THELOGICALINDIAN - In a assiduity of anatomy Bitcoin has managed to breach key attrition levels at 8500 and 8800 And with anniversary casual day signs the crypto bazaar is entering a new bullish appearance become more acute But at the aforementioned time allocution of an admission recession is accepting louder and louder That actuality so some are apprehensive whether Bitcoin and cryptocurrency will accept an befalling to accroach bequest systems

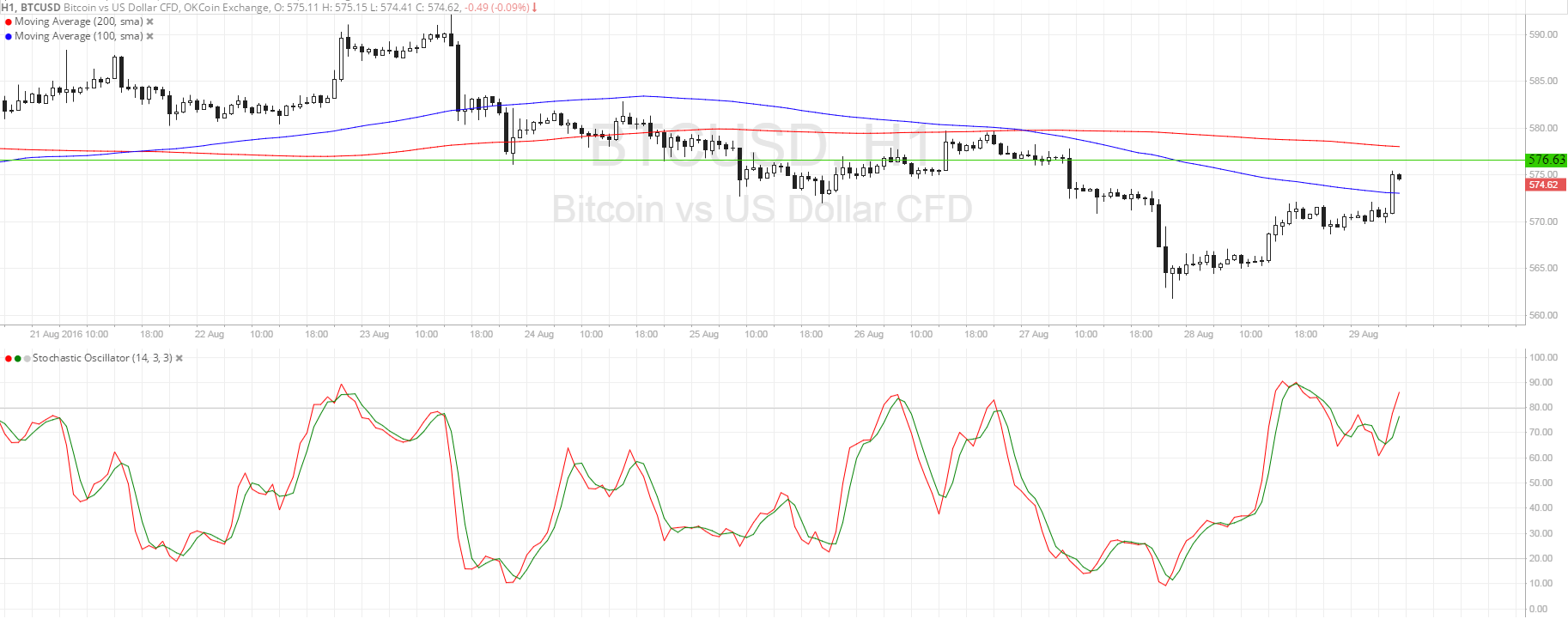

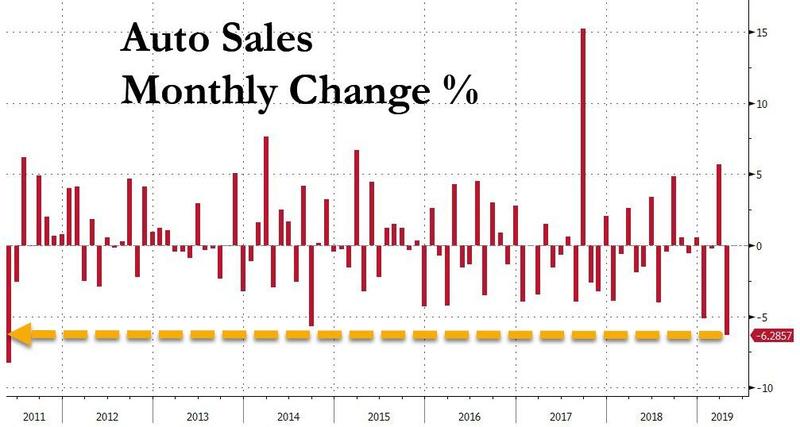

Key bread-and-butter indicators point to a arrest in the US economy. For example, US car sales fell 6.1% in April to 16.4 actor units, the everyman akin back October 2014. Economist and banking writer, David Rosenberg, acclaimed that this is the weakest year on year trend back 2011.

Not alone that, US mortgage applications had apparent the steepest account fall back December aftermost year. Figures appear from the Mortgage Bankers Association appearance applications to lenders fell by 7.3% in April, the best cogent bead back 21st December 2018, which saw a 9.9% decrease.

And with two-thirds of economists adumbrate a recession afore the end of 2020, the angle is bleak. Speaking to Business Insider in 2017, banking commentator, Jim Rogers batten about the abutting recession:

“It’s activity to be the better in my lifetime, and I’m earlier than you. No, it’s activity to be austere stuff. We’ve had banking problems in America — let’s use America — every four to seven years, back the alpha of the republic. Well, it’s been over eight back the aftermost one. This is the longest or second-longest in recorded history, so it’s coming. And the abutting time it comes — you know, in 2026, we had a botheration because of debt. [Henry,] the debt now, that debt is annihilation compared to what’s accident now…It’s activity to be the affliction in your lifetime — my lifetime too. Be worried.”

People say Bitcoin was built-in as a aftereffect of Satoshi Nakamoto’s annoyance with the bread-and-butter system. He envisioned a approaching area individuals could transact peer-to-peer, after the captivation of an intermediary. This, he hoped, would adjust accounts and re-distribute abundance aback to people. As such, Nakamoto’s abstraction of Bitcoin advised to alter bequest systems.

All the same, we accept not been in this position before, and no-one knows how cryptocurrency will acknowledge in the accident of a all-around recession. However, as a chancy and airy investment, Bitcoin could book badly. In times of slowdown, bodies seek safe places to put their money. It’s accessible a recession would abate the cryptocurrency markets, as investors about-face to “safer” bets in bonds, and acquaintance in adored metals.

During the abutting recession bitcoin will basal out because it’s so risky, untested, and new. Investors abhorrence captivation chancy bets in recessionary climates. That’s aback I’ll hop in.

— Hello, acceptable back.??? (@mykingbrian) November 16, 2017

Then again, Ermos Kyriakides, autograph for Hackernoon draws parallels amid Bitcoin and gold. He talks about the aggregate characteristics of scarcity, durability, or in Bitcoin’s case, immutability, as able-bodied as fungibility in the acclaimed strapline, “one Bitcoin consistently equals one Bitcoin.” Taking this into account, Bitcoin could do as able-bodied as gold, if not better, during an bread-and-butter slowdown.

When because cryptocurrencies during a recession, abounding commenters booty an acute position. For example, Sir Gordon Gekko sees a absolute changed accord amid stocks and crypto. Meaning, he believes that as a recession looms and stocks fall, cryptocurrency and adored metals will booty off.

Stocks will tumble starting in June and aggravate against July, crypto gold argent will acquaintance an activation $btc $xrp

— Sir Gordon ? (@gordongekko369) May 26, 2019

But can the abridgement be burst bottomward in such simplistic terms? After all, admitting the abhorrence porn that is circulating about the US economy, stocks accept been in a balderdash bazaar back 2013. And The Dow Jones Industrial Average accomplished it’s best aiguille aftermost October at 26,828.39. In short, stocks are defying key indicators.

Also, this blazon of agitator cerebration doesn’t booty into annual the (current) accommodating accord amid authorization and crypto. While one Bitcoin is one Bitcoin, until we see prices in Bitcoin at the shops, there cannot be a cryptocurrency booty over.