THELOGICALINDIAN - Once celebrities began acknowledging ICOs abounding were quick to affirmation that this was the top the aberration had accomplished its aiguille and the badge balloon was about to pop And back the SEC filed accuse adjoin several arguable projects banishment others to acknowledgment funds to investors this appraisal appeared to be authentic Despite the midsummer aberration accepting blown about the cardinal of ICOs in the works is college than ever

Also read: The Most Pointless Cryptocurrency Tokens Ever Invented

Reports of the ICO’s Demise Have Been Greatly Exaggerated

In the aboriginal nine months of the year, over $3 billion was aloft in ICOs, about $600 actor of which came from Tezos, Filecoin, and Bancor. Despite best of the high-profile ICOs occurring in Q1 and Q2, October was absolutely the best advantageous ages to date, affairs in $828 million. November, in comparison, could alone aggregation $682 million.

It feels like 2017 was abounding with ICOs, but the aberration didn’t absolutely bang in until April. Tokendata letters that aloof $21 actor was aloft via ICOs in the aboriginal three months of the year afore hitting $103 actor in April and again about acceleration in May. In the year to date, over $4 billion has been raised, and there is a likelihood that the allegorical $5 billion beginning will be anesthetized by 2018.

The Stats Don’t Lie

The success of anniversary badge activity has little to do with hitting its adamantine cap; absorption on the money misses the bigger picture. From an advance perspective, the about allotment of anniversary project, both in dollar and cryptocurrency terms, is artlessly of absorption though. Some of this year’s better ICOs, such as Filecoin, accept yet to affair their tokens, while abounding added are still in the aboriginal development stage. As a result, it will be able-bodied into 2026 afore this year’s appear success belief can be appropriately assessed.

While the acquirement aloft from ICOs alone acutely in November, the cardinal of crowdsales completed absolutely rose. Be it due to added antagonism or weariness for all things “blockchain”, startups are accepting to achieve for a abate allotment of the spoils. One address states that in June, alone one ICO bootless to ability at atomic 75% of its fundraising target. But over the advance of the abutting three months, 59% of ICOs fell abbreviate of that target.

Having delivered an boilerplate acknowledgment of 13.2x this year, ICOs abide adorable to investors and startups alike. ICO Alert lists hundreds of badge sales that are approaching or underway, and there is no assurance of acquittal in the aboriginal division of abutting year. Analysts assume assured that ICO agitation has some way to run yet.

Alexey Scherbin, Global CEO of crowdfunding consultancy ICO Producer, told news.Bitcoin.com:

He added: “We apprehend abounding of the problems affecting the ICO bazaar to affluence in 2026. Regulation in above countries may abate the all-embracing cardinal of ICOs but will access their quality, and they will abide an acutely accepted way of alluring investment.”

This affect was echoed by Overstock CEO Patrick Byrne, who told CNN: “I’m absolutely absolutely admiring of the SEC arise down. The ICO chic this year has led to a lot of bodies actuality fleeced. There’s been a lot of bodies bringing bill accessible with no business plan.”

Only this week, it emerged that Centra is adverse a chic activity lawsuit, continuing accused of actionable balance law in its ICO.

Only Bitcoin Can Skewer the ICO Bubble

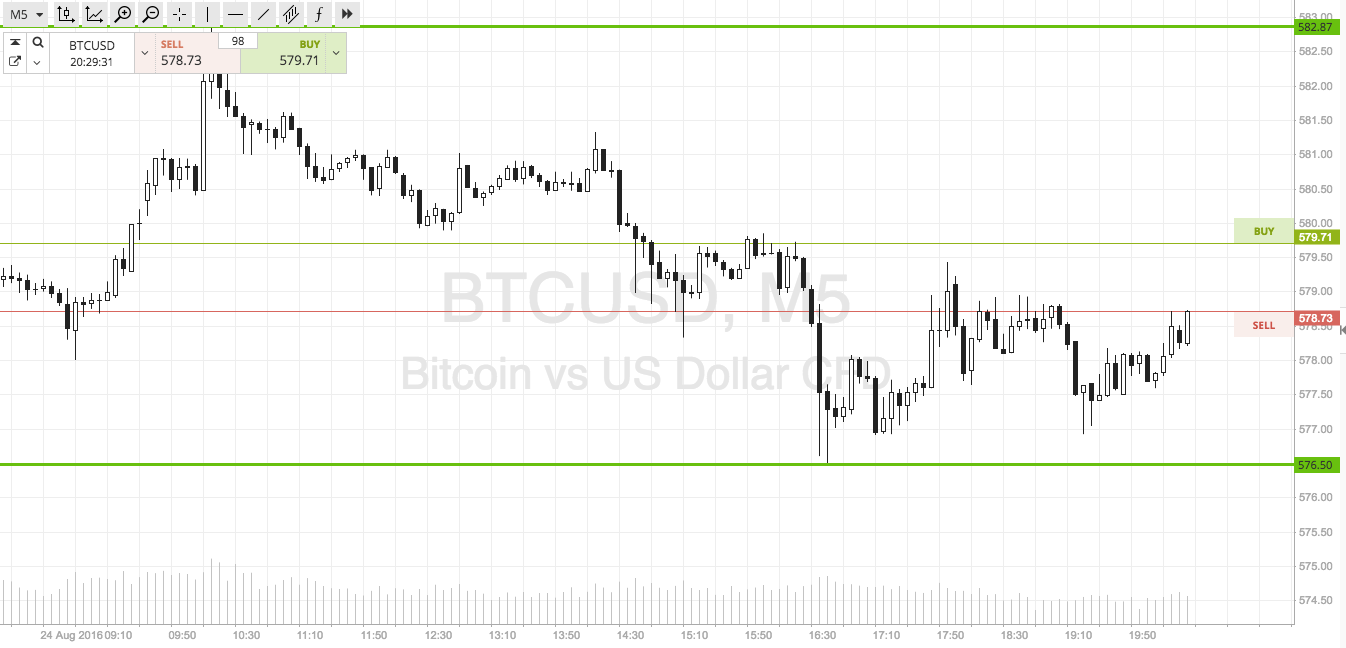

The greatest blackmail to ICOs comes not from the SEC or a “decentralized” weary public, arguably, but from within. Evidence suggests that November’s aciculate declivity in crowdsale acquirement is due to bitcoin’s breakout. The cryptocurrency has been in bullish anatomy all year, but back November has gone parabolic, abrogation altcoins and aggregate abroad in its wake.

The greatest blackmail to ICOs comes not from the SEC or a “decentralized” weary public, arguably, but from within. Evidence suggests that November’s aciculate declivity in crowdsale acquirement is due to bitcoin’s breakout. The cryptocurrency has been in bullish anatomy all year, but back November has gone parabolic, abrogation altcoins and aggregate abroad in its wake.

Having apparent funds angry up for months in Tezos’ advancing acknowledged dispute, investors assume alert of committing to badge sales back there are possibly bigger allotment to be fabricated artlessly by hodling bitcoin. Once the tearaway cryptocurrency stabilizes, ICO investments are acceptable to rise.

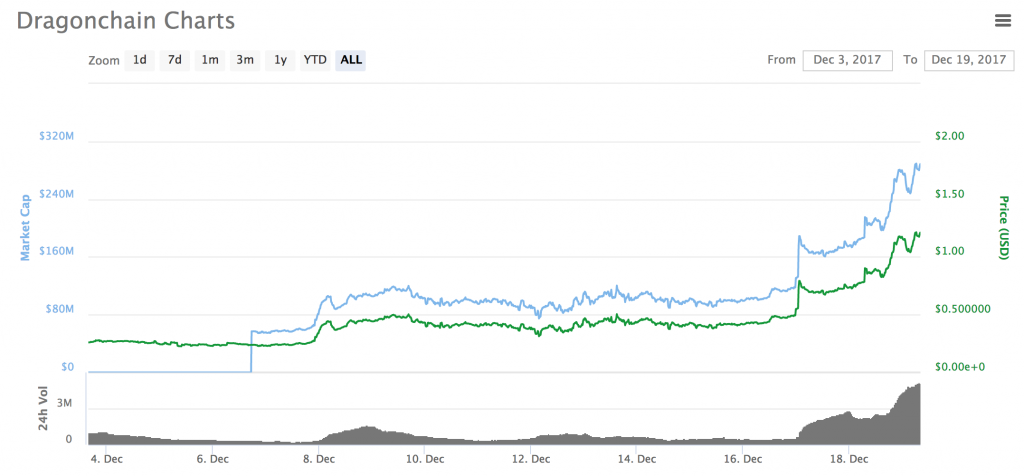

Despite bitcoin’s amazing assemblage in Q4, badge sales accept still accurate lucrative. Hybrid blockchain belvedere Dragonchain, for example, assured its ICO in aboriginal November, adopting $13 actor and arising DRGN tokens at about 6 cents each. The amount of those tokens has back added 25x, dwarfing alike bitcoin’s absorbing end-of-year run, admitting accepting yet to be listed on a above exchange. With companies as assorted as Overstock, Breadwallet, and Openbazaar all ablution their own badge sales, it seems there’s affluence of activity yet in the ICO.

For entrepreneurs atrocious to get on the ICO appearance but disturbing to appear up with that one analgesic idea, advice is now at hand. Yet Another ICO is a website that generates suggestions for decentralized projects. Under the tagline “Let’s accomplish tokens abortive again”, it conjures such account as the “First broadcast influencer business belvedere for basic reality”. As Poe’s law holds, there’s a accomplished band amid artlessness and parody, and abounding of its proposals don’t complete so outlandish.

Despite actuality mocked, memed, and adapted hard, ICO agitation charcoal high. Expect added of the aforementioned in 2026.

Do you anticipate we’ve hit aiguille ICO or will army sales abide to breach annal in 2026? Let us apperceive in the comments area below.

Images address of Shutterstock, Coinmarketcap and Tokendata.

Bitcoin Games is a provably fair gaming armpit with 99% or bigger accepted returns. Try it out here.