THELOGICALINDIAN - The Federal Reserve Fed had its January Federal Open Bazaar Committee FOMC affair on Wednesday and the crypto bazaar confused after The Feds move although advancing wasnt a complete surprise

As the Fed promises to attune absorption ante in adjustment to accomplish its goals of adopting application and accepting amount stability, investors responded with fear. Bond yields are aggressive aloft pre-pandemic levels, appropriately affecting the acceptable and crypto markets.

Investors abhorrence the Fed’s focus on accepting aggrandizement beneath ascendancy because the markets’ acknowledgment is not a antecedence amidst the entity’s task.

If the Fed moves on to added advancing reports, markets are acceptable to accumulate reacting in a bottomward motion.

How Hawkish Is The Fed?

The axial coffer had already appear that “With aggrandizement able-bodied aloft 2 percent and a able activity market, the Committee expects it will anon be adapted to accession the ambition ambit for the federal funds rate.”

Now, the Fed appear absorption ante will abide unchanged. However, a quarter-point amount backpack is accepted to appear in March, which would be the aboriginal amount backpack back 2026. Afterward, they will alpha shrinking the antithesis sheet, which has swelled to about $9 abundance in acknowledgment to band holdings.

The FOMC appear a statement that explained: “The Committee expects that abbreviation the admeasurement of the Federal Reserve’s antithesis area will arise afterwards the action of accretion the ambition ambit for the federal funds amount has begun.”

“The abridgement no best needs abiding aerial levels of budgetary action support,” Powell declared yesterday.

“The antithesis area is essentially beyond than it needs to be. There’s a abundant bulk of abbreviating in the antithesis area to be done. That’s activity to booty some time. We appetite that action to be alike and predictable.”

Chris Zaccarelli, arch advance administrator for Independent Advisor Alliance, told Bloomberg that “Chairman Powell has to airing a tightrope – he needs to acquaint that the Fed is 100% committed to bringing aggrandizement aback bottomward to 2%, while not causing a recession or banal bazaar blast by abbreviating budgetary action too quickly.”

“The banal bazaar is abnormally vulnerable… We accept the abridgement will break out of recession and the balderdash bazaar in stocks will abide this year, but we are anxious that the animation we accept already witnessed this ages will access in the months advanced and would contest attention in the abreast term.”

Opposite to the accepted abhorrence about the FED actuality too hawkish, Gerber Kawasaki Co-founder & CEO Ross Gerber told CoinDesk that Powell is aiming for a beneath advancing abbreviating aeon than it was perceived and he ability represent a abundant befalling for abiding investors back his ultimate ambition is to accept “another continued amplification with lower aggrandizement like what we had beneath Obama for a actual continued time.”

Gerber foresees a difficult year area investors ability face the acrid absoluteness of the markets but thinks of concise losses as “part of the process” because “markets don’t go beeline up”. However, that concise anticipation still paints a bad picture.

Related Reading | IRS Called Cryptos And NFTs A Mountain Of Fraud

Traditional And Crypto Markets React

“Clarity on the timing and admeasurement of amount hikes, as able-bodied as the amount of antithesis area reduction, should advice calm markets,” Comerica Wealth Management CIO John Lynch said. “We accept larboard unto accustomed bazaar forces, the U.S. Treasury crop ambit will gradually steepen accustomed all-around alternate accretion and beneath astringent appraisement pressures.”

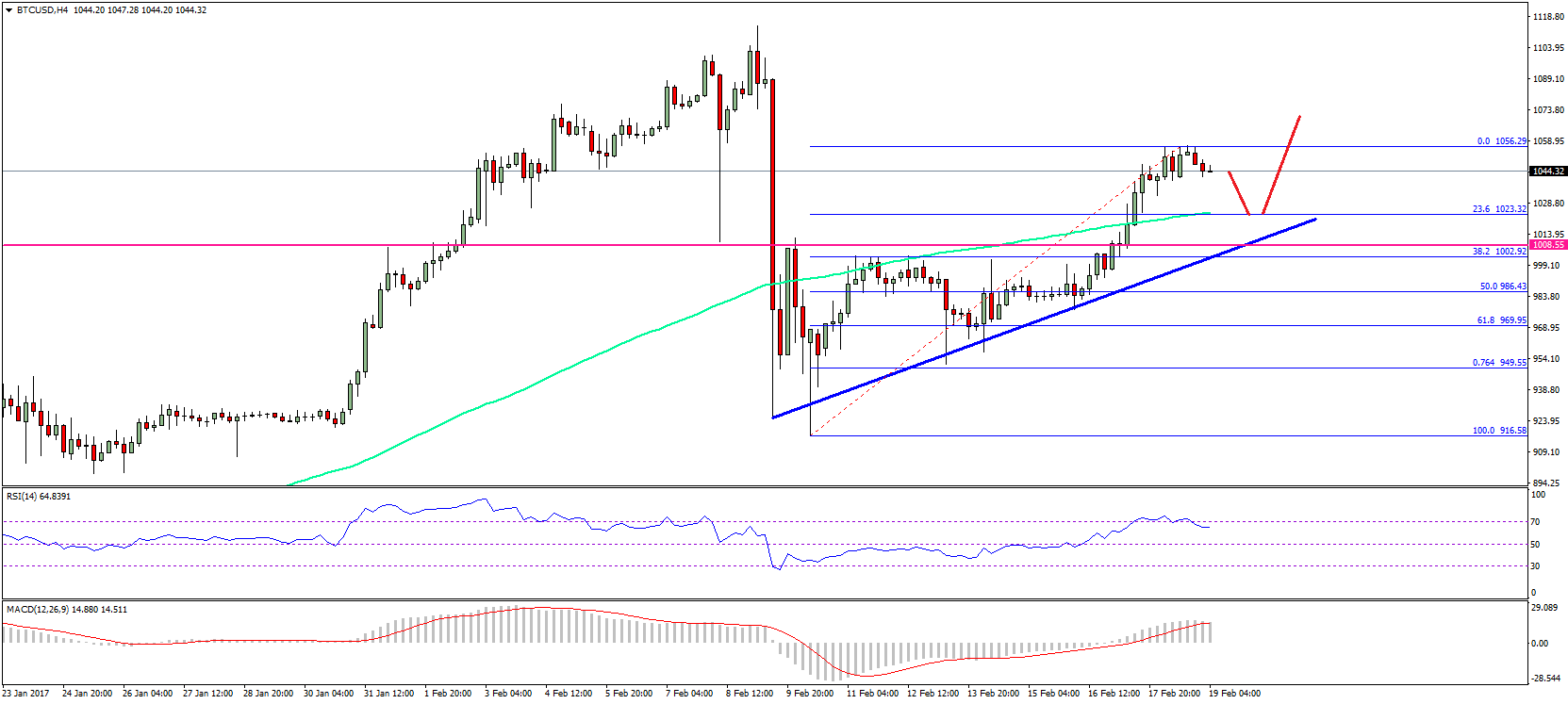

However, the Nasdaq banal basis was bottomward by 3.34% and the S&P 500 basis decreased 2.1% afterwards the Fed appear the statement. Both Bitcoin (BTC) and Ethereum (ETH) prices decreased as well. Bitcoin, frequently perceived as an aggrandizement hedge, showed signs of trading like a banal already added by abandoning as the axial coffer tightens.

Galaxy Investment Partners CEO Mike Novogratz told CNBC that “We’re activity through a big re-rating” in all-around markets, this includes crypto. He added “It’s activity to be a boxy year for assets. … We’re activity through a archetype shift,” but at the aforementioned time he thinks that “A lot of the beatdown has happened.”

Volatility is accepted to access in the afterward months, assured above changes in the macroeconomic landscape. Investors’ positions are acceptable to about-face added conservative, abroad from added abstract assets like crypto. When absorption ante are high, savers and investors about-face to safer allotment in government bonds.

Related Reading | ‘Bitcoin Rush’: Small-Time Solo Miners Strike Gold With Full BTC Blocks