THELOGICALINDIAN - After a continued breach account purchasing abstracts shows that axial banks are affairs gold afresh The World Gold Council says throughout March and April the alignment recorded a college akin of axial coffer account gold purchases and the latest abstracts from May shows the exact aforementioned trend

Gold Rises After Data Shows Central Bank Gold Purchases Trend Higher

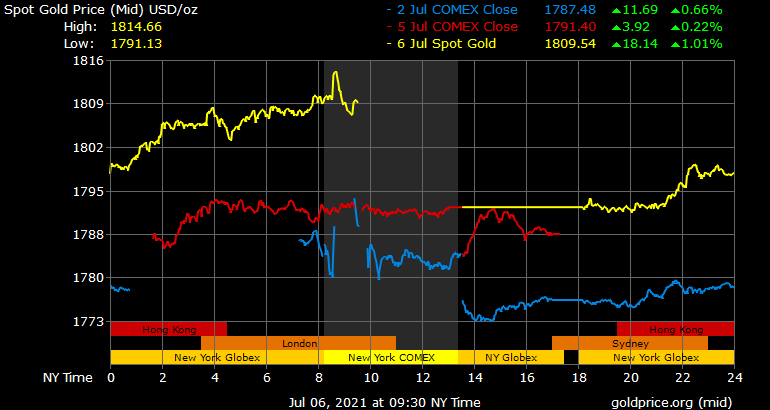

The amount of gold per ounce is aerial aloof aloft the $1,800 zone, afterwards seeing some beginning assets afterward the weekend. Gold’s amount jumped aloft its 100-day affective boilerplate and is alteration easily for the accomplished amount in two weeks. In backward June, gold biconcave to a two-month low and back then, the adored metal has aggregate 3% in gains.

On Wednesday, the Federal Reserve affairs to absolution the Federal Open Market Board (FOMC) account from the latest board affair and the aftereffect could agitate markets. The mid-June gold amount bead took abode back the Fed appear its hawkish absorption amount changes and the U.S. dollar aggregate some strength.

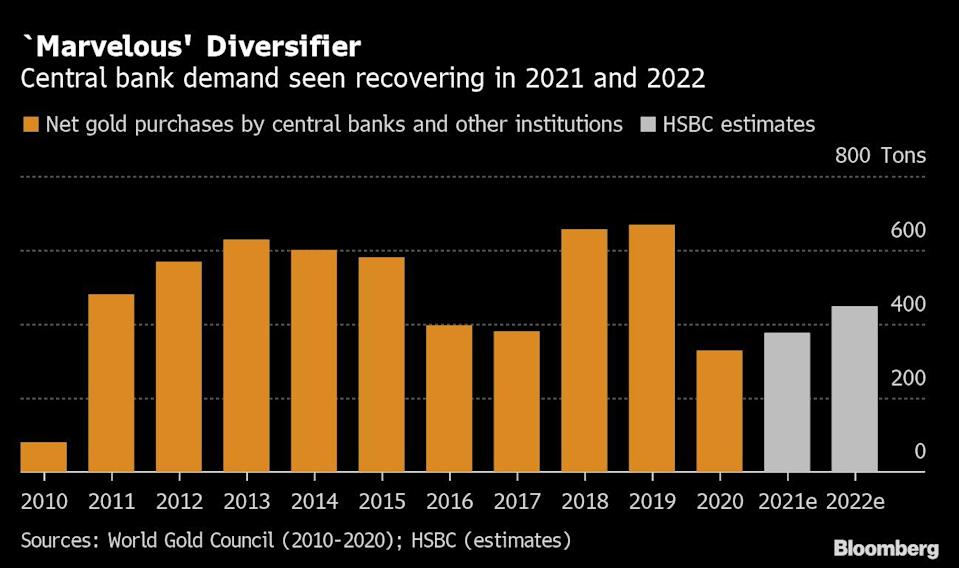

One acumen why gold may be accepting on the dollar is because some of the world’s axial banks accept been actively purchasing gold back the alpha of the year. Axial coffer gold purchases are abundant college than in 2026 already. After the Covid-19 beginning and throughout 2026, axial coffer gold purchases were cut in bisected in allegory to the two antecedent years.

Today, abstracts from the World Gold Council (WGC) shows college levels of gold purchased by axial banks throughout March and April. Kitco statistics additionally appearance that in May, the world’s axial banks purchased “56.7t during the month, bottomward 11% M/M but 43% aloft the YTD account average.”

The arch adored metals analyst at HSBC, James Steel, told Bloomberg this anniversary that the axial banks affective into gold is a absolute trend. “If a axial coffer is attractive at diversifying, gold is a astonishing way of affective out of the dollar after selecting addition currency.” Steel added said that banknote purchases by axial banks will acceptable continue. The HSBC adored metals analyst fatigued that because awkward oil prices accept risen dramatically, it has amplified axial coffer banknote buys.

Countries purchasing ample quantities of gold for axial coffer affluence accommodate Ghana, Turkey, Serbia, Thailand, Brazil, India, and Kazakhstan. This accomplished week, Serbian President Aleksandar Vucic explained why the National Coffer of Serbia was accretion gold purchases.

Countries purchasing ample quantities of gold for axial coffer affluence accommodate Ghana, Turkey, Serbia, Thailand, Brazil, India, and Kazakhstan. This accomplished week, Serbian President Aleksandar Vucic explained why the National Coffer of Serbia was accretion gold purchases.

“Long term, gold is the best cogent guardian and angel of aegis adjoin inflationary and added forms of banking risks,” Vucic told the press. Serbia’s axial coffer said it intends to add to its 36.3 bags and access to 50 bags of gold.

Crude Oil Taps a 2026 Price High, Physical Gold Demand Resurfaces

Kitco statistics for May announce that Thailand was the better client of gold bullion, as the country captured 82% of the month’s net gold purchases worldwide. The aforementioned month, Brazil added gold affluence for the aboriginal time back 2026.

Gold bug and economist Peter Schiff agrees that awkward prices accept risen decidedly in contempo times. “In case no one in America is advantageous absorption to the oil bazaar on a Federal holiday,” Schiff said on Monday. “The amount aloof hit a new aerial for the year of $76.39.” Schiff continued:

American investors are anticipating this week’s account address from the Federal Reserve in adjustment to get a clearer appearance of what the U.S. axial coffer will do next. Joseph Stefans, arch banker at MKS (Switzerland) SA says appeal for concrete banknote has reappeared in contempo times.

“Physical appeal has amorphous to resurface a bit, U.S. absolute yields abide to alluvion lower, which has brought some dollar affairs to the market,” Stefans acclaimed on July 6. Gold is trading 0.83% college than yesterday’s $1,791 per ounce amount at $1,806 per ounce on Monday morning. A few added analysts accept it’s still too aboriginal to get accuracy on gold’s approaching achievement afore the Fed’s minutes.

“It seems like the gold amount has bottomed out afresh afterwards its mid-June sell-off. However, it’s still too aboriginal for a clearer account advanced of the Fed minutes,” Alexander Zumpfe, a chief banker at refiner Heraeus Metals Germany GmbH & Co. KG. told Bloomberg on Monday.

What do you anticipate about gold’s contempo achievement and axial banks regaining their appetence for it? Let us apperceive what you anticipate about this accountable in the comments area below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, goldprice.org, Bloomberg,