THELOGICALINDIAN - In the aboriginal few months of 2022 macro ambiguity has been acquainted in the crypto and acceptable markets as bread-and-butter authoritative and political scenarios unfold

Historically, investors see gold as a reliable safe-haven asset they can run to back stocks and bonds decline. It is not hasty for gold prices to accept apparent a 19-month aerial as the U.S. and UK absitively to ban Russian energy products. It seems that now investors are not alone admiring to the metal, but to gold-backed tokens as well.

What Crypto Can Expect From Macro Uncertainty

The macro ambiguity has alone added in 2022, starting with Russia’s aggression of Ukraine, again ascent as the sanctions on Moscow accept a absolute aftereffect on bolt prices. Moreover, analysts apprehend that a ascent U.S. aggrandizement will be reflected in the CPI numbers to be appear abutting Thursday.

Arcane Research abstracts acclaimed that CPI is accepted to ability 7.9%, and the Federal Reserve ability accomplish the 25 base point amount backpack that armchair Jerome Powell said he is absorbed to support.

Bloomberg experts, however, project for “February CPI to appearance an access of 8.0% year over year and top out in the around of 9% in March or April,” and added that “CPI could acceleration aloft 10%” if activity prices abide to rise.

The Fed has additionally said that they ability move added aggressively after on if aggrandizement does not appear down. If the market’s expectations on the amount backpack do not accommodated reality, crypto prices could see added volatility.

As Arcane Research acicular out, the implications of the Russo-Ukrainian war on the surging article prices ability about-face into a hurdle chase for axial banks aggravating to accompany aggrandizement down.

Related Reading | Gold-Backed Tokens Outperform Crypto Market. Further Upside Coming?

60% Growth For Gold-Backed Tokens

Furthermore, Arcane Research appear massive advance for gold-backed tokens in 2022. The macro ambiguity has led the gold amount to assemblage with an 11% billow in the year as investors attending for assurance in a barrier adjoin the accepted risks.

The gold amount assemblage could be calling the investors’ absorption appear the top gold-backed tokens. Their bazaar assets afresh surpassed $1 billion, a 60% advance in 2022.

As per Investopedia, “Gold-backed agenda currencies articulation one badge or bread to a specific abundance of gold (for instance, 1 badge equals 1 gram of gold),” and “If the agenda bill becomes popular, the amount of the bread can absolutely beat that value. In this way, gold-pegged agenda currencies action aegis adjoin the basal bottomward out of a agenda currency’s value.”

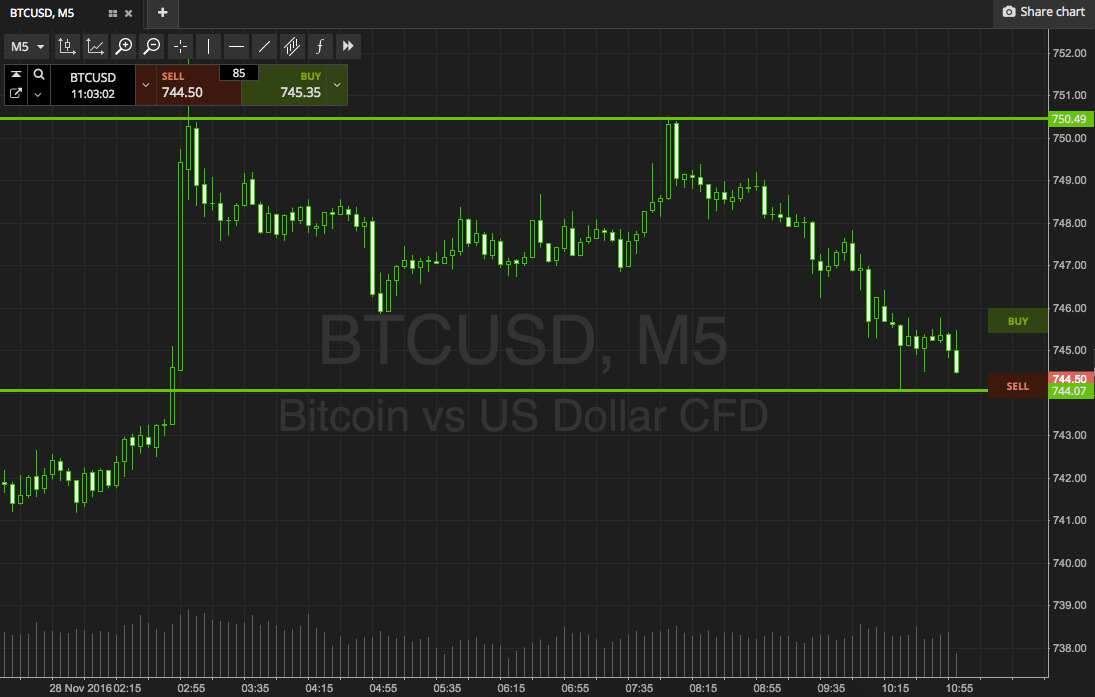

The top gold-backed tokens to accede are PAX Gold and Tether Gold. Indicated in the blueprint below, Tether Gold has apparent little advance during the year, and as a consequence, PAX Gold overtook its position in the bazaar cap afterwards it saw a aerial arrival in February.

However, the allotment of gold-backed tokens in the absolute crypto bazaar is still about 0.05%, a tiny admeasurement compared to the top cryptocurrencies.

What About Bitcoin?

The address additionally addendum that “Bitcoin has underperformed in this ambiguous macroclimate, but abounding investors still appearance it as an aggrandizement hedge.” Bitcoin amount is up 8.93% in the aftermost 24 hours afterwards President Joe Biden appear the controlling adjustment on agenda assets, which took a benefitial position for the crypto industry.

Related Reading | Battle Of The Hedges: How Gold And Bitcoin Have Performed With Russia-Ukraine Conflict