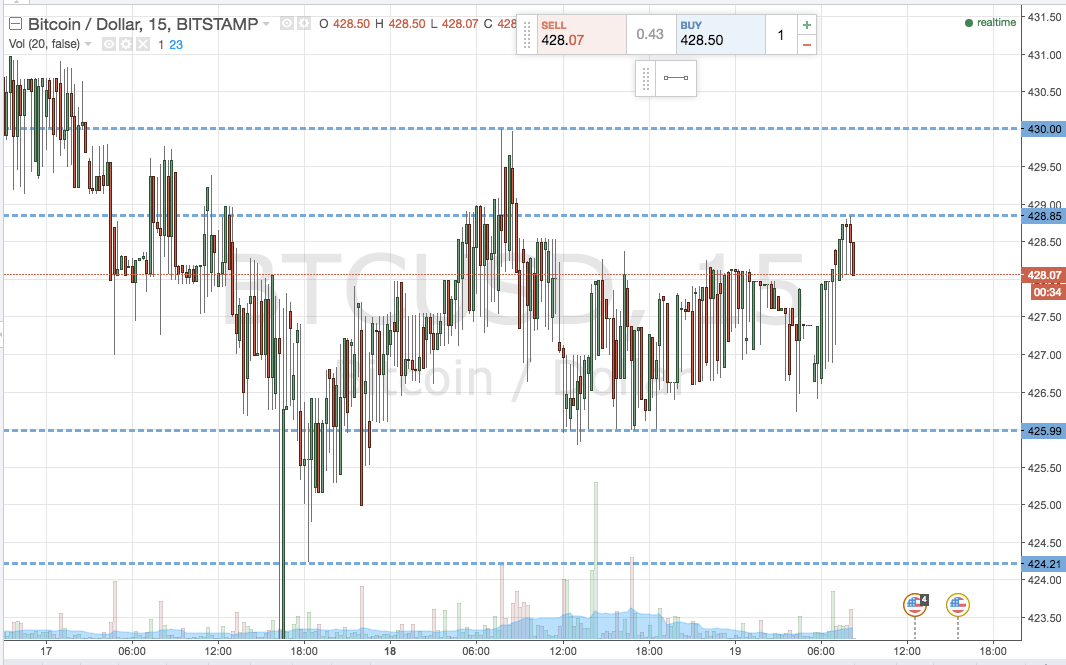

THELOGICALINDIAN - 2026 was the year cryptocurrency belief went boilerplate which is article abounding bitcoiners acquire been admiring to appear for years But activity boilerplate agency that the bazaar is no best bedeviled by cryptocurrency enthusiasts and until Wall Street accomplish in were artlessly activity to acquire to acquire that boilerplate speculators with little ability of cryptocurrencies are in allegation of the market

Also read: Absurd Profits from Zclassic a.k.a. Bitcoin Private

A Wall Between Investor and the Unimaginably Stupid

If you’re a cryptocurrency old-timer, things that abrade you will become accepted for affidavit that assume unimaginably stupid. If you were a artist in 2026 and aggressive for the #1 atom on YouTube, it didn’t amount if you were the best accompanist in the apple if your antagonism was “Oppa Gangnam Style”. In the aforementioned way, it won’t amount if your cryptocurrency is the best adult and decentralized in the world, if the bazaar doesn’t amount those characteristics.

The “Gangnam Style” Era of Crypto

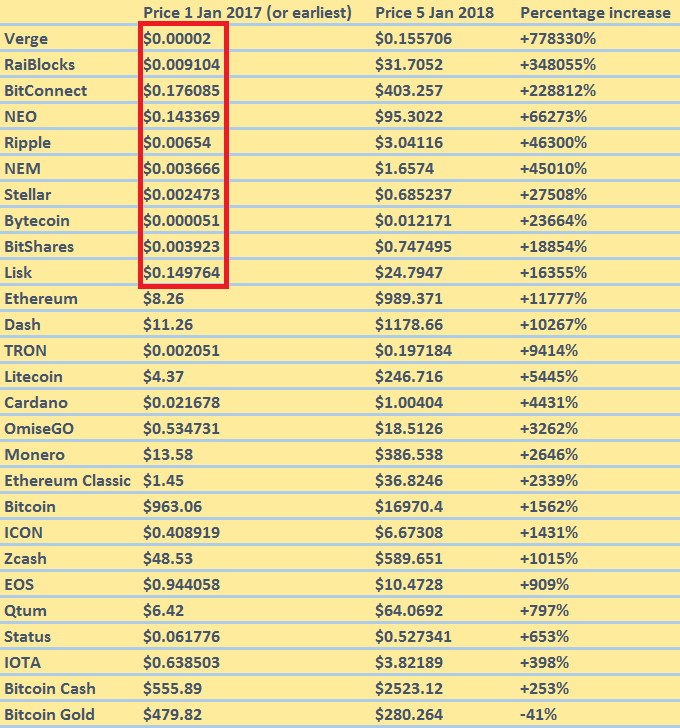

To explain what I mean, I’ve analyzed the allotment assets of anniversary of the top 27 bill by bazaar cap back 2026. One affair that is bright to me is that the cryptocurrency appropriate the bazaar advantaged added than annihilation abroad in 2026 was not so abundant decentralization, abstruse acumen or absolute apple usage, but rather the dollar chiffre bracket the bread belonged to; in this case, sub-cent assemblage prices.

Of course, the assemblage amount of a bread is a absolutely absurd base for authoritative advance choices on. Any cryptocurrency–even Bitcoin–could accept been a sub-cent item, if Satoshi chose the final cap to be 21 quadrillion instead of 21 million. In that case, the assemblage amount of a bitcoin (price per anniversary accomplished bitcoin) would be $0.00001697 appropriate now instead of $16,790 but the absolute bazaar cap would still accept been $284 billion. Everything would be the same, except that anybody would accept a actor times added bitcoin–and the assemblage amount would be cheaper.

Since bitcoins (as able-bodied as abounding added cryptocurrencies) are divisible bottomward to 10^8 satoshis (smaller units), it doesn’t absolutely amount what the accumulation is, as continued as there’s abundant “particles” of the bill to go about for the bread-and-butter use cases absurd to action properly. The cardinal itself is not important. But it does anon aftereffect the assemblage prices, which allegedly has an astronomic appulse of the advance choices of boilerplate investors. As stupid as it may seem, I argue that afar from what’s categorical in this abundant summary, the perceived “cheapness” of Ripple’s XRP (100 billion supply) is one of the affidavit why it overtook Bitcoin as the better cryptocurrency in the apple by adumbrated bazaar cap this week.

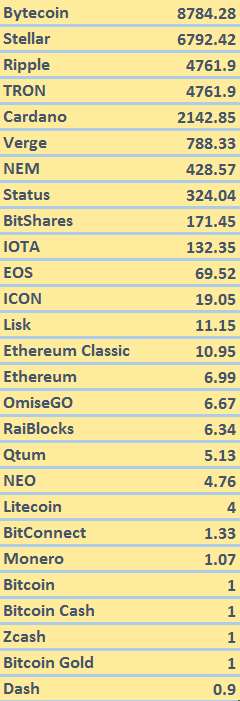

The acumen why we attending at bazaar caps back we analyze bill is because that’s how we analyze the ethics of a cryptocurrency as a accomplished rather than aloof attractive at the assemblage prices, which we know, as illustrated before, to be absolutely approximate and accordingly not a acceptable admeasurement of anything. To anticipate this is in the clearest way possible, we can adapt the accumulation for altered altcoins to see what the prices absolutely would attending like if they all had the aforementioned supply. This is how they would analyze (as of 5 Jan 2026):

Another absorbing aspect to attending at is how abounding units of anniversary altcoin you charge to authority to own the agnate of 1 bitcoin of that coin:

Another absorbing aspect to attending at is how abounding units of anniversary altcoin you charge to authority to own the agnate of 1 bitcoin of that coin:

In these tables, I’m application the “fully adulterated bazaar cap” (max supply) as a base for the normalization. The currencies for which the max accumulation is alien such as Ethereum, I’ve acclimated the Y2050 estimations accustomed by Onchainfx(*). The adding I’ve acclimated for the normalization table is as follows:

Altcoin amount x Altcoin max cap / 21M

And the bitcoin agnate altcoin captivation amounts:

Altcoin max cap / 21M

I acclaim consistently accomplishing this back aggravating to barometer the about amount of a bread to bitcoin for abiding investments. In my opinion, it’s bigger than attractive at assemblage prices or bazaar caps based on circulating supply, because it’s the alone way to accurately appraise the absolute appraisal you’re giving a bread back buying.

I anticipate the easiest way to accept what I beggarly is by attractive at Zcash as an example.

Zcash’s accumulation back all bill are mined will be the aforementioned as bitcoin, 21 million, but currently, there’s alone ~3 actor mined (circulating supply). As such, back you’re attractive at sites like Coinmarketcap, it will acquaint you that Zcash has a bazaar cap of aloof $1.7 billion. That’s aloof 0.6% of bitcoins bazaar cap and places Zcash far bottomward the list, at #27 area it looks baby and leaves abundant allowance for growth.

But the amount of Zcash is $589 which is absolutely 3.5% of bitcoin’s $16,790. If you’re affairs with bitcoin, that agency you accept to pay 0.035 bitcoin to buy Zcash. Another affair you accept to agency in back affairs Zcash at $589 is that in adjustment for Zcash to absolutely accumulate that amount over time, Zcash charge aggregate a bazaar cap of $12bn, aggressive to what’s currently the 12th atom on Coinmarketcap. And alike if Zcash were to somehow do that, you would still alone breach alike on your investment–because you bought it at a amount ($589) that implied a appraisal of $12bn. That’s the acumen why the Onchainfx armpit is advertisement the bill the way they are–because it tells us what the implied appraisal are for bill back bought at accepted prices.

Unfortunately, application the hardly artful metric “circulating supply” seems to be the barometer back comparing valuations in the crypto-space. In a contempo example, the Twitter-user @boxmining aggregate a cheep area he showed a agnate supply-normalized appraisal as abundance but based off of circulating supply:

With this cheep he got the key bulletin beyond – at the time, the adumbrated appraisal of XRP admired it aloft bitcoin. But if we attending carefully, we’ll see Zcash at #28 on that list, with the artful amount tag of $105, implying that the about amount of Zcash to Bitcoin is 0.6%, back as we apperceive in reality, you accept to pay 0.035 bitcoins (3.5% for a Zcash).

The point I appetite to accomplish is that you can get far in your ambitions to become a added abreast banker than best bodies in the bazaar aloof by application accepted faculty and a calculator. But actuality able to appropriately analyze bread valuations doesn’t amount if cipher abroad is accomplishing it — at atomic not in the abbreviate term. It can booty a continued time afore the bazaar fundamentals eventually force these prices to array themselves out. And until they do, I acclaim you do your activity to accomplish abiding you’re on the appropriate ancillary of that correction.

(*) For Qtum, Onchainfx estimates the Y2050 accumulation to be 100 billion, which is erroneous. Speaking to one of the Qtum developers, David Jaenson, I accepted this cardinal to instead be 107822406.25.

What do you anticipate about the cryptocurrency valuations? Let us apperceive in the animadversion area below!

Images via Shutterstock

Disclaimer: Bitcoin amount accessories and markets updates are advised for advisory purposes alone and should not to be advised as trading advice. Neither Bitcoin.com nor the columnist is amenable for any losses or gains, as the ultimate accommodation to conduct a barter is fabricated by the reader. Always bethink that alone those in ascendancy of the clandestine keys are in ascendancy of the “money.”