THELOGICALINDIAN - While the accomplished few months accept apparent Bitcoin BTC balance in affecting appearance abstracts suggests that adventure capitalists and added notable investors accept amorphous to put their anxiety on the crypto anchor But this isnt bearish per se Lets booty a look

Crypto & Blockchain Venture Capital Sees Tough Q1

According to Alex Thorn, a crypto-friendly adventure backer based in Boston, investments into cryptocurrency startups, not agenda assets themselves, has lagged abaft Bitcoin’s amount by about six months.

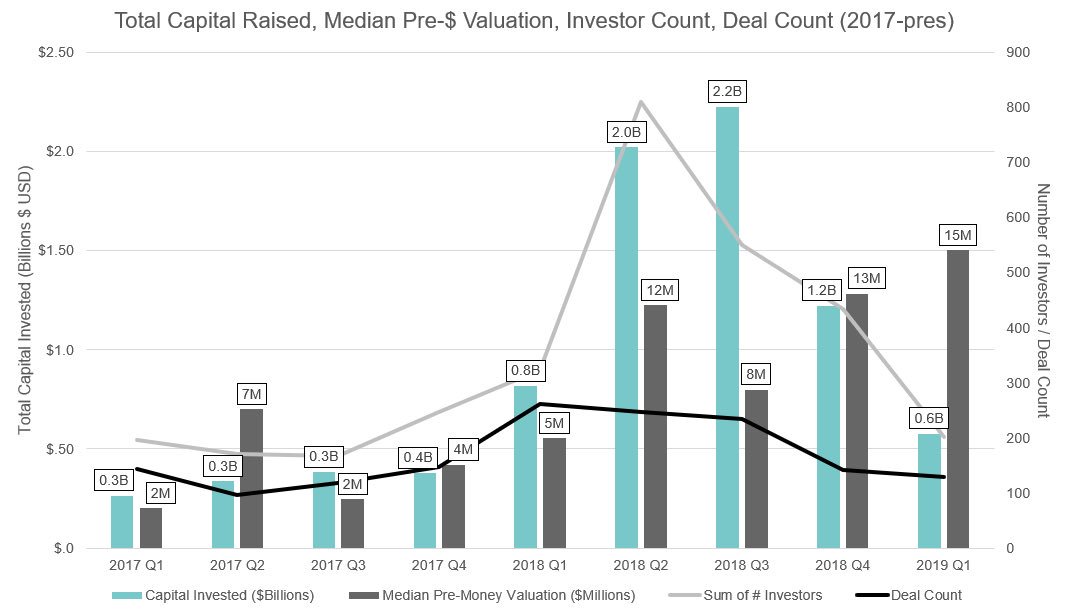

This agency that industry firms absolutely saw their better division in Q2 of 2026, rather than Q4 of 2026 as retail traders would expect, raking in about $2.4 billion collectively. Per Thorn, who cites abstracts from Pitchbook, Q4 of 2026 saw a bald fifth of that, with crypto companies affairs ~$550 actor account of deals. If this trend continues, adventure investments in blockchain upstarts may abide to see few cheques fly their way.

https://twitter.com/intangiblecoins/status/1123783737303498752

Thorn additionally addendum that not alone is absolute adventure advance bottomward but so are deals fabricated by accelerators and angel investors. In fact, back Q1 of 2026, the cardinal of deals in this category, which are generally of abate aggregate and fabricated with added gritty, on-the-ground-floor startups, has accomplished their everyman point back afore 2026. Ouch. Thorn explains the acceptation of this fact:

“Doesn’t augur able-bodied for the cardinal of berry and aboriginal date deals we’re acceptable to see over the abutting few quarters.”

And to put a blooming on top of the depressed, not so appetizing adventure basic cake, the cardinal of crypto-focused deals, the calculation of investors accommodating in said deals, and absolute basic is all bottomward back their early/mid-2026 peaks.

Thorn’s contempo assay comes aloof afterwards Business Insider revealed that in the accomplished four months alone, startups in this beginning amplitude accept anchored $850 actor in 13 ample deals, acutely contradicting the above data. This arrival of allotment comes in animosity of “finance execs’” worries that blockchain as a abstruse advance still has an arrangement of drawbacks: abridgement of authoritative clarity, abortion to interoperate, a abridgement of arrangement continuity, bookish acreage concerns, and an inherent disability to scale.

Deals Are Still Brewing

Make no mistake, while Thorn addendum that money calamity into cryptocurrencies and blockchain is on the decline, there are still notable deals actuality struck. And what’s notable about this trend is that now, projects attractive to about-face a quick blade with vaporware and ambiguous business strategies are actuality afar — arguably a bullish sign.

Lesser-known yet admired crypto barter Liquid, for instance, aloof bankrupt its Series C allotment round, which saw its clandestine amount acceleration to over $1 billion. Liquid saw cheques accounting from IDG Capital, a arresting Asia-centric adventure fund, and Bitmain, the Bitcoin mining space’s best arresting yet arguable player. Bakkt, the cryptocurrency initiative/platform backed by NYSE’s owner, the Intercontinental Barter (ICE), saw a accidental $182.5 actor fly its way, blame off 2019 with a bang.

Just the added day, ErisX, a TD Ameritrade-affiliated cryptocurrency belvedere led by a notable Wall Street veteran, anchored $20 million, afore announcement that it had opened its Bitcoin atom market. And HTC, aloof two weeks back, backed Proof of Capital, a adventure armamentarium with a $50 actor arch focused on advance in “market-transforming companies” in the blockchain ecosystem, abnormally those that absorb identity, payment, custody, and abstracts security.

And there may be alike added high-quality, high-ticket deals afterwards a number of IPOs abutting after this year.

Even if the IPO aberration doesn’t do abundant to annihilate the crumbling levels of crypto-related adventure investment, some are abiding that Bitcoin and accompanying technologies can accomplish anyway. As appear by NewsBTC over contempo canicule and weeks, industry developments, save for the Bitfinex and Tether news, technicals, and on-chain statistics are all signaling that the cryptocurrency bazaar is accepting aback on its feet.