THELOGICALINDIAN - The advance of stablecoins in 2026 has been clashing annihilation apparent afore Each anniversary added and added of the fiatbacked crypto assets are printed about as fast and as generally as the Federal Reserve is press new cash

After the latest boost, the absolute stablecoin bazaar cap has accomplished a anniversary of $10 billion. But what’s active the connected affecting billow in demand?

Stablecoin Market Cap Reaches Over $10 Billion

All throughout 2026, stablecoins accept accomplished above anniversary afterwards milestone.

Following a able blast in May, the stablecoin accepted as Tether “flippened” XRP for the third-ranked slot in the absolute cryptocurrencies by bazaar cap.

Just the bulk of Tether circulating on the Ethereum blockchain alone afresh exhausted out Bitcoin in circadian affairs processed. Tether additionally exists on Omni-layer Bitcoin and Tron’s blockchain.

Related Reading | It’s Official: Tether Flippens XRP After Recent Market Crash

But it’s not aloof Tether that is growing. Joining Tether in seeing a above bang in new tokens actuality minted, are added battling stablecoins USD Coin, Paxos Standard, and others.

In total, stablecoins accept accomplished a accumulated total bazaar cap of $10 billion. This represents over 3.5% of the absolute cryptocurrency bazaar cap.

Bitcoin currently commands a massive advance at over 65% dominance, but Ethereum itself isn’t too far advanced of the absolute stablecoin bazaar cap at aloof $25 billion, and alone over 9% of the absolute bazaar dominance.

But what absolutely is fueling this absurd appeal for added and added stablecoins?

Stable bill bang through $10 billion bazaar cap. Should we be anxious at all? pic.twitter.com/9Yg4usJgt6

— Mati Greenspan (tweets are not trading advice) (@MatiGreenspan) June 15, 2020

What Is Driving The Demand For The Fiat-Backed Cryptocurrency Coin?

Tether has afford the negative stigma that was already surrounding it to become a awful admired asset in the crypto space.

Stablecoins were primarily acclimated as a flight to assurance back the cryptocurrency asset class’ belled animation struck.

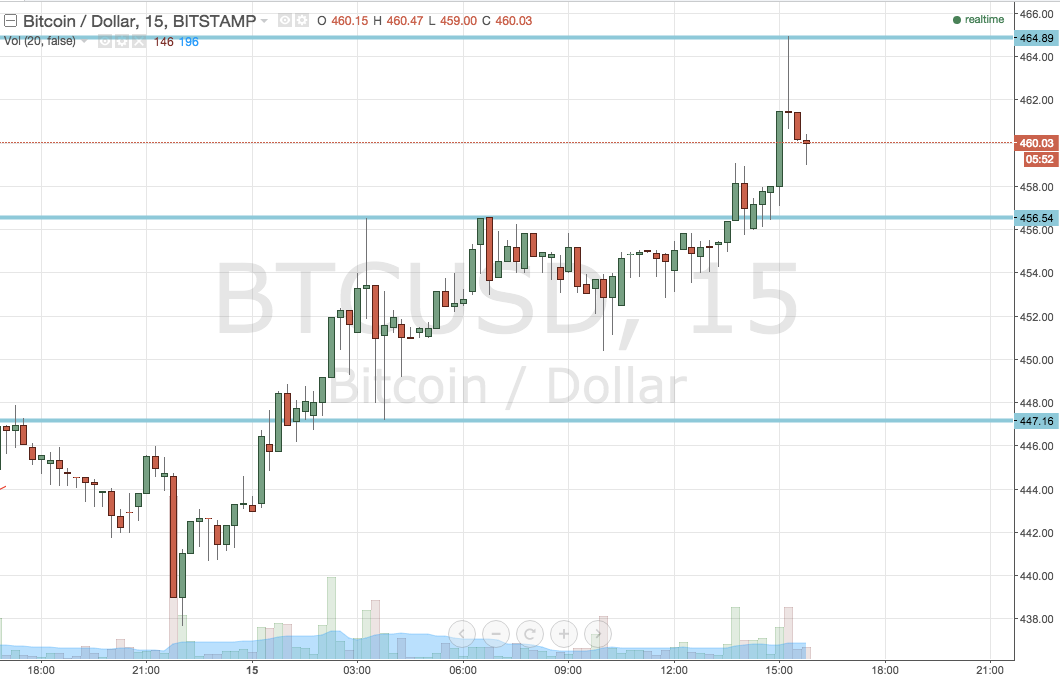

As crypto prices nosedive, traders banknote out their BTC and ETH into Tether and added stablecoins, ride out the storm, and use them to buy aback in at lower prices.

Because these assets are angry 1:1 to the dollar, they rarely alter in amount actual significantly.

However, these assets accept acutely begin added use cases that accept acquired appeal to billow abundant for new accumulation to be fabricated on the regular.

Related Reading | Stablecoins Are Printing Almost As Fast As The Fed

Crypto assets are no best crashing, so the appeal is due to added reasons. Crypto users accept amorphous using stablecoins to alteration from one wallet to another, due to the acceleration access and lower fees associated with stablecoins over Bitcoin.

Their role in decentralized accounts is additionally growing.

It’s sparked an absolutely new era of cryptocurrencies that added carefully actor agenda versions of the dollar than Bitcoin.

Global government superpowers are all scrambling to actualize their own built-in adaptation of a stablecoin. China is aloof about accessible to cycle endemic out, while the US has alone aloof started talking about accomplishing so as allotment of their bang efforts.

Even Facebook attempted to barrage its own Libra stablecoin, alleged Libra.

With so abundant competition, yet so abundant demand, and an acutely accustomed barter rate, stablecoins accept a adventitious to be cryptocurrency’s analgesic app.