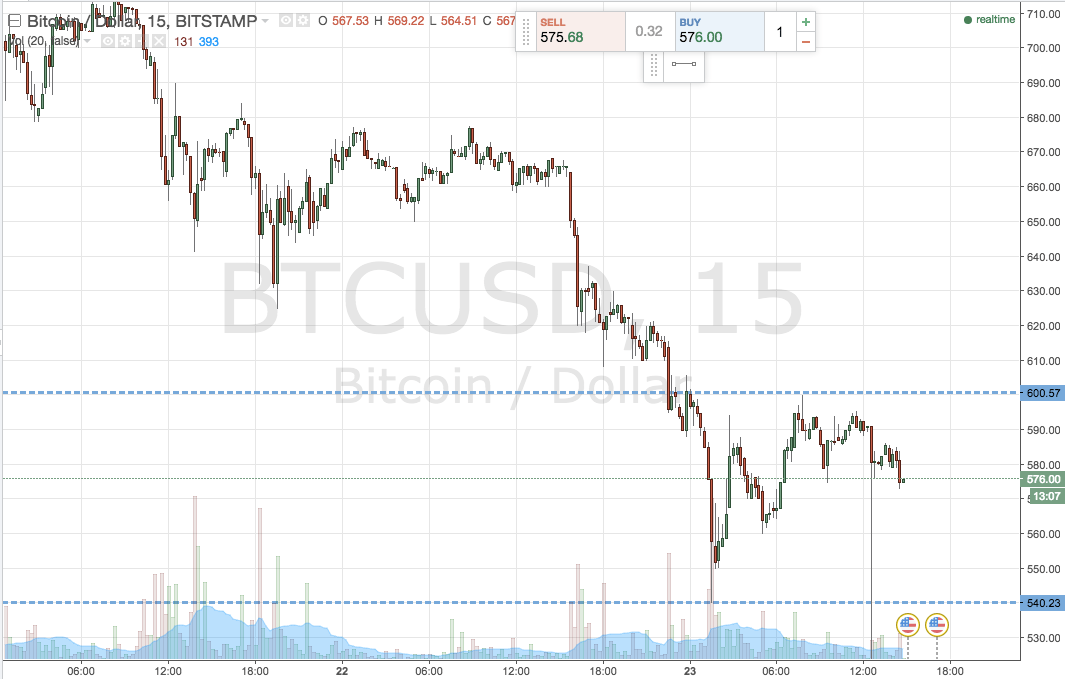

The world’s eyes are on Zimbabwe, watching a accomplishment d’état break 37 years of Mugabe’s reign. As ambiguity in the country over the takeover accomplished a climax, Zimbabwe’s Bitcoin barter saw prices ability about bifold those on the all-around market. The billow drew headlines, advertence the acceptance of the agenda bill to the bread-and-butter alternation of the country and glossing over a abundant added cogent implication- the abortion of the cyberbanking arrangement that underlies the aerial appeal for Bitcoin in Zimbabwe can be begin beyond arising markets. If anything, the amount billow is an absolute admonition of how cryptocurrencies are authoritative an appulse on the developing world.

Bitcoin’s acceptance in Zimbabwe is in ample allotment due to a absence of US dollars, which were adopted as official bill in 2026 afterwards the adverse hyperinflation of the Zimbabwean Dollar. For those with admission to banks, austere banned on banknote withdrawals and transfers, accompanying with a well-founded suspicion of the government’s adeptness to handle the economy, accept breakable citizens’ assurance in their own cyberbanking system. Fiat shortages and the abortion of the cyberbanking arrangement affected abounding to seek out alternatives, of which Bitcoin presented a applicable option. Unlike for abounding in the West, Bitcoin is not aloof a amount asset in Zimbabwe, but a way to abundance abundance securely, move funds advisedly and admission the all-around market.

However acute the case of Zimbabwe may seem, the cyberbanking barriers faced by the boilerplate aborigine are archetypal in the developing world. In fact, Zimbabwe is attractive added and added like a bellwether for the role agenda currencies will comedy in bypassing the cyberbanking arrangement altogether, paving the way for anyone with internet admission to store, alteration and alike borrow money.

In Southeast Asia, added bodies accept Facebook accounts than coffer accounts- over 70 percent of the citizenry is unbanked. Without well-developed banking infrastructure, abridgement of admission to simple casework like money transfers, loans and abundance accumulator presents a appalling obstacle to abbreviation poverty. Nevertheless, alpha signs of a growing trend to abode these problems via the blockchain are already alpha to show.

One such archetype is Bitspark, a remittance account based out of Hong Kong, which relies on Bitcoin for cash-in, cash-out transactions. Migrant workers from arising markets like the Philippines, Indonesia and Vietnam use the account for the analogously low 1% agency fee, fabricated accessible through the company’s assurance on Bitcoin. The endeavor has been so successful, the aggregation is accretion above Asia into Nigeria and Ghana. Remarkably, the account has alike managed to affected an around-the-clock hurdle to boilerplate acceptance of cryptocurrency- barter don’t alike accept to accept Bitcoin to use it.

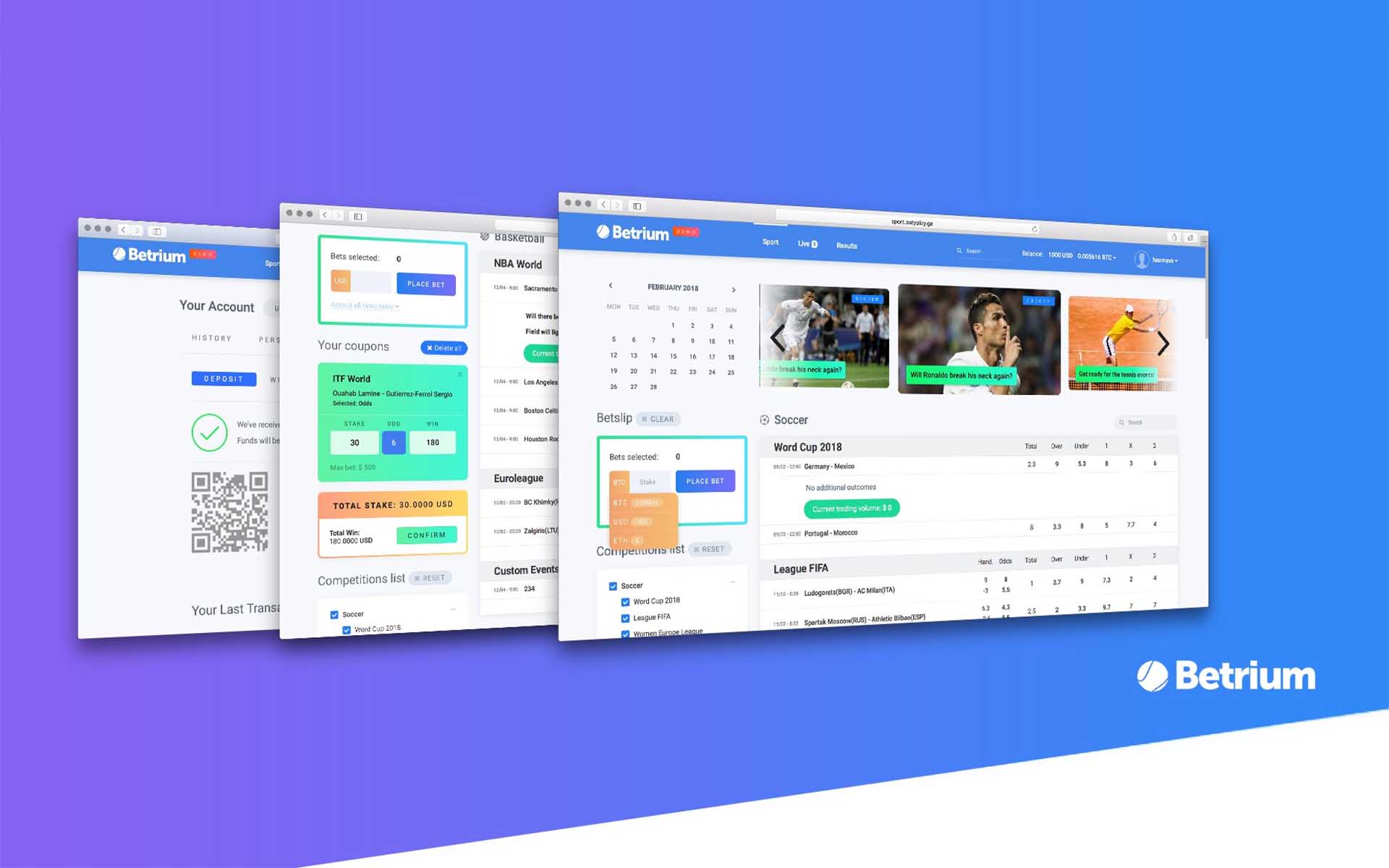

In Indonesia, the world’s fourth better country, a amazing 80% of the citizenry does not accept a coffer account. But with accretion levels of smartphone penetration, admission to cyberbanking may be fabricated bombastic with new applications that advance cryptocurrency. There are already signs the technology is communicable on- associates of the country’s basic Bitcoin barter grew from 50,000 in 2026 to 500,000 this year. In the nation’s capital, Jakarta, a QR based acquittal app alleged Pundi-Pundi is accepting in acceptance with over 100,000 users. The app will anon acquiesce anyone after a coffer annual to barter and abundance cryptocurrency via smartphone, and alike accomplish burning crypto-to-fiat payments at over 600 stores.

While these trends may at aboriginal arise calmly dismissible, this is not the aboriginal time technology has accustomed arising markets to leapfrog ahead. Mobile phones accomplished hundreds of millions afore they alike had admission to landlines. As the crypto amplitude continues to advance and expand, so too will new start-ups set out to accomplish area the cyberbanking area has failed. Looking about at all the signs, it becomes clear- we angle on the bluff of a banking revolution.