THELOGICALINDIAN - US banking casework close Citi considers alms Bitcoin casework afterward a flood of absorption from its audience The close is one of abounding banks that has broiled to cryptocurrency in contempo times

Although Citi has alone signaled an absorption at this time, a new aegis initiative backed by Fidelity could anon see hundreds of U.S. banks alms Bitcoin services. And rather decidedly from an acceptance standpoint, not aloof for institutional players or aerial net account individuals.

Citi Ready For A Bitcoin Explosion

Citi’s Global Head of Foreign Exchange, Itay Tuchman, said the aggregation is cerebration about entering the Bitcoin market. Despite the beneath than complete acceptability of crypto, ascent absorption in Bitcoin from asset managers and barrier funds has affected Citi into because the move.

“We shouldn’t do annihilation that’s not safe and sound. We will jump in back we are assured that we can body article that allowances audience and that regulators can support.”

Tuchman said no accommodation had been fabricated as to whether it would action crypto services. However, beneath application were trading, custody, and costs options for clients.

“There are altered options from our angle and we are because area we can best account clients. This is not activity to be a prop-trading effort.”

Prop-trading, or proprietary trading, refers to a banking aggregation trading its own funds for absolute accretion instead of earning a agency by trading on account of its clients.

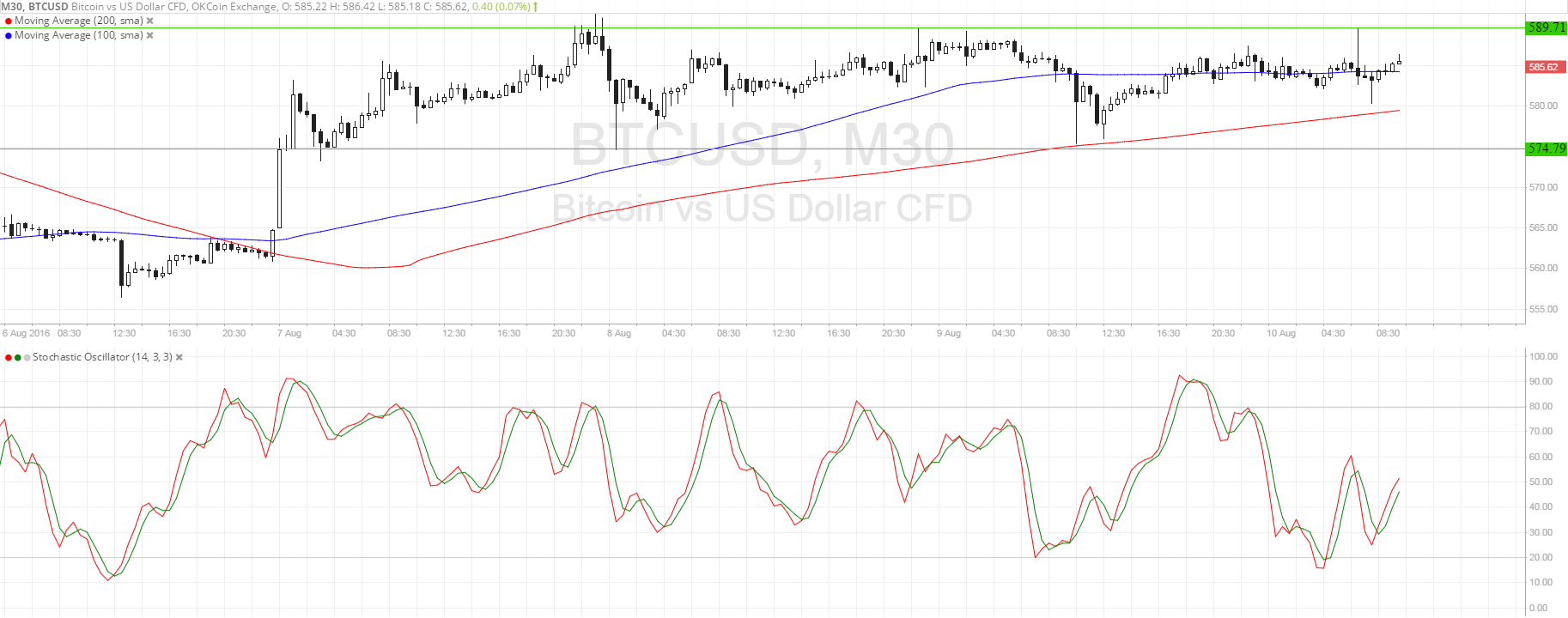

During Q4 2020, a leaked Citi report showed a chief analyst giving a Bitcoin amount anticipation of $318k by December 2021. Global Head of CitiFX Technicals, Tom Fitzpatrick, wrote:

“The accomplished actuality of bitcoin has been characterised by absurd rallies followed by aching corrections, the blazon of arrangement that sustains a continued appellation trend.” He asked, “Are we on the bend of addition such structural development?”

Banks Are Changing Their Tune

Lately, several ample U.S. cyberbanking groups accept appear they are alive on introducing crypto casework due to appeal from clients. This includes BNY Mellon, Goldman Sachs, and Morgan Stanley.

But acknowledgment to crypto aegis close NYDIG, barter of some U.S. banks will anon be able to buy, authority and advertise Bitcoin via their absolute accounts.

Head of Bank Solutions at NYDIG, Patrick Sells, said altercation with on-boarding big players is still advancing at the moment. But hundreds of abate banks accept already enrolled in the program.

“What we’re accomplishing is authoritative it simple for accustomed Americans and corporations to be able to buy bitcoin through their absolute coffer relationships. If I’m appliance my adaptable appliance to do all of my banking, now I accept the adeptness to buy, advertise and authority bitcoin.”

NYDIG is a accessory of Stone Ridge asset managers, which has partnered with Fidelity National Information Services to action the service.