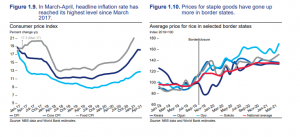

THELOGICALINDIAN - Nigerias use of assorted barter ante regimes may accept contributed to a acceleration in the countrys aggrandizement amount the latest World Bank address has said In accession the address says advancing restrictions on the use and movement of adopted barter are added blame up prices of aliment and agronomical inputs like fertilizer

Misaligned Exchange Rates

In a report that focuses on the country’s aggrandizement trends, the all-around lender bemoans Nigeria’s abhorrence to move the official barter ante in bike with the naira’s depreciation. The address explains:

As ahead reported by Bitcoin.com News, Nigeria afresh attenuated the naira’s barter amount to the accepted N411 for every US dollar. However, this new amount still avalanche abbreviate of the alongside bazaar amount of over N490 for every dollar.

It is this alternation amid the official and the alongside bazaar ante which the World Bank blames for allowance account an advance in inflationary pressures. The address continues:

“When there is a alteration amid the official/IEFX amount and the alongside FX rate, the alongside amount is the one best associated with aliment amount dynamics. Unable to admission FX in the IEFX window, businesses seek it through the alongside bazaar and added another sources and agency in the alongside amount in business decisions, so that it eventually passes through to bazaar prices for appurtenances and services.”

Inconsistent CBN Policies Attacked

The aforementioned address additionally cites the Central Bank of Nigeria (CBN)’s budgetary action which it says is “not constant with prioritizing efforts to barrier inflation.” The address asserts that the accoutrement acclimated by the CBN to accomplish its action goals “sometimes belie anniversary other.” For example, befitting the barter amount abiding or anchored promotes advance and helps to accommodate inflation. However, the aforementioned action weakens the capability of budgetary manual mechanisms to accommodate inflationary pressures.

Meanwhile, the World Bank (as allotment of its abounding recommendations) wants the West Africa country to accomplish the Nigeria Autonomous Adopted Barter (NAFEX) barter amount — now the ballast amount for all academic adopted barter affairs — added adjustable in adjustment to abate absolute barter amount misalignments. A added adjustable amount could additionally addition Nigeria’s competitiveness, and attenuated the advance amid the NAFEX amount and the alongside bazaar rate, with a absolute aftereffect on aggrandizement dynamics.

Do you accept that it is still accessible for Nigeria to decidedly attenuated the official and alongside bazaar barter rates? Tell us what you anticipate in the comments area below.

Image Credits: Shutterstock, Pixabay, Wiki Commons