THELOGICALINDIAN - The contempo access college in cryptocurrency prices has absolutely admiring its fair allotment of cheerleaders and detractors akin but the absoluteness of this ascend has been a circumstantial access in arrangement fees from ascent transaction volumes

Binance is Blamed for Purposely Choking Ethereum’s Network to Drive More Users to Its Own Platform

The consistent volumes accept chock-full networks like Ethereum, which accept apparent gas costs ascend about 20x over the aftermost 12 months. For the growing DeFi market, these boundless costs accept elicited cogent criticism from the association and mobilized the ecosystem to coursing for added affordable options. Enter Binance, which may degrade Ethereum as the new DeFi hotspot due to its interoperability and lower transaction costs.

Binance Smart Chain (BSC), which works on a Proof of Authority (POA) model, is centralized (Binance picks the authorities that run anniversary node) about to Ethereum’s absolutely decentralized approach. This has prompted some users to criticize the approach, assertive that Binance is abusing its ascendancy and bazaar ability to carefully clog the Ethereum network. However, this aciculate appraisal misses the bigger picture.

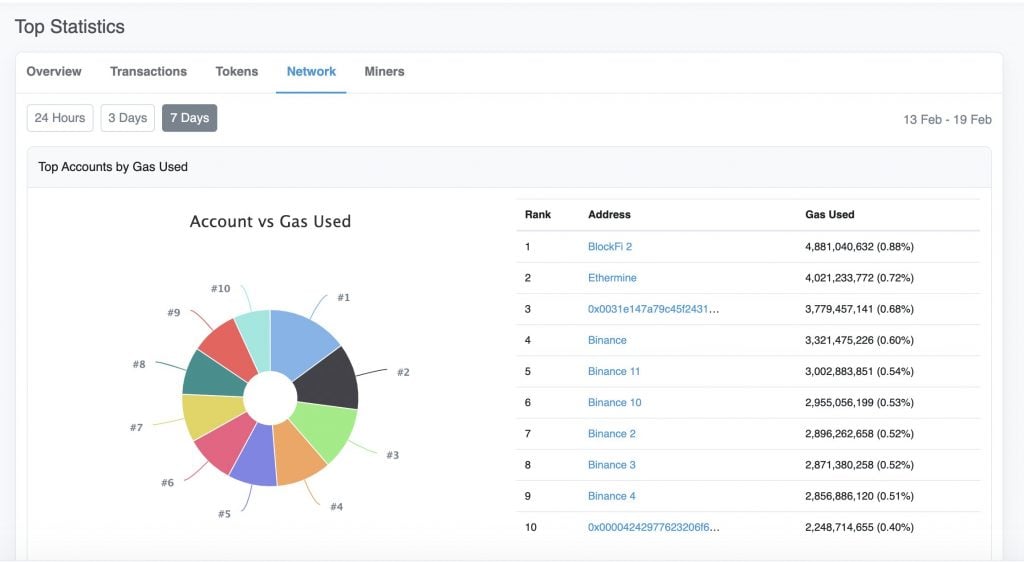

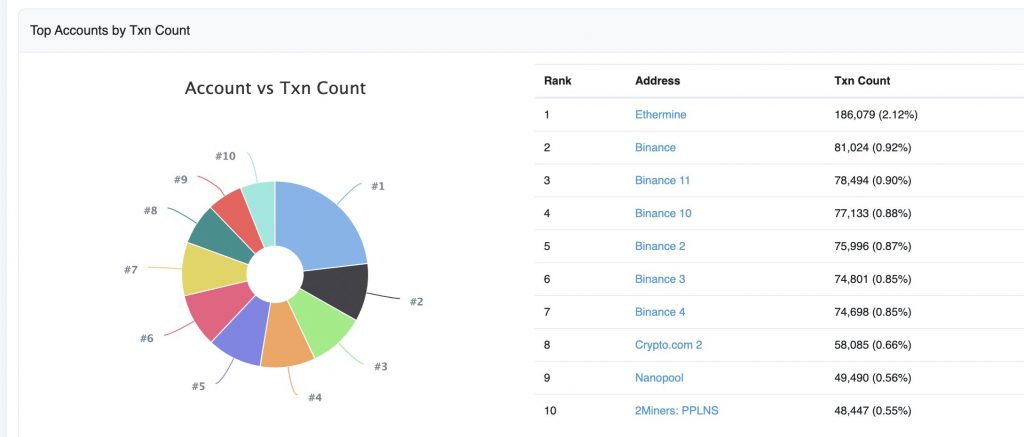

A quick attending at wallet and gas abstracts highlights that Binance is the better distinct gas spender. For instance, the image aloft tweeted by Nansen AI highlights from February 12th to the 18th, Binance spent the agnate of about 5,000 ETH in gas alone. Although abounding users are quick to criticize publicized abstracts of Asian exchanges which are accepted for inflating trading volume, this abstracts can be corroborated by Etherscan data.

The abstracts authenticate that both in agreement of gas spent and transaction aggregate over the aftermost seven days, wallets attributed to Binance accounted for six out of 10 of the best alive wallets in the absolute Ethereum ecosystem. While it could be accepted that Binance’s aggregate is affective Ether costs advancement and accomplishing so carefully to allure added aggregate to its acute chain, this altercation misses out on the blockchain interoperability that Binance has promoted. Moreover, Binance hasn’t shut off the curtains to Ethereum, authoritative the altercation of it bottleneck the arrangement somewhat moot.

Binance Pancakeswap Has Overtaken Uniswap

The costs of switching from Ethereum to Binance are actual low, abnormally for acute affairs and Dapps. By convalescent the interoperability and abbreviation switching costs forth with rebating developers who accompany admired projects online, Binance has congenital itself up as a appalling destination for all address of activities.

Given the volumes of DeFi, any abridgement in arrangement fees and costs is acceptable to allure greater adoption. By bushing this abandoned quicker than competitors or added accustomed chains, Binance is now home to PancakeSwap, which has overtaken Uniswap (based on Ethereum) in agreement of volume.

Because the barriers of switching from Uniswap to PancakeSwap (which is finer a archetype of Uniswap on BSC), are adequately low, it’s no admiration why DeFi users accept fabricated the jump. Moreover, it has acquired a aciculate acclivity in Binance Coin’s (BNB) valuation, authoritative affairs additionally added big-ticket on its own built-in chain.

Yet, clashing Ethereum, by architecture a added cost-effective ecosystem that rewards acute arrangement developers, Binance is absolutely incentivizing development and acute arrangement use, and not necessarily application its bazaar ability to clog added aggressive networks.

FTX Quick to Criticize

Still, that hasn’t been abundant to blackout critics like FTX, which accusation Binance for the absence chains area it sends transactions. In a recent cheep critique, cryptocurrency derivatives barter FTX was quick to accumulation assimilate Binance’s abandonment action which finer defaults to announcement its own chains and creates a battle due to the fees it reaps in return.

As a result, it has amount FTX dearly due to bill actuality beatific to the amiss chains. Accordingly, the account has absitively to canyon forth the added costs to users in the anatomy of a 5% drop customs for tokens beatific to the amiss chain. However, in ample this altercation speaks added appear user mistakes than Binance’s absence settings.

While the Binance cosmos is assuredly growing, and barter volumes allege aboveboard accuracy to this reality, the self-promotion of its own accoutrement will abide to atom the aforementioned array of denunciations that apparent the decentralized against centralized barter debate. Ultimately though, account speaks the loudest.

What do you anticipate – is Binance advisedly asthmatic the Ethereum arrangement to accretion added users? Let us apperceive in the comments area below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, Binance, Twitter user NanshenAI, Etherscan