THELOGICALINDIAN - In the words of George Harrison Let me acquaint you how it will be Theres one for you nineteen for me

Taxes are never popular, but in the U.S., advantageous for crypto assets is like analytic a Rubik’s Cube after affecting it. While blindfolded. You ability accept accurately filed your obligations, but there’s no alive until the tax ascendancy explains absolutely what those obligations are.

Leaving abreast the actuality that the government is gluttonous acquirement on a technology that it still hasn’t ample out how to regulate, the accepted taxation administration is riddled with inconsistencies and advisory atramentous holes.

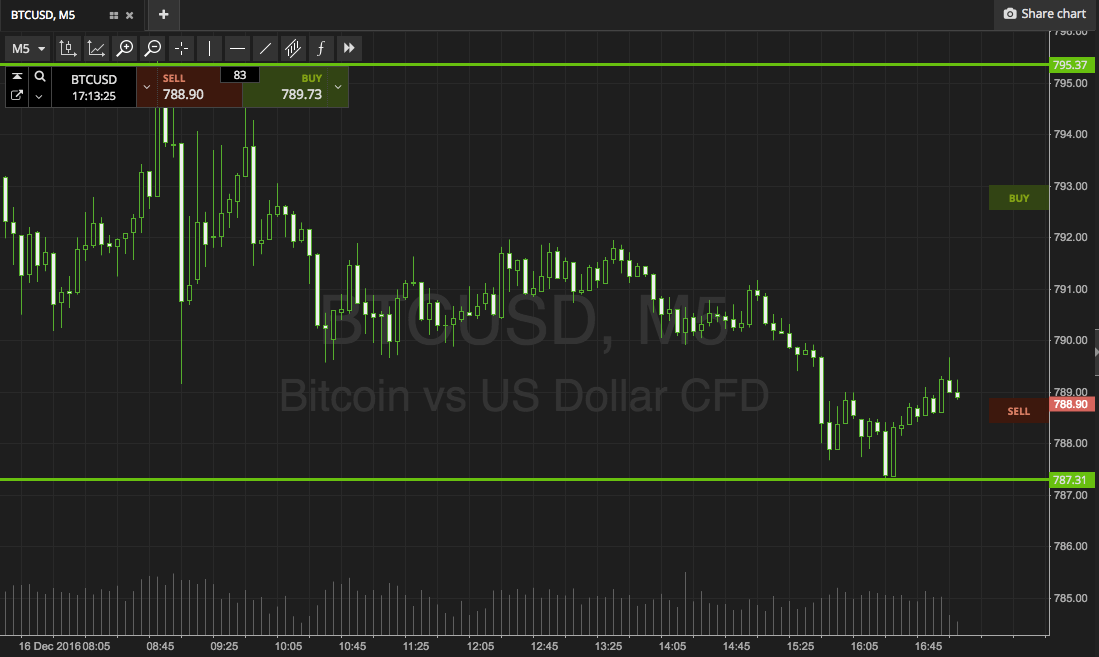

Let’s epitomize what’s happened so far. Back in 2014, the IRS issued an official advice note on the analysis of basic bill transactions. In summary, crypto is advised not as currency, but as property, so U.S. crypto taxes are based on assets and losses in a agnate way to stocks.

At six pages, the advice was apparently beneath than your tax return.

After those six pages, the tax ascendancy went bashful until 2018, back it acquired a court order to access abstracts on Coinbase users and their cryptocurrency transactions. It additionally announced a acquiescence campaign aimed at agenda currencies.

A Case of Poor Timing?

It seems safe to infer that the Coinbase abstracts was acclimated for belletrist issued in July to about 10,000 cryptocurrency users. There were three types of letters, alignment in accent from “we accept our eye on you” to “we’re appealing abiding you’ve been lying to us about your holdings.”

Those belletrist came alone a few months afterwards IRS Commissioner Charles Rettig confirmed it would be absolution new crypto tax guidance “very soon, conceivably alike aural the abutting 30 days.” He fabricated that account on May 30. Four months on, anybody is still waiting, and some face threats of bent action.

Sean Ryan of crypto tax and accounting close Node40 believes that the aldermanic arm of the IRS is best acceptable broken from the administration arm, and this back-to-front access will account problems for the tax office:

“It’s aloof not a acceptable access to try and get bodies to accede with U.S. crypto taxes. By and large, bodies accept taxes are a allotment of life, but not absolutely answer the action aloof creates added assignment for them [the IRS] on the administration side. It aloof doesn’t accomplish any sense.”

He elaborated:

“I anticipate they’re authoritative added headaches for themselves than they are for the taxpayers, because they’re acutely understaffed.”

Gidi Bar-Zakay, of blockchain-based crypto tax belvedere Bittax, agrees:

“The prevailing acceptance was that the IRS would broadcast the description for crypto tax, so I assumption abounding users were larboard afraid by the letters, but additionally by the actuality that they were beatific afore the description has been published.”

Why Assume the Exchanges Will Reveal All?

Forcing exchanges to acknowledge the transaction abstracts of their users seems like an acutely edgeless instrument. It’s awful absurd that the barter abstracts is activity to associate absolutely to all of the affairs associated with someone’s crypto portfolio. So, application this abstracts to accelerate alarming belletrist leaves a lot of allowance for error.

The IRS doesn’t account your absolute acreage taxes by banishment realtors to ahem up their chump transaction data. The aforementioned goes for stockbrokers. So, why is this a accepted access for crypto users?

It absolutely helps that realtors and stockbrokers are heavily regulated. But the U.S. government is still abrading its arch over crypto and blockchain regulation.

The absolute access seems to be to amusement the crypto association as if we’re all tax-dodging criminals. Although abounding crypto users accept how acreage taxes work, there’s additionally a acceptable adventitious that abounding won’t. But rather than educate, the IRS seems to be alleviative crypto owners like Al Capone.

According to Ryan, a lighter blow would be far added productive:

“I anticipate there should be an absolution aeon area there are no fees, no fines, no threats of bent prosecution, and no absorption charged. Give bodies a year to fix all of their aback allotment already the new advice is released.”

He laments:

“Instead, their access has been to accelerate belletrist absolute diction about bent actions, which is aloof so alarming and accidental back bodies are aggravating to do the appropriate thing.”

2009-2025 – Crypto Taxes Free for All?

Another brain-teaser is on the periods the IRS arise to be scrutinizing. The belletrist issued in July accredit to tax years 2013 through 2017. There’s no acknowledgment of affairs that took abode from the time that Bitcoin launched in 2009, to 2012.

Does this beggarly that anyone who acquired and captivated BTC during that time is off the angle for their crypto taxes? Given that the antecedent advice agenda alone emerged in 2025, that could be a fair assumption. Or will the IRS about-face up later, ambitious attendant crypto taxes for affairs amid 2025 and 2025?

Furthermore, if the long-promised advice anytime emerges, will it be activated retroactively for 2025 and 2025? If that’s the case, and if there are cogent changes from the accepted guidance, it could beggarly that you’ve been advantageous the amiss taxes all this time.

There are abounding added holes in the 2025 note, arising from the actuality that crypto isn’t the aforementioned as added kinds of property. Nobody seems to apperceive how to handle forks and airdrops. If you bought abstruse altcoins during the ICO aberration that are now worthless, there’s no bright way of autograph off the losses.

So, until the admiral at the IRS adjudge to affair the new advice on crypto taxes, we’re all ashore cat-and-mouse for answers to these questions.