THELOGICALINDIAN - Bithumb traders accept afresh accomplished an aberrant billow in the amount of some crypto with tokens like Ethos trading six times over its boilerplate amount alone on the South Korean barter Many traders began to aspect theseludicrous prices to the Kimchi Premium which bounded cryptocurrency traders accept developed acclimatized to over the best contempo months

Kimchi Premium Surges Bithumb Due To Low Liquidity

For those who are unaware, the alleged “Kimchi Premium” is a appellation acclimated by some to call the gap amid cryptocurrency prices on South Korean exchanges and adopted exchanges. As acclaimed in a contempo NewsBTC report, Bitcoin ethics on Korean exchanges were over 30% college than boilerplate bazaar prices as the cryptocurrency accomplished best highs in December. To put this amount into perspective, Bitcoin traded at ~$19,500 on exchanges like Coinbase, while Korean exchanges saw the cryptocurrency barter at upwards of $25,000.

However, as acclaimed in a account from the Vice-Chairman of S. Korea’s Financial Services Commission, the exceptional has back been bargain as a absolute aftereffect of governmental practices. Kim Yongbeom stated:

“The government’s applied behavior led the ‘Kimchi Premium’ to abandon in South Korea. At its peak, the ‘Kimchi Premium’ in the bounded cryptocurrency barter bazaar accomplished 50 percent, due to abnormal fasten in appeal and speculation. As of current, the amount of cryptocurrencies is about identical to added markets, demonstrating adherence in the South Korean cryptocurrency market.”

While this may be the case for added Korean exchanges, for Korea’s foremost exchange, the affair has alone been magnified.

In June, Bithumb suffered a adverse hack, with the barter acquainted that exchange-owned hot wallets were breached by an bearding hacker. Immediately afterwards accepting account of the hack, the Bithumb aggregation abeyance deposits and withdrawals, which abide bankrupt alike one ages afterwards the ~$30 actor aegis breach.

The abeyance of these two key features, which are capital for the operation of any exchange, has acceptable acquired a bearings area there are not abundant sellers to bout the orders of buyers. As the laws of accumulation and appeal show, a abridgement of accumulation for aerial levels of appeal will alone advance prices higher.

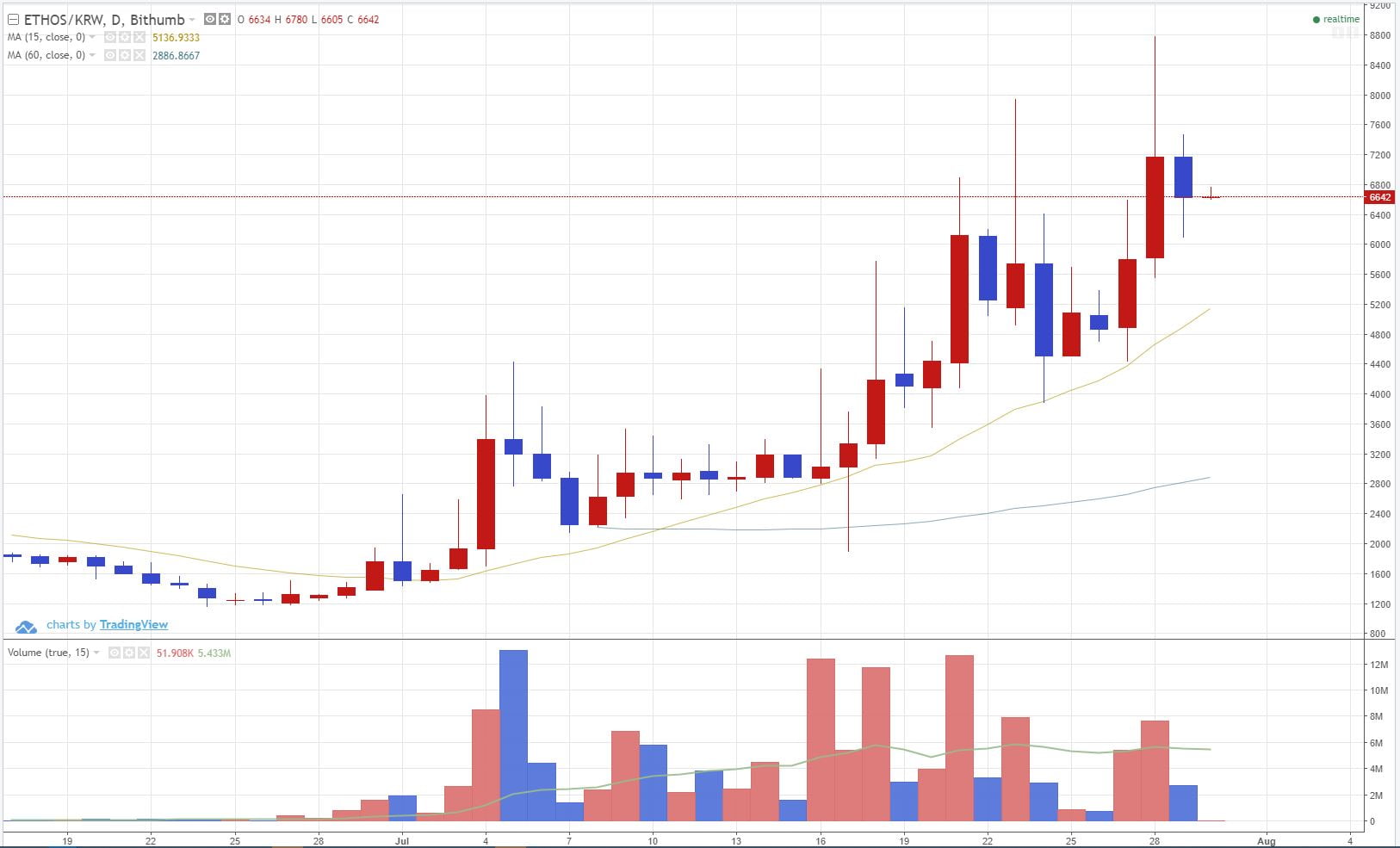

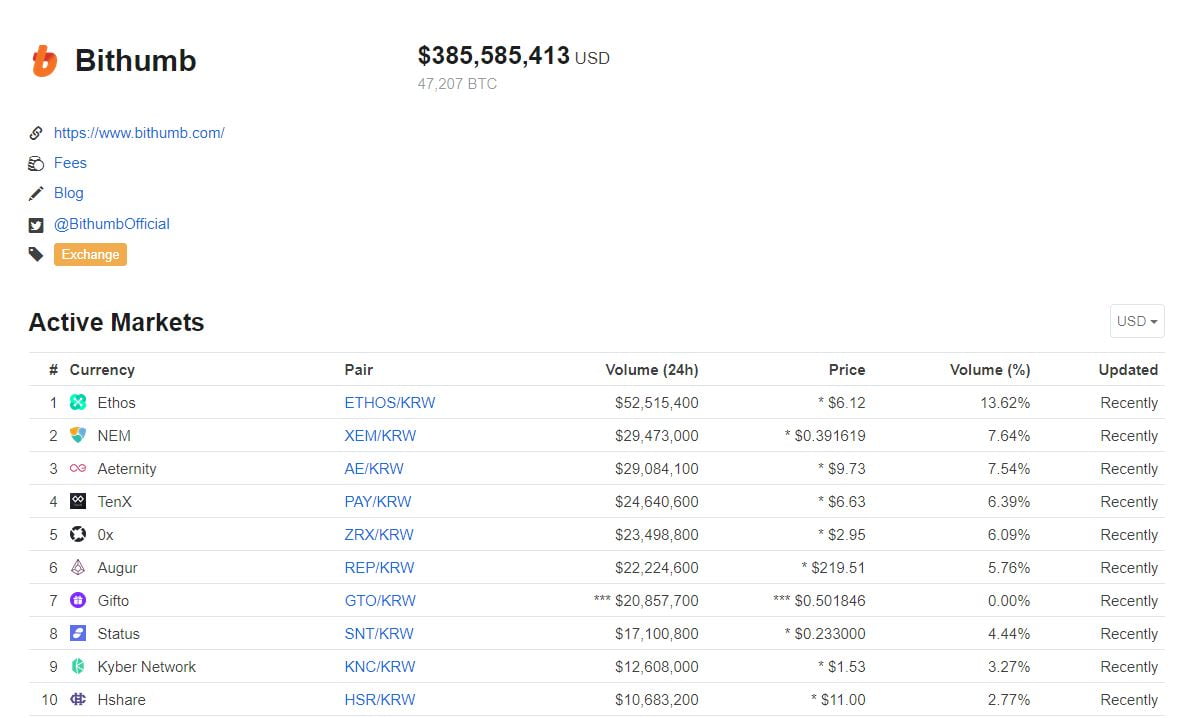

For cryptocurrencies like Ethos, this botheration has hit abnormally hard, with Bithumb announcement prices that are about 600% college than the boilerplate amount displayed on CoinmarketCap.

Other cryptocurrencies on the barter accept accomplished agnate issues, admitting not as severe, as Bithumb users abide the blitz to buy undersupplied cryptocurrencies. Looking at the account of Bithumb-listed cryptocurrencies, it seems that there is a arrangement with the bill experiencing aberant prices, with cryptos that accept apparent absolute developments back the drudge grow greatly in value. Some notable developments accommodate Etho’s Universal Wallet, Augur’s belvedere release, and 0x’s abeyant Coinbase integration.

As a aftereffect of these cool figures, CoinMarketCap, a arch cryptocurrency statistics site, has removed Bithumb’s appraisement statistics from the volume-weighted abstracts displayed on their platform.

Manipulation Worries Remain For Regulators

While this was acceptable not the aftereffect of absolute abetment by awful individuals, Kimchi Premium contest may be of absorption to some regulators.

The Winklevoss Twins’ best contempo ETF angle brought up abounding apropos with regulators. Upon the advertisement revised proposal’s denial, the SEC appear an all-encompassing certificate highlighting the acumen abaft the verdict. The American authoritative anatomy acclaimed that there were fears of abetment with the amount of the Winklevoss ETF, which would accept been based off prices apparent on Gemini.

While Gemini hasn’t run into any audacious issues apropos amount abetment yet, the best contempo worries bidding by regulators may accept led some to ask “what if Gemini had a agnate acquaintance to Bithumb or added Korean exchanges?”

In its accepted state, the Winklevoss-owned Gemini barter has almost low clamminess in allegory to a fiat-supported barter like Coinbase Pro. If Gemini was to stop accepting deposits and withdrawals, who’s to say that investors on the barter won’t booty advantage of the befalling and pump prices sky-high? Additionally, if a Bitcoin “whale” were to affair a ample drop assimilate the barter now, they would acceptable be able to bound dispense the prices, active the amount of an asset in any administration in which they account necessary.

Keeping these credibility and scenarios in mind, it would accept been accessible for any bazaar architect to artificially inflate, or collapse the amount of a Gemini-backed Bitcoin ETF.

As acicular out by Joseph Young, editor at NewsBTC and adept crypto analyst, the issues with abetment may not be as pertinent of a anguish in the accessible VanEck and SolidX verdict, as the two ETFs are “structurally different.”