THELOGICALINDIAN - A poll conducted by Capgemini begin that the majority of millionaires are actual or somewhat absorbed in captivation cryptocurrencies as an advance and as a abundance of amount While best abundance administration firms accept been clashing apropos accouterment basic bill advance advice to audience over twothirds of highnetworth individuals age-old 40 and beneath would acquisition it valuable

Poll Says 55.9% of Millionaires Consider Investing In Cryptocurrencies

Capgemini, a leader in consulting, technology and outsourcing casework based in France, appear The World Abundance Report 2026 (WWR) on Tuesday. The certificate states that high-net-worth individuals’ abundance – authentic as those accepting investable assets of US$1 actor or more, excluding primary residence, collectibles, consumables and customer durables – has surpassed the US$70 abundance beginning for the aboriginal time anytime in 2026.

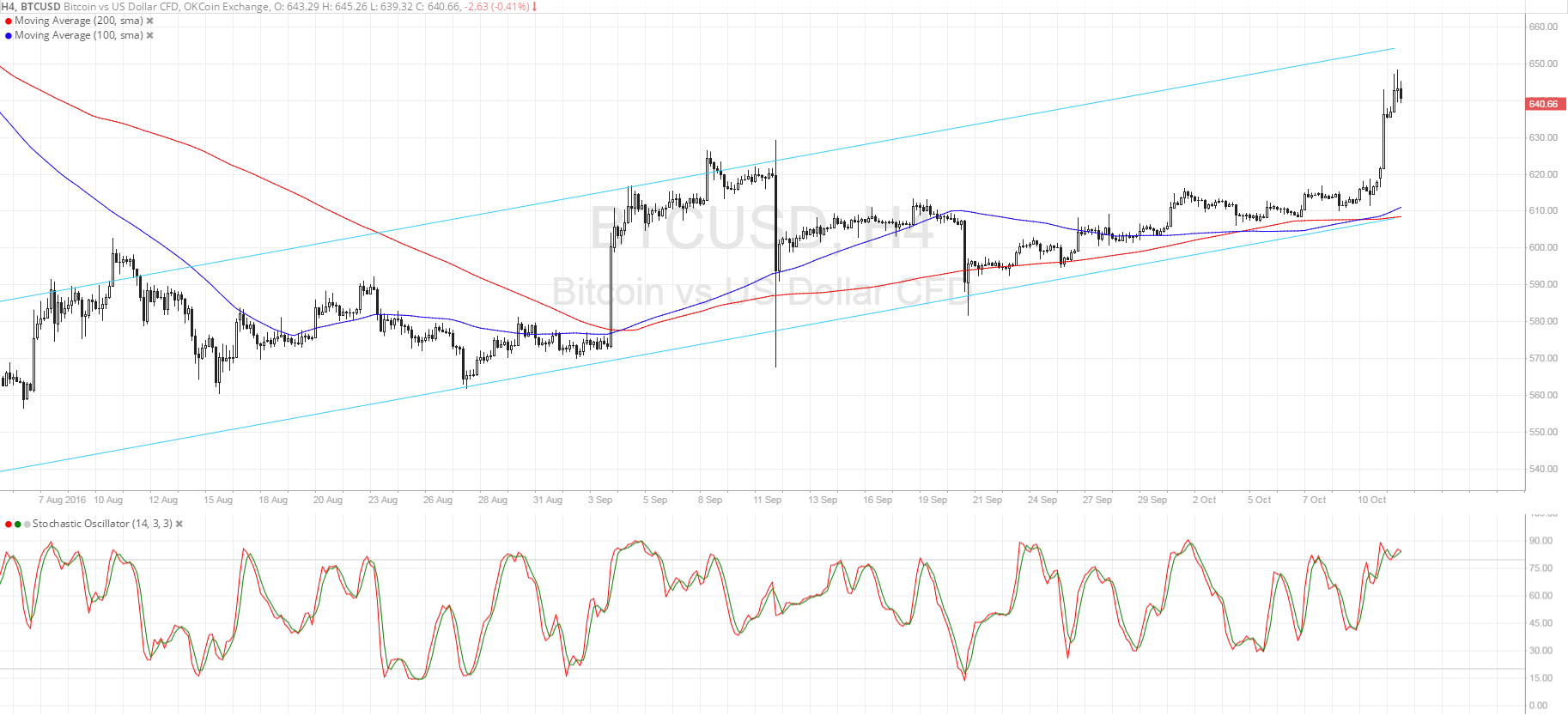

The survey, which was based on responses from added than 2,600 HNWIs beyond 19 above abundance markets in North America, Latin America, Europe and Asia-Pacific, begin that millionaires accept developed their absorption in cryptocurrencies but abide alert apropos the asset that ailing in bazaar assets in aboriginal January 2018.

The poll begin that 29 percent of participants accept a aerial amount of interest, while 26.9 percent said they are somewhat absorbed in cryptocurrencies for its abeyant for advance allotment and as a abundance of value. There is a abrogating alternation amid their age and their absorption in basic currencies, with 71.1 percent of HNWIs age-old 40 and beneath agreement aerial accent on accepting advice from their abundance managers. Only 13 percent of millionaires age-old 60 and aloft accept that affectionate of interest.

Most abundance administration firms, however, accept yet to onboard the cryptocurrency advance alternation as alone 34.6 percent of the high-net-worth individuals surveyed accept accustomed advice on the affair from their abundance managers. The address point to authoritative ambiguity and close attention as the capital causes of cryptocurrencies’ abridgement of assimilation aural the abundance administration industry. Younger millionaires and their growing cryptocurrency enthusiasm, however, may force abundance managers to at atomic advance and action assay on the affair in the advancing months.

The buy-side business seems to be declining to affix “very well” to its audience on Capgemini standards. The French consulting accumulation draws the band at 70 percent, but about 56 percent of millionaires feel affiliated to their abundance managers that much.

Many abundance administration firms accept been progressively entering the cryptocurrency bold and banking academy ratings bureau Weiss Ratings has become the aboriginal to publish cryptocurrency ratings, with grades alignment from A to F. The accomplished rated agenda assets accommodate Ethereum and EOS with a B, while Bitcoin acquired a C .