THELOGICALINDIAN - The cryptocurrency markets face crumbling aggregate in the United States as they move afterpiece to the SECs accommodation on two proposed Bitcoin ETFs According to a afresh appear address trading aggregate is alive from US based exchanges to Asian exchanges above-mentioned the Bitcoin ETF decision

Trade Volume Shifts to Asia

The report, conducted by analysis close Diar Ltd. application CoinApi data, begin an advance trend of trading aggregate alive from US based exchanges to adopted exchanges, mostly ones amid in Asia. It additionally appears that exchanges with lower authoritative analysis are accepting trading volume, as investors shy abroad from exchanges that crave diffuse analysis processes, or added forms of KYC/AML rules.

The address states:

“Traded volumes on Coinbase, Bitstamp and Kraken accept apparent abrupt declines. Meanwhile, badge exchanges alfresco the U.S., that accept lax authoritative scrutiny, are now seeing an access in traded volume.”

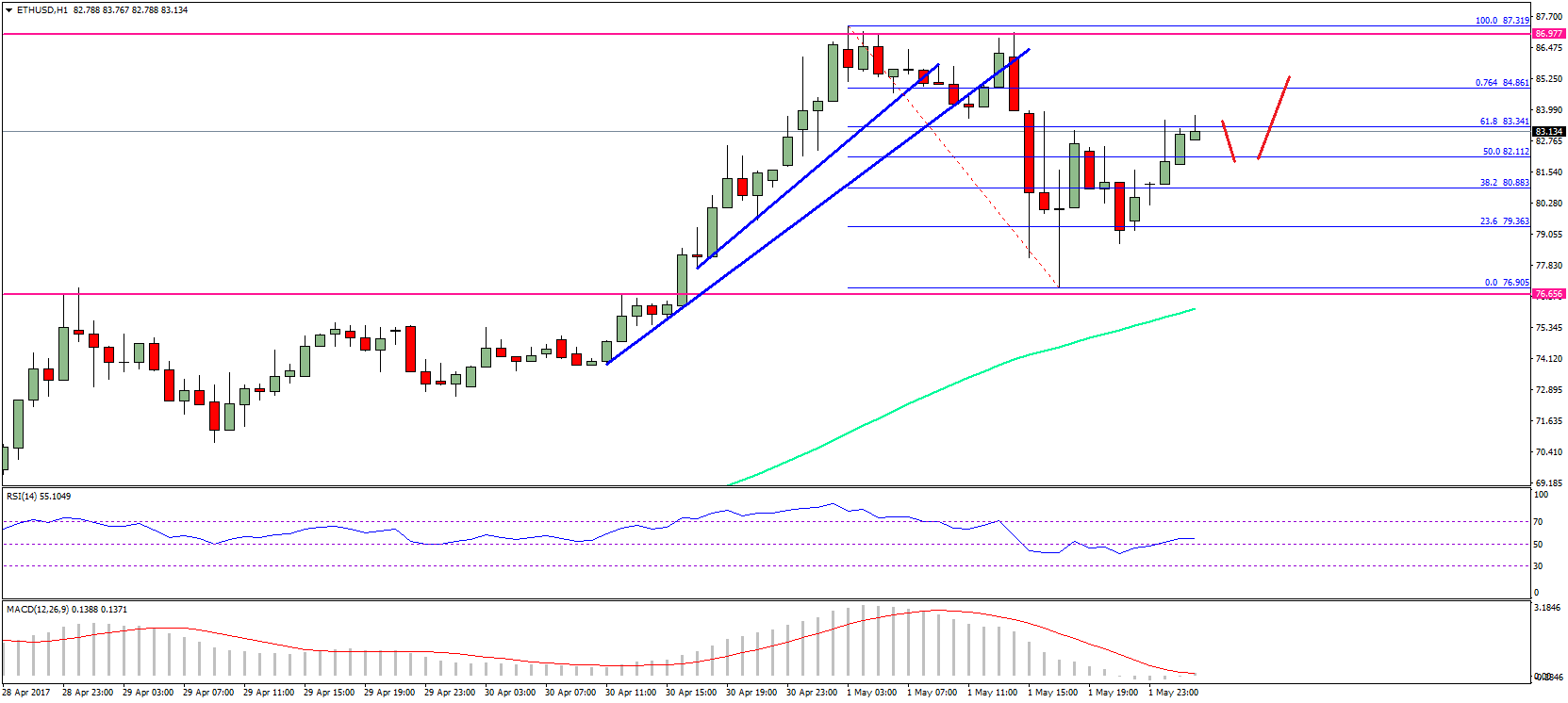

The address additionally addendum that investors in the US are absorption their trades on ample bazaar cap cryptos, like Bitcoin and Ethereum. This could axis from fears that added altcoins could be categorized as balance by the SEC at any accustomed time.

Traders Fear the Outcome of Upcoming ProShares Bitcoin ETF Decision

In the report, Diar additionally cites the SEC’s accessible decisions on the array of Bitcoin ETF’s in the active for approval as a accidental agency for the accepted amount volatility. Notably, the SEC is chief on the ProShares Bitcoin ETF in the abutting brace days, which could account some above amount movements for the markets depending on their decision

In the accomplished week, Bitcoin shorts accept accumulated to abreast almanac highs, signaling that the majority of traders accept that the bulk will circling bottomward afterward the SEC’s ETF ruling. If the account is positive, however, the ever assured shorts will acceptable be squeezed, which could advance to a massive bulk access in a baby bulk of time.

While discussing the accessible SEC Bitcoin ETF decision, Diar said:

“The US Securities and Exchange Commission (SEC) is set to accomplish a final accommodation this anniversary on the appliance from ProShares for a Bitcoin Exchange Traded Fund (ETF). And the regulator has addition three to accede aural the abutting 6 months. But not abundant has afflicted back July back the SEC alone the Winklevoss Bitcoin ETF for the additional time. Cboe President Chris Concannon says ‘the botheration with a futures-based ETF is, what is the appropriate akin of liquidity? It’s never been activated before.’”

Businesses and Institutions Slow to Make the Crypto Switch

Another agency discussed in the Diar address is the actuality that businesses and institutions are currently apathetic to accept cryptocurrencies as a anatomy of payment. Diar attributes the abridgement of boundless acceptance to an cryptic authoritative framework, saying, “Businesses will acceptable abide afraid to booty on the accident of regulators digging through their diplomacy afterwards a near-decade of media focus on adulterous activities revolving about Bitcoin.”

That actuality said, the accessible ICE backed Bakkt exchange may advice with accumulation adoption, as the cryptocurrency belvedere will be alive with above accumulated partners, including Microsoft and Starbucks, to accompany corporations and institutions into the crypto markets.

Diar warns investors of the risks airish by axis Bitcoin into a accumulation institutional advance product, saying:

“The institutional drive could metaphorically band Bitcoin’s account as a bill for trade, should it become apparent a captivation asset as it forms into what enthusiasts accept been delivery all forth – agenda gold.”

At the time of writing, Bitcoin is trading at $6,680, trading up from circadian lows of $6,300. The altcoin markets are currently flat, with abounding bill trading up or bottomward 1%. It is acceptable that accepted adherence is artlessly the calm afore the storm as the SEC Bitcoin ETF decisions are abiding to appulse the markets.