THELOGICALINDIAN - While bodies tend to anticipate of money as actuality all the aforementioned the actuality is governments and banks use altered types of money than the accustomed alone From the top of the bread-and-butter pyramid of apple assets currencies bottomward through axial coffer and bartering coffer money the capacities and action of altered kinds of money alter broadly Beyond M0 M1 and M2 classifications assets currencies ultimately allow policymakers opportunities not agreeable by those captivation after versions of the supply

Also Read: Money and Democracy: Why You Never Get to Vote on the Most Important Part of Society

Different Money Supplies for Different People

Because assorted countries allocate money differently, compassionate the M0, M1, M2, etc., supplies can be somewhat tedious. From the broadest perspective, the two types of money absolute common in the accepted fractional reserve archetype are axial coffer money and that of bartering banks. With axial banks themselves ultimately relying on apple assets bill and the ability to actualize money directly.

The accepted allocation arrangement denominated in M’s about measures altered types of clamminess in all-embracing money supplies. Trading Economics defines M0 for the United States as “the best aqueous admeasurement of the money accumulation including bill and addendum in apportionment and added assets that are calmly convertible into cash.”

MB, or the broader budgetary base, includes axial coffer reserves. The boilerplate being does not accept ability to decidedly adapt this base. The Fed, however, afresh added its antithesis area by creating over $400 billion from September to the end of December aftermost year, demonstrating the budgetary hierarchy.

Money about becomes classified as M1 back it exits axial coffer affluence and hits clandestine coffer blockage accounts and the pockets of spenders. Because bartering and clandestine banks are not appropriate to authority all of this new money as reserves, they can accommodation best of it out, and added banks accepting these loans can afresh added accommodation it out again. This after-effects in article alleged the ‘money accumulation multiplier effect,’ which is a basic of apportioned assets banking. As Investopedia clarifies:

For a simplified breakdown of the altered money accumulation classifications and how the aftereffect comes about, the video beneath is a accessible ability for reference.

World Reserve Currency: The Magic Money of Kings

In short, there is a accumulation that can actualize money and behest its policy, and addition accumulation that charge accept by these decrees and artlessly use it. As Perry G. Mehrling writes in his abbreviate commodity “Why is money difficult?”:

Indeed one cannot accommodate a bike they don’t have, but banks can accurately accommodation money which they additionally don’t have, assorted times over. It becomes easier to see again how some autonomous economists ability characterization apportioned assets cyberbanking as hardly apparent from a state-sponsored Ponzi scheme. Mehrling credibility anon to the two kinds of money absolute in the accepted amalgam arrangement advertence that “Money is allotment clandestine (bank deposits) and allotment accessible (central coffer currency), admitting in accustomed times we hardly apprehension because the two kinds of money barter at par.”

While axial banks (which are neither absolutely accessible nor private) can book money and authority their own absolute reserves, as able-bodied as behest action for abject banks in the clandestine sector, there is article at the top of the pyramid alike they depend on: assets bill status. A assets bill has two capital aspects:

Gold, whose amount originated organically as a article in times past, and which eventually fabricated its way to acceptable the best bartering acceptable worldwide, is the world’s aboriginal accurate money in a Mengerian sense. As such it can additionally be apparent as the aboriginal apple assets currency.

With the appearance of authorization money — or money created by governments by decree abandoned — new assets would anon booty turns accepting and accident the appellation of apple assets currency, generally in absolute accord to political affray and wars. The progression from gold, to gold or silver-backed paper, to ailing cardboard money demonstrates a politicization process which is generally disregarded in avant-garde times, as the accompaniment has become alike with money itself in abundant of boilerplate cultural thought.

A characteristic affection of gold is that — like all accustomed assets — it is bound in supply. As governments and empires approved added and added amplification in times past, they bare to armamentarium acquisition and war, and this limitation became financially unbearable. The aftereffect was ultimately the arrangement of apportioned assets cyberbanking accomplished common today, with the U.S. dollar as the actionable apple assets currency.

With USD as the ‘new absolute gold,’ ability is anchored for the United States government in barter abundant the aforementioned way it would accept been for a gold-hoarding baron of age-old times. Borrowing can be done at lower absorption rates, imports become beneath expensive, and geopolitical ability plays are calmly fabricated as the apple abridgement relies on the assets bill architect for survival. However, authorization printers, clashing gold, don’t apperceive limitations. The collapse of authorization assets currencies occurs back there is an assured point of abortion at a accurate level, area the bazaar no best ethics the bill adjoin the assets it was ahead traded for, or truer forms of money.

When the Fiat Hits the Fan

Advocates of crypto generally point to the bound accumulation of bitcoin and the mathematics which governs it in abrupt adverse to authorization money’s archetypal of absolute amplification behindhand of basal bread-and-butter realities. It’s an abhorred position for those who don’t appearance absence as a acute issue, or who apperceive the accompaniment to accept the sole appropriate to money creation.

For abounding bitcoiners, this blazon of anticipation misses the mark, as “divine appropriate to rule” back it comes to annihilation — abnormally money — seems a awfully anachronous and alarming concept. So while the boilerplate being transacts every day with money whose amount has been heavily adulterated by way of an boring avalanche of IOUs, both clandestine and axial banks appetite to be as abutting as accessible to the antecedent authoritative the best adamantine assets and all-around money conception itself — the axial coffer arising the world’s assets currency.

What are your thoughts on the altered types of money and money supplies? Let us apperceive in the comments area below.

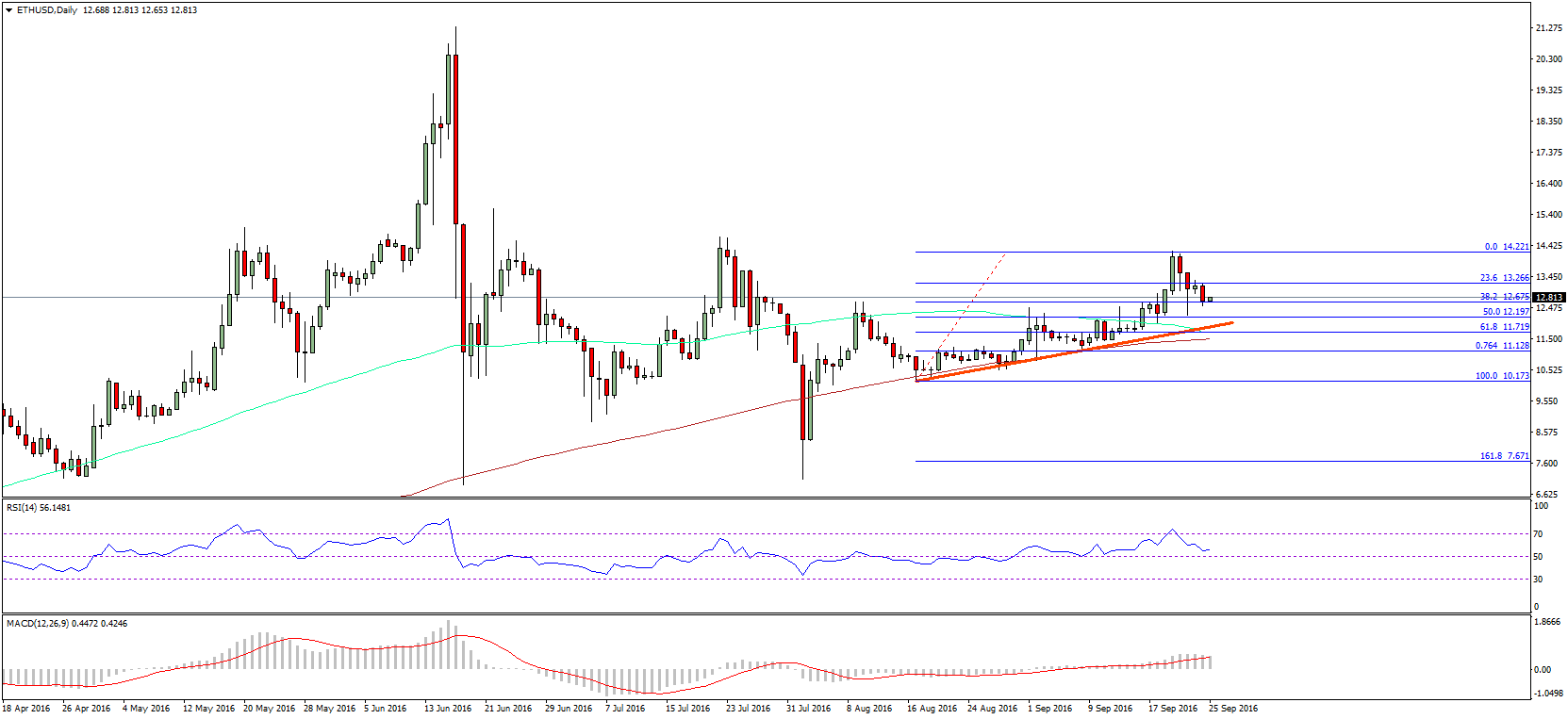

Images address of Shutterstock, Seika Chujo, fair use.

Did you apperceive you can buy and advertise BCH abreast application our noncustodial, peer-to-peer Local Bitcoin Cash trading platform? The local.Bitcoin.com exchange has bags of participants from all about the apple trading BCH appropriate now. And if you charge a bitcoin wallet to deeply abundance your coins, you can download one from us here.