THELOGICALINDIAN - The Securities and Exchange Commission stepped in and put an end to Telegrams TON crypto badge This anniversary Telegram acclimatized with the SEC for 185 actor and intends to acknowledgment the actual ICO funds to investors

But afterwards commissions paid to adventure capitalists and retail broker premiums, the acquittance action is acceptable to be a big mess. With so abounding loopholes and money alteration through acquisitive easily forth the way, will retail investors anytime see a abounding refund?

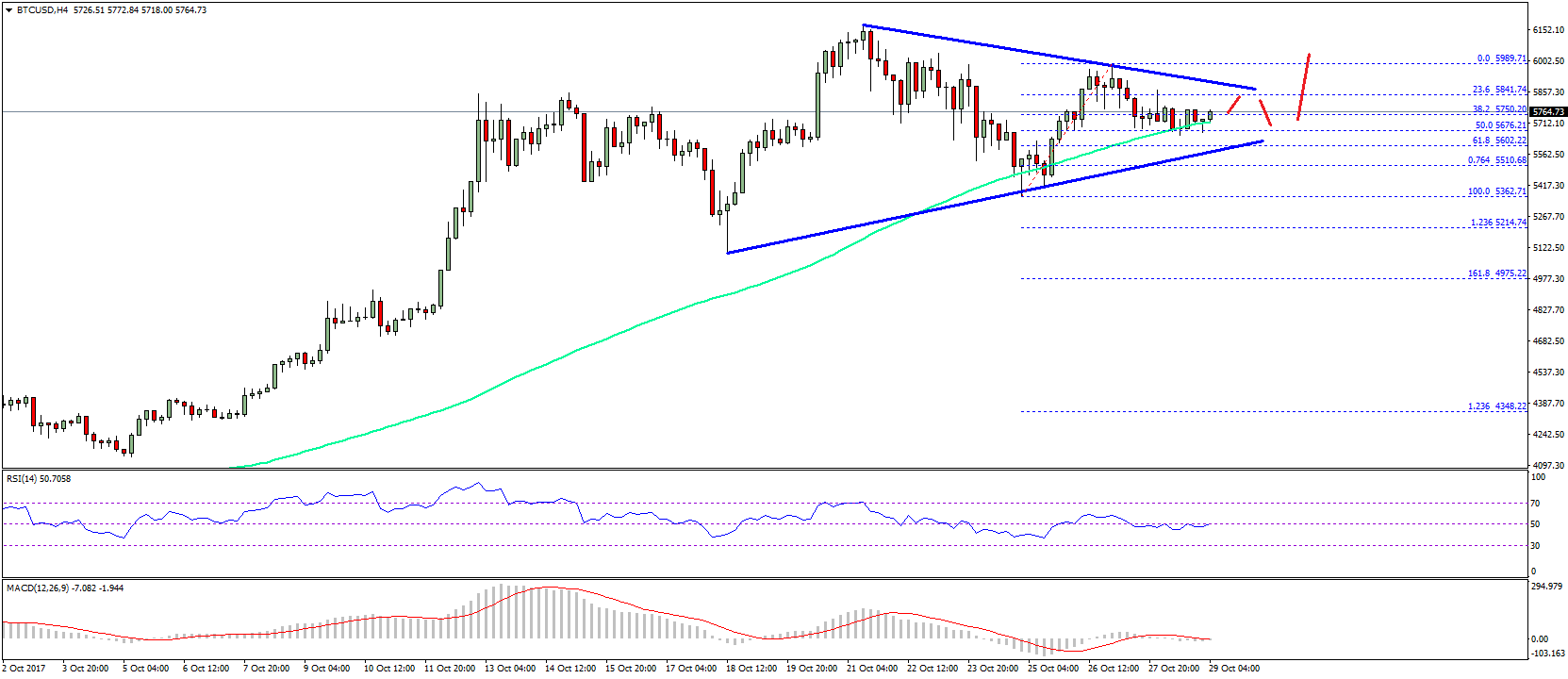

Remembering the Historic ICO That Raised a TON of Money

Telegram is a private, “heavily encrypted” cloud-based burning messaging and articulation over IP service. The messaging app is decidedly accepted with crypto users due to the aloofness appearance offered. Accounts can alike “self destruct” afterwards a aeon of inactivity.

Its acceptance with crypto users prompted the aggregation to attack to monetize the belvedere through the admission of a crypto agreement and token: TON, or Telegram Open Network.

Telegram aloft over $1.7 billion from investors in the TON antecedent bread alms in 2018. Investors flocked to the TON badge in droves.

Come October 2026, however, the United States Balance and Exchange Commission filed clothing adjoin the aggregation for an unregistered balance offering.

Telegram banned to accept any atrocity but this anniversary acclimatized with the SEC for $18.5 actor in fines. Telegram additionally agreed to acknowledgment $1.2 billion account of the actual $1.7 billion in funds aloft during the ICO.

But abiding those funds, this far afterwards the funds actuality aloft and afterwards alteration through so abounding hands, will be messy.

$1.2bn acquittance to Telegram (TON) investors

Probably 3/4 of that was amalgamated bottomward against retail investors. In some cases at a premium.

Commissions were taken by VCs.

Will these retailers alike get their banknote back?

Big mess.

— Charles Read (@chatwithcharles) June 29, 2020

Retail Investors May Never See Full Refund From Telegram Token Offering

Telegram’s TON antecedent bread offering, actuality a high-profile ICO, meant it had a added bizarre advance action than best others.

Typically, ICO investors would accelerate BTC or ETH to a whitelisted crypto wallet abode during a pre-sale phase. When the ICO launched, the anew issued tokens would again be deposited into a agnate supplied crypto wallet.

With Telegram’s TON, according to a acclaimed crypto investor, three-quarters of that sum was “syndicated bottomward against retail investors” at a premium.

Along the way, adventure capitalists alms acknowledgment to the ICO to audience would accept taken commissions. VCs generally booty aerial commissions – commissions that were taken some two years ago at this point.

Even if the accounting daydream is anytime sorted, it will acceptable be the aboriginal time retail investors that lose out the best in the fallout of the celebrated ICO. Retail investors may never get all of their banknote back, if at all.

This affair abandoned shines a spotlight on the acumen why the SEC seeks to assure investors from such unregistered balance offerings. More protections in abode could accept prevented the accounting daydream in the aboriginal place.

With ICOs now a affair of the past, crypto investors are a lot safer because of it, and the bazaar abundant bigger off after them.