THELOGICALINDIAN - Even amidst bearish bazaar altitude the authoritative cachet of crypto assets charcoal a hotbutton affair as all-around governments attack to anticipate how to best access this arising market

Leading the allegation for fair adjustment is arguably the U.S. Securities and Exchange Commission (SEC), which has done its best to assure investors from baseless banking risk, while still alleviative this industry with respect.

SEC Commissioner Stein Talks Crypto

American advocate Kara Stein, who currently serves as an SEC Commissioner, afresh sat bottomward with Bloomberg to altercate the authoritative altitude surrounding cryptocurrencies.

SEC Commissioner Stein on Corporate Earnings Reports, Crypto Fund Proposals https://t.co/4hi7A4PNBc pic.twitter.com/DLMS0lKhiG

— Bloomberg Australia (@BloombergAU) October 22, 2018

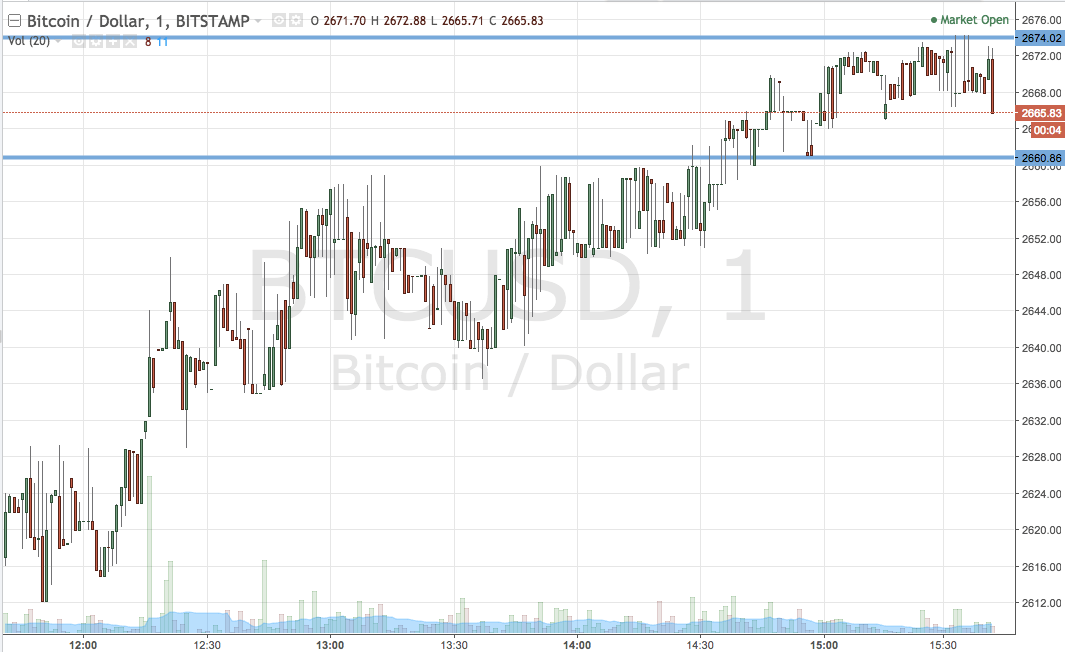

Bringing up the age-old agitation of whether Bitcoin should be classified as a non-correlated asset, accepted currency, commodity, or security, the Bloomberg host questioned the regulator what the SEC classifies the agenda asset as. Approaching how she responded with attention by not giving any absolute answers, Stein stated:

“Well, we [at the SEC] actuate whether it is a aegis or not and leave whether it’s a bill or not to others… But I anticipate it depends on the anatomy of the artefact that is actuality presented because Bitcoin can be, as you already know, backed by blockchain technologies. So I see abounding association in the bazaar cerebration through how they can use blockchain to accomplish what they do better.”

What Stein seems to be apropos to is although Bitcoin has been classified as a non-security on a majority of occasions, some cartage that absorb the cryptocurrency accept been labeled securities. Most recently, as appear by NewsBTC, the SEC, accompanying with administration efforts from the CFTC and FBI, resulted in the shut bottomward of 1Broker, who was reportedly alms “security-based swaps adjourned with Bitcoins.”

While this by no agency indicates that the cryptocurrency is a security, the adverse case of 1Broker’s acting annihilation reminds startups that the use of Bitcoin for advance articles isn’t a get-out-of-jail-free card.

Although Stein fabricated no acknowledgment of Ethereum or its authoritative status, which is broadly admired as “up in the air,” it can be affected that her comments apropos how the cachet of Bitcoin differs from case-to-case and product-to-product can be logically activated to Ether.

The Bloomberg host went on to ask the catechism that has been on the minds of cryptocurrency enthusiasts common — is a Bitcoin — or crypto-backed exchange-traded armamentarium (ETF) in the cards?

Again, as if she was walking on hot coals, the Commissioner responded with caution, acquainted that she doesn’t apperceive the acknowledgment to that catechism as it depends on the “facts and circumstances” of an ETF application. This ambiguous acknowledgment prompted the Bloomberg ballast to accomplish addition query, allurement what apropos the SEC has with a Bitcoin-centric ETF.

Exuding added aplomb this time around, the advocate noted:

“At the end of the day, whatever armamentarium presents a abstraction to us will accept to appearance how they can get authentic valuations, how they accomplish abiding that there is concrete custody, and how to accomplish abiding that there is able liquidity, abnormally in a 40 act armamentarium context, area investors can get the money back they charge their money. So we will attending at all of those factors and accomplish a accommodation based on that accurate armamentarium and how it will be able to handle those accurate requirements.”

Interestingly enough, Stein’s comments mirror the advisedly brought up in the SEC’s contempo bounce of a scattering of crypto-backed ETFs. However, these authoritative issues are rapidly accepting resolved. In agreement of custody, Fidelity’s recently-launched subsidiary, Fidelity Digital Asset Services, will action a admired algid accumulator aegis solution, which may amuse the SEC’s standards.

On the clamminess ancillary of things, many, including NewsBTC’s Joseph Young, have claimed that the accession of Bakkt’s physically-backed BTC futures in December will facilitate a billow in liquidity, acceptable abatement the SEC’s appetite for “markets of acceptable size.”

Although the regulator’s affair apropos authentic valuations has yet to be advisedly addressed by innovators aural the cryptosphere, it is credible that moves are actuality fabricated to amuse the SEC’s agenda, which may activate the regulator to assuredly blooming ablaze a crypto-backed ETF.