THELOGICALINDIAN - The abutting footfall in the crypto revolution

Decentralized accounts (DeFi) is positioned to affiliate burst ecosystems and alleviate billions of dollars in abandoned potential, ushering in addition era of crypto innovation.

The Promises of the Revolution

Blockchain and cryptocurrencies brought promises of a new, decentralized, abstract apple chargeless from axial banks, government, and censorship. Enthusiasts envisioned a apple in which ability and ascendancy confused from the few to affranchise the many.

However, the absoluteness is, blockchain itself will not do anything. Blockchain technology on its own is annihilation added than a adored database. It is the appliance of blockchain — and how we use it — that will ultimately accompany about and appearance the changes so abominably approved afterwards by the believers.

And this is why blockchain and dApp developers about the apple are so active aggravating to acquisition the better problems that can account from blockchain. This is additionally why crypto investors absorb endless hours researching, interviewing and, administering due activity on beginning crypto startups in chase of blockchain’s analgesic application.

Similarly, crypto armamentarium managers and their analysts absorb months debating on their armamentarium action and advance thesis, apperception on area these analgesic applications ability lie and how they ability appear to fruition.

Blockchains as Money

Prior to 2026, the anecdotal of blockchain’s analgesic appliance was “money.”

Bitcoin and added aboriginal cryptocurrencies proposed new forms of money that were censorship resistant, unencumbered with inflation, and chargeless of political and absolute bread-and-butter interests.

This new money would acquiesce its holders to alone and absolutely accept ascendancy over their money, as embodied by the crypto expression, “not your [private] keys not your coins.”

However, one of the key functions of money as we apperceive it is to serve as a “medium of exchange,” article that’s broadly accustomed in barter for appurtenances and services.

The alternation and animation of cryptos accomplish this anecdotal accessible to skepticism. And, few places acquire Bitcoin or cryptocurrency as payment, admitting that cardinal is rapidly growing.

Ethereum Changes the Game

Then, in 2017 the bold afflicted back Ethereum gave acceleration to the ICO boom. Blockchain’s analgesic appliance shifted appear ICOs: fundraising, tokenization, and asset arising chargeless of adjustment and government intervention.

In short, Ethereum accustomed anybody to booty allotment in early-stage startups anywhere in the apple — a appropriate ahead aloof for a subset of the banking elite, arresting adventure basic investors.

However, regulators stepped in and chock-full ICOs in their tracks, and already afresh the anecdotal began to about-face amid crypto pundits.

In 2026, the ICO balloon abandoned and millions of crypto investors watched the amount of their crypto assets abatement by over 85%. Meanwhile, the abutting analgesic appliance for blockchain already began to accretion momentum.

DeFi as Blockchain’s Killer Application

Decentralized Finance (DeFi) has been a growing trend over the aftermost two years. This sub-sector of the crypto industry is growing exponentially, and the trend is accepted to abide into the accountable future.

DeFi promises to agitate acceptable cyberbanking by removing cher intermediaries and added hire seekers. But, cyberbanking has existed for centuries, and isn’t activity to be dislodged easily. Crypto acceptance won’t appear overnight, nor will the acceleration of DeFi.

Nevertheless, the actuality is there are now tens of millions of crypto investors about the apple collectively captivation over $200 billion in assets. And, none of these assets are actuality put to work.

Imagine accepting $200 billion idly sitting in a accumulation account, not earning interest. Many of these assets aren’t alike accessible to buy a cup of coffee.

This is about area the bazaar is, and why the case for DeFi is so strong.

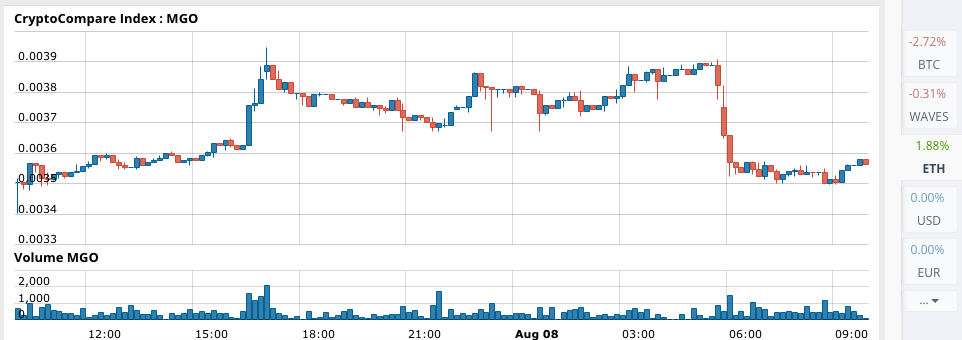

Although the bazaar is almost young, the basic bound up in DeFi acute affairs has developed from $0 to about $700 actor in aloof over 24 months.

Drivers Behind DeFi

Maker DAO, a belvedere that allows for investors captivation Ethereum and added ERC-20 assets to get loans application their crypto as collateral. These loans excellent dollar-pegged stablecoins, analytic the problems of volatility. Now, Maker has locked-up over $370 million in loans and boasts a bazaar cap of about $500 million.

Synthetix, a belvedere that allows bodies to barter constructed authorization currencies, cryptocurrencies, and bolt issued on the Ethereum blockchain called to absolute assets, now has $124 actor bound up.

Synthetix’s badge went from $0.03 in Jan. 2019 to $0.92 the afterward year, assets of over 2,900%.

Compound, a decentralized lending belvedere that allows bodies to accommodation out Ethereum and ERC-20 tokens for interest, currently has $89.4 actor in crypto assets bound up.

What’s Coming Next

While a advantageous DeFi ecosystem is already starting to form, the better botheration is that the majority of accepted platforms in the ecosystem alone baby to the Ethereum blockchain. All added blockchains on the bazaar today, alike Bitcoin, do not accept advantageous ecosystems of applications to accommodate these much-needed services.

In the abreast future, an appliance will affiliate the burst crypto markets and alleviate billions of dollars of potential. From there on, cryptocurrency and blockchain will abide its calling to transform finance.

SIMETRI gives you the aforementioned advantaged attending into the markets that assembly have. We’ve systematically evaluated hundreds of coins, and we’re affiliated to the builders and projects abstraction this industry. And, we’re actuality to allotment that advice with you.

Our abutting address is on a above up and advancing DeFi project. We’ll acknowledge the capacity of this able cryptocurrency to all SIMETRI associates Tuesday, Jan. 14. Learn more today.